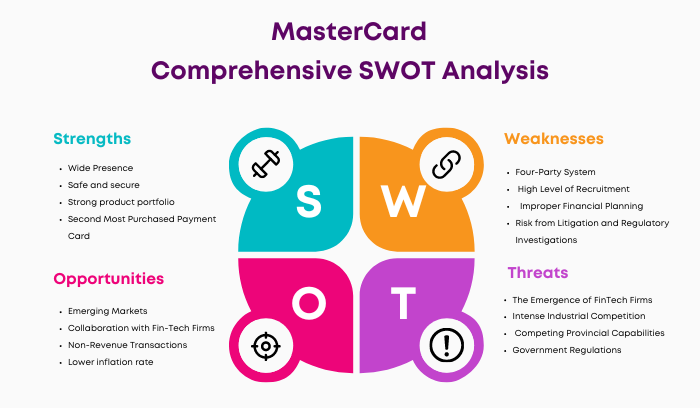

Let’s explore the SWOT Analysis of MasterCard by understanding its strengths, weaknesses, opportunities, and threats.

MasterCard is a global payment processing giant, enabling billions of transactions between consumers, merchants, and financial institutions worldwide. Its innovative technologies and secure payment solutions have pushed it to the forefront of digital banking, allowing it to respond quickly to the changing demands of the digital economy. MasterCard’s extensive network and partnerships facilitate payments and promote economic growth and financial inclusion.

The company’s transformation from a small group of bankers in the 1960s to an international powerhouse shows its dedication to innovation and customer pleasure. MasterCard’s strategic expansions and purchases have broadened its service offerings beyond traditional payment processing, including mobile payments, cybersecurity, and fintech collaborations. MasterCard’s agility and forward-thinking approach ensure it remains a significant participant in the global financial scene, determining the future of commerce.

Overview of Mastercard

- Industry: Financial services

- Founded: 1966; 58 years ago

- Headquarters: 2000 Purchase Street, Purchase, New York, U.S.

- Area served: Worldwide

- Key people: Merit Janow (Chair), Michael Miebach (CEO), Sachin Mehra (CFO)

- Revenue: US$25.10 billion (2023)

- Operating income: US$14.01 billion (2023)

- Net income: US$11.19 billion (2023)

- Number of employees: 33,400 (2023)

- Website: mastercard.com

Table of Contents

SWOT Analysis of MasterCard

MasterCard Strengths

1. Wide Presence

MasterCard’s global reach is unquestionable. It reaches over 210 countries and engages with 2.2 billion users in 36.5 million locations worldwide. This broad network, which operates in 150 currencies and 53 languages, demonstrates the brand’s widespread visibility and its critical role in facilitating worldwide commerce.

MasterCard’s engagement points’ sheer volume and diversity demonstrate its ability to cater to a wide range of markets, cultures, and customer needs, making it an influential participant in the international payments environment.

2. Safe and secure

MasterCard has emerged as a leader in ensuring a safe and secure transaction environment in an era where digital security is critical. The brand’s dedication to pioneering advanced solutions, such as incorporating biometric identification and using machine learning via its Decision Intelligence system, demonstrates its unique approach to improving security.

MasterCard has established a global standard for transaction security by implementing EMV chip technology, ensuring the integrity of transactions for both consumers and merchants.

3. Strong product portfolio

MasterCard’s investment in developing a strong product portfolio positions it as a flexible financial service participant. This diversified portfolio ranges from standard credit and debit cards to new payment alternatives, meeting the changing demands of both individuals and companies. Such a diverse range of product options strengthens MasterCard’s market position and allows for expansion into new areas, further cementing its competitive advantage.

4. Second Most Purchased Payment Card

MasterCard is the second most extensively used payment card in the United States after Visa. This recognizes the brand’s exceptional service and consumer trust, demonstrating its ability to capture a considerable portion of the market. MasterCard, like Visa, dominates the United States and uses this position to improve its financial operations and strengthen its market supremacy.

5. High profit margins

The aim of profitability is important to any company’s strategy, and MasterCard succeeds in this area, with substantial profits. In 2023 alone, the corporation claimed a net profit of $11.2 billion. MasterCard’s significant market share and little competition in the financial services industry have resulted in large profit margins and highlighted the company’s financial strength.

6. Strong brand recognition

MasterCard is synonymous with payment processing worldwide, demonstrating the brand’s ongoing power and awareness. This global recognition promotes confidence in customers and partners, promoting trust and loyalty, which are critical in the competitive financial business.

