Cost-based pricing or markup pricing is a pricing strategy that companies utilize to first determine the production costs of an item and then by adding a percentage on top of that cost they decide the selling price of that item. It is also known as markup pricing.

In this pricing model, a markup is added to the cost of that product itself to get the selling price. This markup is a percentage of the total cost. The goal here is to ensure that the seller sets a higher price for the services or products provided to the customer than it costs to produce to make profits from its sales.

Table of Contents

What is Cost-based pricing?

Definition – Cost-based pricing is defined as a pricing method in which the selling pricing of goods or services is based on their cost of production, manufacturing, and distribution. In the pricing cost-based, a profit percentage or fixed profit figure is added to the cost of the goods or services that decides their selling price.

For example, if the total cost of a smartphone is $3,000 for a manufacturer then they can add 10% of the cost to get its selling price i.e. $3,300 ($3,000 + 10%* $3,000).

Discover how rising costs impact your pricing strategies.

Quick Statistic: According to the U.S. Bureau of Labor Statistics, the Producer Price Index for final demand increased by 9.7% over the 12 months ending in January 2022, reflecting significant rises in production costs for businesses. This surge has prompted companies utilizing cost-based pricing to reassess their pricing models to maintain profitability. (Source: U.S. Bureau of Labor Statistics, 2022)

Different projects can have different scopes, which cause prices to fluctuate depending on various goals and objectives. Based on the size of the project and market research, cost-based pricing scales as well. This is why it is an ideal pricing method for project pricing. To keep prices low, companies try to cut their costs wherever feasible. Conversely, some companies intentionally generate high costs to claim higher profits and margins.

