Table of Contents

What is ADL Matrix?

The ADL Matrix, short for Arthur D. Little Strategic Condition Matrix, is a management tool used to analyze the competitive position of a business in relation to its key rivals. This matrix helps companies evaluate their product portfolio and strategic options based on 2 dimensions: the industry’s life-cycle stage and competitive position.

The ADL Matrix classifies the `Industry Life-Cycle Stage` into four categories:

- Embryonic

- Growth

- Mature

- Decline

The `Competitive Position` is divided into five categories:

- Dominant

- Strong

- Favorable

- Tenable

- Weak

Key Takeaways!

- The ADL Matrix helps businesses map their market position relative to competitors.

- Companies can use the ADL Matrix to assess their products and strategies based on the industry life-cycle stage and competitive position.

- This matrix helps identify strategic opportunities and threats, aiding proactive decision-making and planning.

Why Use the ADL Matrix?

Using these two dimensions, companies can plot their products or services on the matrix to gain insights into their market position and make strategic decisions accordingly. Some of the key reasons for using the ADL matrix are:

- To identify the competitive strengths of a product or service

- To assess the potential for growth and profitability in various industries

- To make informed decisions about product portfolio management, market expansion, or divesting underperforming business units

- To provide a framework for strategic planning and prioritize investments in different industries

Remember, the ADL Matrix is a strategic tool used to guide decision-making. It’s not an exact science, but it provides a helpful framework for understanding a company’s position within its industry.

Stages in ADL Matrix Industry Maturity

1. Embryonic

The Embryonic stage in the ADL Matrix represents industries that are just beginning, characterized by low market share and rapid market growth. Uncertainties are high and there exists a potential for competitive advantages to be established.

- The market is small but has significant growth potential.

- Competition is scarce, allowing early entrants to establish a strong market position.

- Companies might face high risk due to uncertainties in consumer acceptance and regulations.

- Innovation and technology advancements shape the industry’s future trajectory.

2. Growth

The Growth stage is marked by rapid market growth, increasing competition, and a growing consumer base. Companies in this stage have established a strong foothold and are focused on expanding their market share.

- The industry experiences significant growth in demand for products or services.

- Competition increases as more players enter the market to capitalize on its potential.

- Companies leverage their competitive advantage to increase market share.

- The focus is on expanding geographically and diversifying product offerings to meet consumer needs.

3. Maturity

In the Mature stage, industry growth stabilizes, competition intensifies, and market shares become more established. Companies in this stage must work hard to maintain their position and defend against new entrants.

- Market growth slows down as the industry reaches saturation.

- Existing companies battle for market share, making it difficult for new players to enter.

- Companies focus on improving efficiency and cost-cutting measures to maintain profitability.

4. Ageing

The Aging stage is characterized by declining market growth, intense competition, and a decrease in market share. Companies in this stage must find new ways to revitalize their business and adapt to changing consumer preferences.

- Market growth declines as the industry becomes oversaturated and/or faces disruptive technologies.

- Competition remains fierce as companies fight for a shrinking market share.

- Companies must adapt and innovate to stay relevant and avoid becoming obsolete.

Competitive Positions

1. Dominant

In the Dominant position, a company holds a significant market share and has a strong competitive advantage over its competitors.

- The company can set industry standards and influence market trends.

- Its products or services are highly sought after and consumers have a strong brand loyalty.

- The company can command premium prices and maintain high-profit margins.

2. Strong

A company in the Strong position has a considerable market share and competitive advantage but faces increasing competition from other companies.

- The company must innovate and adapt to stay competitive.

- It may expand into new markets or diversify its products.

- Despite increased competition, the company remains profitable with loyal customers.

3. Favorable

A company in the Favorable position has a small but significant market share and may have a competitive advantage in a niche market.

- The company has room to grow and increase its market share.

- It may face some competition, but it is not as intense as in other positions.

- The company must continue to innovate and cater to its specific customer base to maintain its favorable position.

4. Tenable

In the Tenable position, a company faces moderate competition and has a decent market share, but lacks a strong competitive advantage.

- The company might struggle to stand out from competitors and face pricing pressure.

- It must prioritize improving efficiency and finding ways to gain a competitive edge.

- If successful, the company can potentially strengthen its position in the future.

5. Weak

A company in a Weak position has a small market share and lacks a competitive advantage.

- Survival in a competitive market is challenging, especially during rapid growth.