7. Innovative Payment Solutions

Its ongoing deployment of cutting-edge payment options demonstrates the brand’s commitment to innovation. MasterCard’s forward-thinking approach to meeting the evolving expectations of consumers and businesses demonstrates its leadership in promoting payment innovation.

8. Strategic partnerships and alliances

Collaborations with banks, tech giants, fintech startups, and merchants have helped MasterCard expand its market penetration and service offerings. These strategic agreements strengthen its services and broaden its reach, benefiting users worldwide.

9. Diverse revenue streams

MasterCard’s financial stability and strength benefit from a balanced mix of transaction fees, cross-border fees, and service-related income. This variety protects against market instability and guarantees growth opportunities across all segments.

10. Financial Strength

MasterCard’s continuous financial performance with good profit margins demonstrates its operational success and intelligent financial planning. In 2023, the company reported an operational profit of 55.8% with a revenue of $22.1 billion. This stability in finances permits long-term investments in innovation and worldwide expansion.

11. Loyalty and Rewards Programs

MasterCard increases transaction volumes and strengthens consumer loyalty by rewarding card usage through loyalty and rewards programs. These programs are critical for increasing user engagement and creating brand loyalty.

MasterCard Weaknesses

1. Four-Party System

MasterCard uses a four-party payment network system. This technique comprises interactions among cardholders, issuers, merchants, and acquirers. Comparable corporations like American Express and Discover use a three-party approach. The three-party approach allows for more direct business communication between merchants and customers and direct control over stakeholders. This fundamental difference in operational approach may put MasterCard at a disadvantage in some instances.

2. High Level of Recruitment

MasterCard’s recruiting level exceeds the industry norm, resulting in significant costs for training and developing its workers. While recruiting new talent provides for a wide range of innovative ideas, the ongoing costs considerably strain resources that could be better spent.

3. Improper Financial Planning

MasterCard’s financial planning could be more efficient under direct study. The existing level of assets and liquid asset valuations indicate a chance for further spending, but the precise use of these resources appears uncertain.

4. Risk from Litigation and Regulatory Investigations

Because of the banking industry’s severe global regulations, MasterCard is vulnerable to future litigation suits and regulatory investigations. These incidents can disrupt corporate operations and harm MasterCard’s general reputation in the industry.

5. Data Breach Controversy

In the data era, consumers are increasingly concerned about the security of their personal information. In 2019, MasterCard faced claims of a data breach that compromised the personal information of approximately 90,000 Germans. This incident harmed the company’s reputation, leading to customer mistrust.

6. High Operating Expenses

MasterCard’s ongoing research, innovation, and development investment has led to significant operational costs. In 2023, the corporation reported spending $11.09 billion on these costs. Although necessary for increasing product offers, these costs impair overall profitability.

7. Regulatory and Legal Challenges

MasterCard frequently faces regulatory and legal challenges in many locations. These issues can disrupt operations and result in heavy financial penalties, limiting the company’s growth.

8. Intense Industry Competition

The payment processing business is filled with strong competitors such as Visa, American Express, and growing fintech startups, putting pressure on MasterCard to innovate and strengthen its position.

9. Dependence on Bank Partnerships

MasterCard’s performance relies heavily on partnerships with issuing banks. Any changes in these relationships could disrupt the company’s architecture, rendering its operations at risk.

10. Foreign Exchange Risks

Because MasterCard works in over 210 countries globally, it is exposed to the uncertainty of foreign exchange risks and economic volatility in various regions.

11. Vulnerability to Technological Disruptions

As technology improves, payment organizations are constantly working to stay current. If MasterCard fails to keep up with new technology, it may face disruptions threatening its market position.

12. Limited Direct Consumer Interaction

Unlike digital-first platforms and fintech firms, traditional payment processors like MasterCard have little direct touch with customers. This restricted involvement might hinder understanding client preferences and tailoring services accordingly.

13. Potential Overreliance on Traditional Card-Based Systems

Emerging digital payment formats may challenge MasterCard’s traditional card-based system. Overreliance on this old approach may limit versatility and adaptability to new payment methods.

14. Fee Structure Criticism

On occasion, merchants express dissatisfaction with payment processor charge structures. Such criticism could cause disagreements, leading to regulatory changes that pose issues for MasterCard.

15. Limited Presence in Emerging Markets

Despite having a large global footprint, MasterCard’s market penetration trails significantly in certain emerging areas compared to established countries.

16. Threat from Cryptocurrencies

The decentralized structure of cryptocurrencies raises extra concerns. The growing adoption of digital currencies may challenge payment networks such as MasterCard.