Types of a Cost-based Pricing Strategy

Different types of cost-based pricing are –

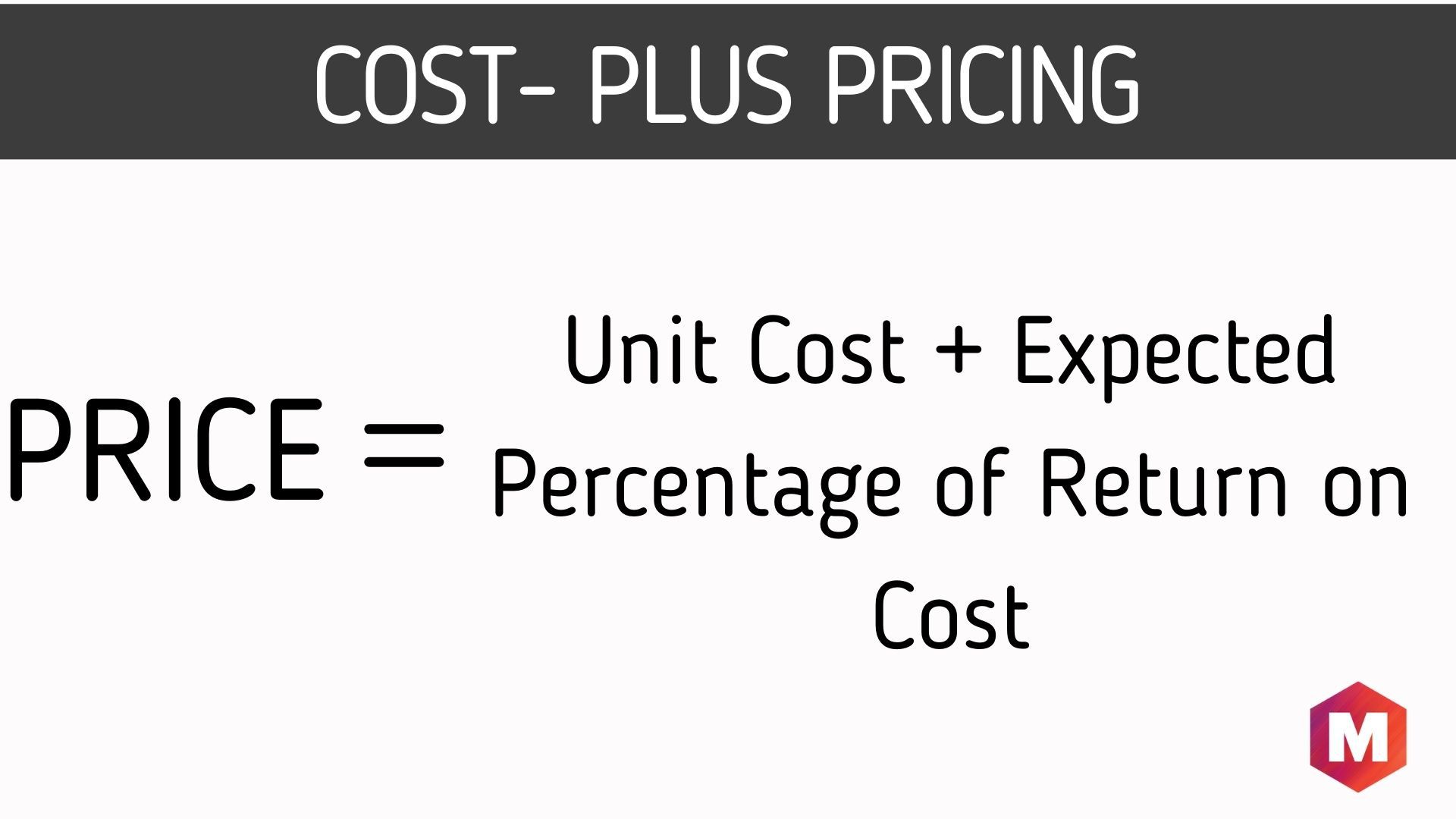

1. Cost-Plus Pricing

In cost-plus pricing, a company or manufacturer will add a fixed percentage of the total costs as the markup to arrive at the selling price. As a result, this method is also known as the average cost pricing and is the simplest pricing method. The standard markup here accounts for profit as well.

The formula to calculate the cost-based pricing is-

Price = Unit Cost + Expected Percentage of Return on Cost

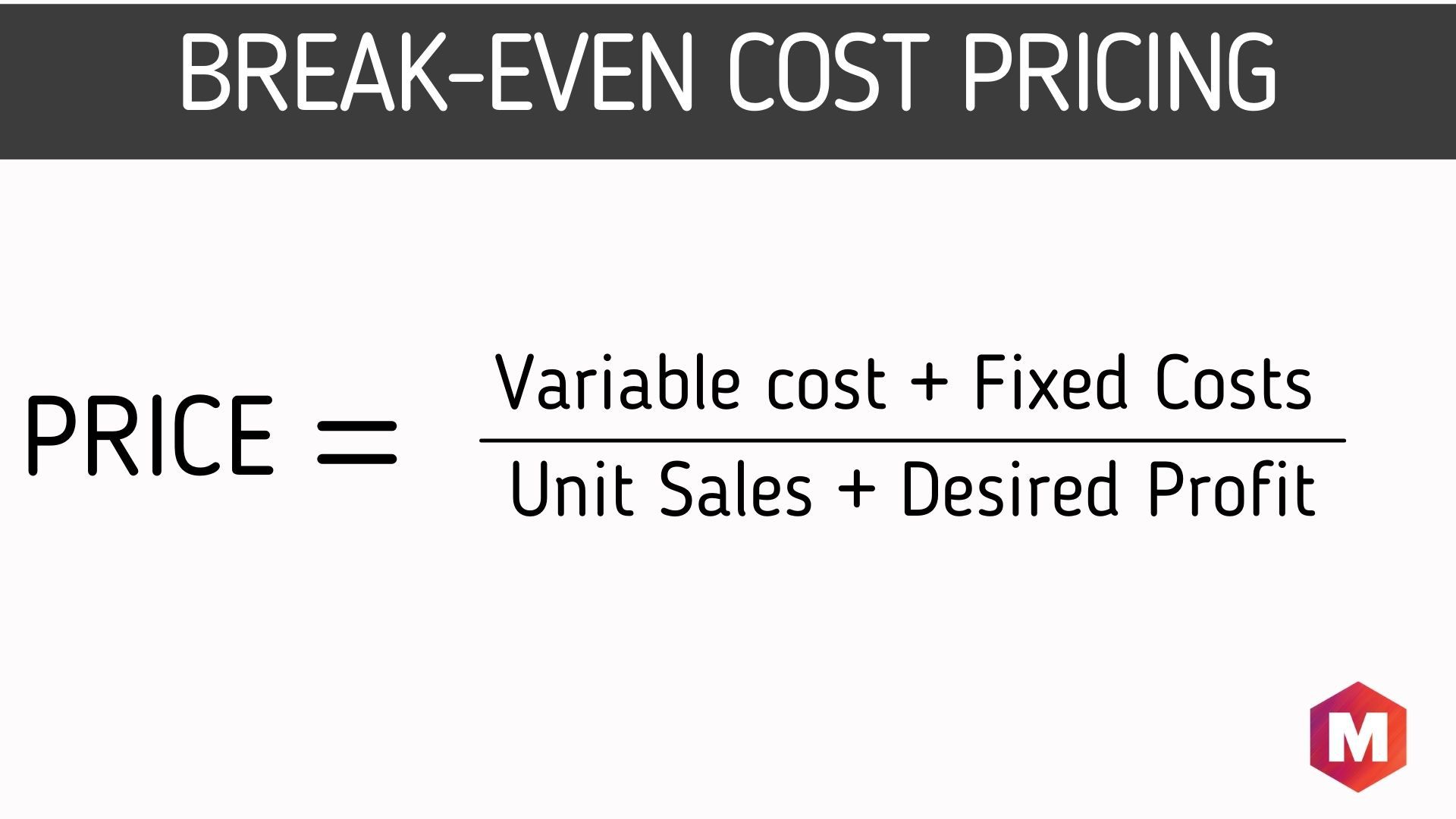

2. Break-Even Cost Pricing

Under the break-even cost pricing approach, the company’s main objective is to cover its fixed cost. Industries with high fixed costs resort to such pricing strategies. This is the level where a company breaks even or the point where there are no profits or losses. Industries like the aviation industry have extremely high fixed costs and hence, use this pricing strategy.