- The company must prioritize product/service improvement and differentiation from competitors.

- Failure to do so could result in acquisition or closure.

How to Apply the ADL Matrix?

Step 1: Categorize Your Industry Maturity

- First, identify the maturity stage of the industry where your strategic business unit operates.

- This classification should fall into one of the four categories: embryonic, growth, mature, or decline.

- These stages illustrate the life-cycle of an industry and the level of its market development.

- For instance, a newly emerging product line may fall into the embryonic stage, while a business line with a strong market presence might be in the mature stage.

Step 2: Evaluate Your Competitive Position

- Determine where your business stands competitively within the industry

- Evaluate the position of your business line in the market

- Consider factors such as market share, brand recognition, and competitive strengths

- Classify your business as dominant, strong, favorable, tenable, or weak

- Businesses with high market share and dominant positions are often classified as strong or dominant

Step 3: Position on the Matrix

- Determine your industry maturity category and competitive position

- Plot your strategic business unit on the ADL Matrix

- Gain insights into potential strategic directions

- Identify resource allocation for different business lines

- Remember, the matrix is a framework for strategic planning, not a definitive decision-making tool

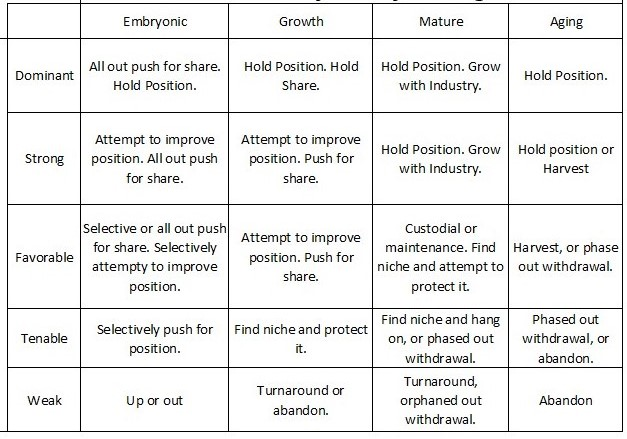

ADL Grid of Competitive Position and Industry Life Cycle Stages

The image represents the ADL Matrix grid, a strategic tool that categorizes businesses based on their competitive position and the industry life cycle stage. The matrix is divided into 20 cells, each representing a unique strategic scenario.

- The Y-Axis represents the competitive position of your business, ranging from “Dominant” to “Weak.”

- The X-Axis displays the life cycle stage of your industry, from “Embryonic” to “Decline.”

- Each intersection point on the grid provides a strategic direction for the business based on its unique position.

- By understanding your position on the ADL Matrix, you can determine the best strategic course to strengthen your market position.

Example

Let’s break down how to use the ADL Matrix with a simple example.

Imagine we have a company, “ABC Tech”, that specializes in manufacturing smart home devices.

- The first step would be to identify the life-cycle stage of the industry. Since the smart home industry is rapidly growing and innovating, this could be considered a ‘Growth’ stage industry.

- Next, we determine ABC Tech’s competitive position. Suppose ABC Tech has a wide range of popular products and a significant market share. Hence, we can say it has a ‘Strong’ competitive position.

- By locating the intersection of ‘Growth’ and ‘Strong’ on the ADL Matrix, we can identify strategic options for ABC Tech. These could include further investment in product development, diversification of product lines, or aggressive marketing strategies.

Conclusion!

Utilizing the ADL Matrix allows a company to align its strategies with its competitive standing and industry lifecycle. It is an essential tool for making informed business decisions and driving sustained growth.

FAQs

1) Who invented the ADL Matrix?

The ADL Matrix was invented by the consulting firm Arthur D. Little in the 1970s.

2) What are the pros and cons of the ADL Matrix?

Pros:

- Offers a thorough industry analysis.

- Identifies a company’s strategic position relative to competitors.

- Aids proactive planning by aligning business strategies with industry life cycles.

- Easy to understand and interpret for strategic decision-making.

Cons:

- Oversimplifying complex competitive environments can lead to misinterpretations.

- The model assumes companies in similar life-cycle stages, which is rarely true.

- Accurate positioning relies on reliable and current industry data, which may not always be available.

- Disruption from technological or market innovation is not considered.

3) What are the dimensions of the ADL matrix?

The dimensions of the ADL Matrix are Industry Life-Cycle Stages and Competitive Position.

Liked this post? Check out the complete series on Management