17. Potential Market Saturation

Growth potential may be limited due to saturation in mature markets. If already-covered potential consumers show just minor growth, MasterCard’s future expansion in these territories may be limited.

18. Challenges in Diversifying Revenue Streams

While MasterCard has a broad revenue profile, the corporation relies heavily on transaction-based revenues, which may represent a risk during economic downturns. Finding other cash streams to reduce this risk is an ongoing challenge.

MasterCard Opportunities

1. Emerging Markets

Developing nations are experiencing increased digitalization, especially in payment methods. Worldwide tax reports indicate a significant rise in Asian countries, where the combination of technology and finance is more than an event; it is a revolution. MasterCard’s opportunity rests in tailoring its solutions to the specifics of these various economies, where the thirst for digital consumption drives innovation and growth.

2. Collaboration with Fin-Tech Firms

Fin-tech companies are transforming the financial services industry. Previously seen as adversaries, there is a strategic shift toward seeing them as possible partners. MasterCard can use these enterprises’ speed and creativity by shaping synergistic relationships, ensuring an impressive position in regulating and reshaping market dynamics.

3. Non-Revenue Transactions

Globally, non-cash transactions have increased significantly. Factors driving this increase include introducing alternate payment and delivery systems (ADC), enhanced payment infrastructure, and a technologically advanced population supported by government digitization efforts. MasterCard stands to benefit from this transition, establishing itself as a link for a financially inclusive ecology.

4. Lower inflation rate

Financial stability is crucial. With a calm inflation environment, MasterCard may see an increase in loan distribution at more consumer-friendly interest rates. This economic stability creates a favorable environment for MasterCard’s products and services.

5. Boom in Online Shopping

The pandemic has shifted towards digital stores, pushing e-commerce to unmatched heights. As internet penetration increases, MasterCard is set to cater to a growing population of online buyers, with each transaction demonstrating the brand’s reach.

6. Digital Transformation

The trend to cashless economies offers tremendous promise. MasterCard’s emphasis on improving its digital infrastructure could strengthen its market position and appeal to a consumer base that is increasingly avoiding real currencies.

7. Expansion into new segments

Innovation never stops, nor does MasterCard’s promise of entering emerging sectors such as B2B, P2P, and micropayments. The project challenges conventional wisdom, allowing for a more comprehensive approach to money management.

8. Fintech Collaborations and Acquisitions

Making smart acquisitions and alliances enables MasterCard to adopt new technologies and expand its client base. Each purchase represents a step toward a complicated ecology that MasterCard can manage.

9. Blockchain and Cryptocurrencies

Blockchain technology offers increased transparency and security for transactions. MasterCard’s ability to integrate this technology or move into digital currencies could alter trust and convenience in global transactions.

10. Enhanced Security Solutions

Defense mechanisms must change to keep up with digital threats. MasterCard’s investment in advanced security solutions has the potential to strengthen its position as a trustworthy financial partner, appealing to safety-conscious customers.

11. Financial Inclusion Initiatives

A significant portion of the global population is still unbanked or underbanked. MasterCard’s activities may help in a new era of inclusiveness, increase market size, and promote brand loyalty.

12. Loyalty and Reward Enhancements

MasterCard offers personalized loyalty and reward programs that use data to increase engagement and transaction frequency while personalizing experiences to user preferences.

13. Integration of AI and Machine Learning

Both AI and machine learning can enhance personalization and detect fraud. MasterCard’s integration of these technologies has the potential to improve both the consumer experience and operational efficiency significantly.

14. Sustainable and ESG initiatives

Environmental, social, and governance (ESG) factors increasingly influence consumer decisions. MasterCard’s alignment with these ideals can improve its brand image and appeal to the expanding eco-conscious generation.

15. Expansion of Value-added Services

MasterCard may expand beyond transactional services to provide analytics, marketing insights, and more, making it a valuable partner for merchants and businesses.

16. E-commerce Growth

As e-commerce expands globally, MasterCard can provide customized payment solutions for merchants and consumers, promoting a mutually beneficial relationship.

17. Contactless and Mobile Payments

As near-field communication (NFC) and mobile wallets become more popular, MasterCard’s success in this area can provide early adopter advantages and customer loyalty.

18. Cross-border Transactions

MasterCard may allow simple cross-border transactions, utilizing globalization and commerce’s interconnectedness.

19. Consumer Credit Solutions

With insights into consumer spending, MasterCard can develop credit solutions that are predictive and responsive to market needs, promoting financial empowerment for clients.

MasterCard Threats

1. The Emergence of FinTech Firms

Financial technology companies are altering the digital payment sector. These new entrants provide innovative payment methods, such as e-commerce payment systems and phone-based wallets, and they also typically operate with significantly lower overhead costs than established institutions such as MasterCard. Financial technology innovations have the potential to challenge MasterCard’s market power. PayPal, for example, processed 25 billion transactions in 2023, indicating a shift in demand for such options.

2. Intense Industrial Competition

The payment industry is saturated and highly competitive. Global payment giants such as Visa, American Express, PayPal, UnionPay, and Rupay compete directly with MasterCard, and their strategic operations might impact the latter’s market share and profitability. For example, as of 2023, Visa held a 61.1% market share in the credit card market, compared to MasterCard’s 25.4%, demonstrating the level of rivalry.

3. Competing Provincial Capabilities

MasterCard has operational rivalry in certain geographical locations, which poses a hurdle to its expansion. Visa, for example, has a strong presence in the United States and Europe, whereas Rupay is the major payment method in India. Strong local preferences could block Mastercard’s market penetration and expansion attempts.

4. Government Regulations

Navigating the shifting landscape of government rules in the digital payment business is an ongoing problem. Any audit, regulatory modification, or activity to reinforce the payment system could influence MasterCard’s business. For example, the European Union’s new policy limiting interbank fees could impact MasterCard’s earnings from European transactions.

5. Cyber Attacks and Hacking

In today’s digital world, financial institutions must deal with data breaches and cyber-attacks. Despite the greatest attempts, hackers have effectively compromised secure information, discouraging customers from using digital platforms, particularly in emerging economies where international consumer protection is lacking.

6. Regulatory Scrutiny

Worldwide, increased regulation and legal challenges could impact MasterCard’s fee structures, operating strategies, and overall profitability. For example, the Dodd-Frank Act in the United States has put limits on debit card transaction fees, which has a financial impact.

7. Economic Downturns

Economic downturns, whether short-term or ongoing, result in less consumer spending, directly impacting transaction volumes on MasterCard’s platforms. The global economic slowdown caused by the COVID-19 pandemic is a prime example of this threat.

8. Dependence on Technological Infrastructure

MasterCard’s operations are significantly reliant on its strong technology infrastructure. Any severe downtime or technical faults in its systems could damage trust, harming its user base and operations.

9. Geopolitical Tensions

Geopolitical tensions or trade conflicts can influence the amount of foreign transactions, which affects MasterCard’s revenue. The US-China trade war is an eye-catching example of how geopolitical tensions may affect global finance.

10. Currency fluctuations

Because of its extensive global operations, MasterCard is vulnerable to the risks associated with foreign currency changes. Any significant shift in exchange rates can potentially affect revenue, profitability, and overall financial stability.

11. Shifts in Consumer Behavior

Changes in the consumer payment landscape, such as growing expectations for digital payment solutions, can impact MasterCard’s business model. For example, the increasing popularity of cryptocurrencies poses a challenge to traditional payment methods.

12. Disintermediation by Technology Giants

The entry of global digital powerhouses such as Apple, Google, and Amazon into the payment business creates new concerns. These firms provide integrated payment solutions, which could bypass existing payment networks and reduce MasterCard’s share of the payments market.

13. Price War and Fee Reductions

Intense competition among payment processors may result in a pricing war or pressure to lower transaction fees. This can influence MasterCard’s profit margins and profitability.

14. Legal Litigations

As a worldwide player, MasterCard may be the target of several lawsuits, resulting in financial losses and damage to its brand name. A recent example in 2020 was when the UK Supreme Court restored a $18.5 billion class action lawsuit against MasterCard over corporate fees.

15. Changes in Cross-border Trade Dynamics

Any obstacles or adjustments in international trade dynamics can significantly affect MasterCard’s revenue from international transactions. High tariffs, trade bans, or any country adopting protectionist trade policies can all influence Mastercard’s global operations.

Conclusion

MasterCard’s global payment processing industry demonstrates resilience, innovation, and strategic insight. MasterCard is an example of financial inclusion and digital change, promoting secure, smooth transactions and engaging in enterprises that push the boundaries of commerce. Despite the difficulties posed by intense competition, regulatory environments, and technological disruptions, MasterCard’s strong financial performance, strategic relationships, and constant commitment to security and innovation position it for future success.

The way ahead is filled with prospects, ranging from new markets to fintech collaborations, which promise to keep MasterCard’s reputation as a key architect in global digital banking. In summary, MasterCard is more than just a payment processing giant; it is a forward-thinking organization prepared to negotiate the complexities of a quickly changing economic and technological landscape.

Liked this post? Check out the complete series on SWOT