The formula for calculating break-even cost pricing is-

Price = Variable cost + Fixed Costs / Unit Sales + Desired Profit

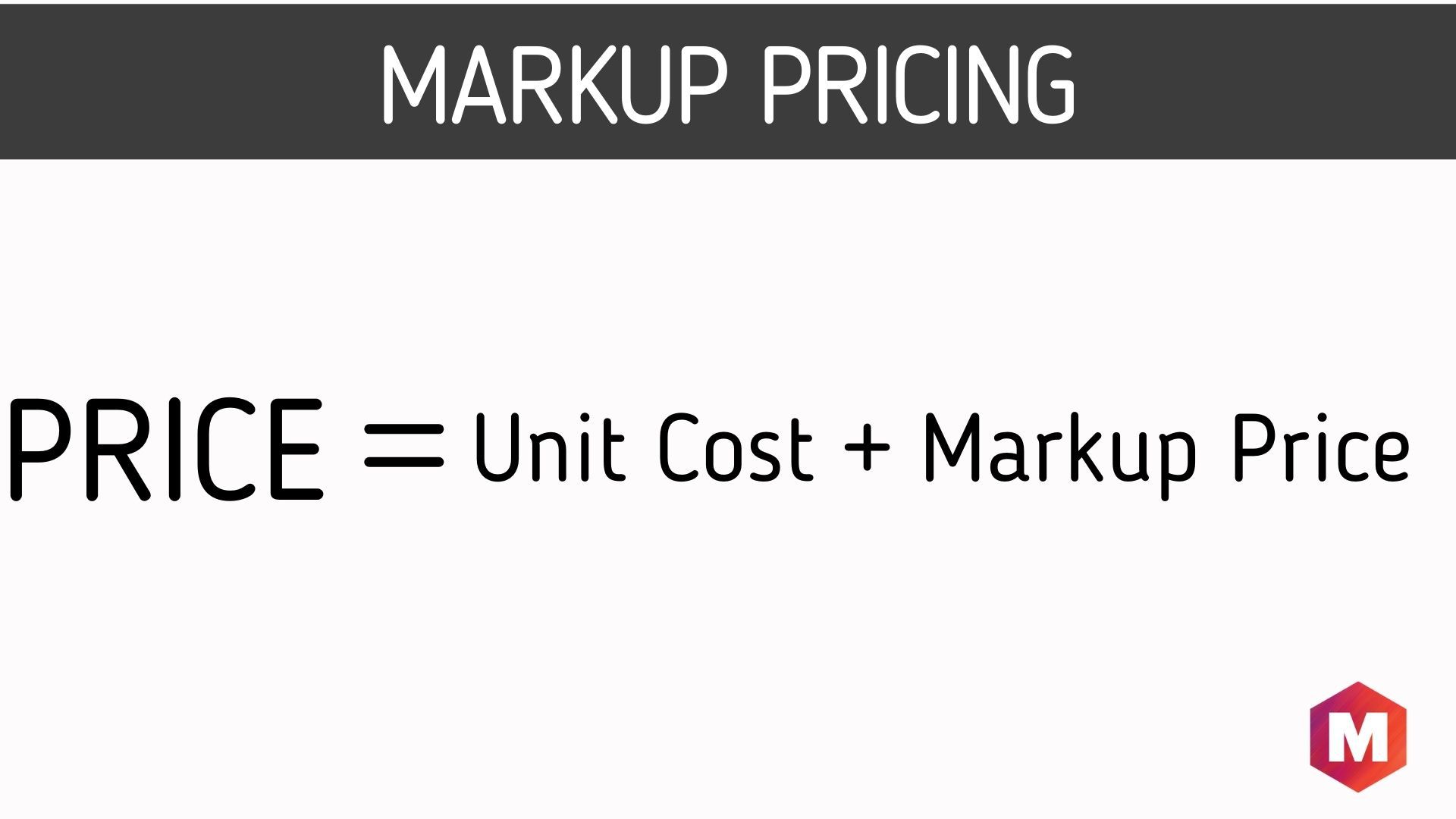

3. Markup Pricing

In this type of pricing, the reseller adds a certain amount of the cost to get the selling price. Retailers usually apply such a pricing strategy to determine their selling prices.

The formula for calculating the markup pricing is-

Price = Unit Cost + Markup Price

Here, Markup Price = Unit Cost / (1-Desired Return on Sales)

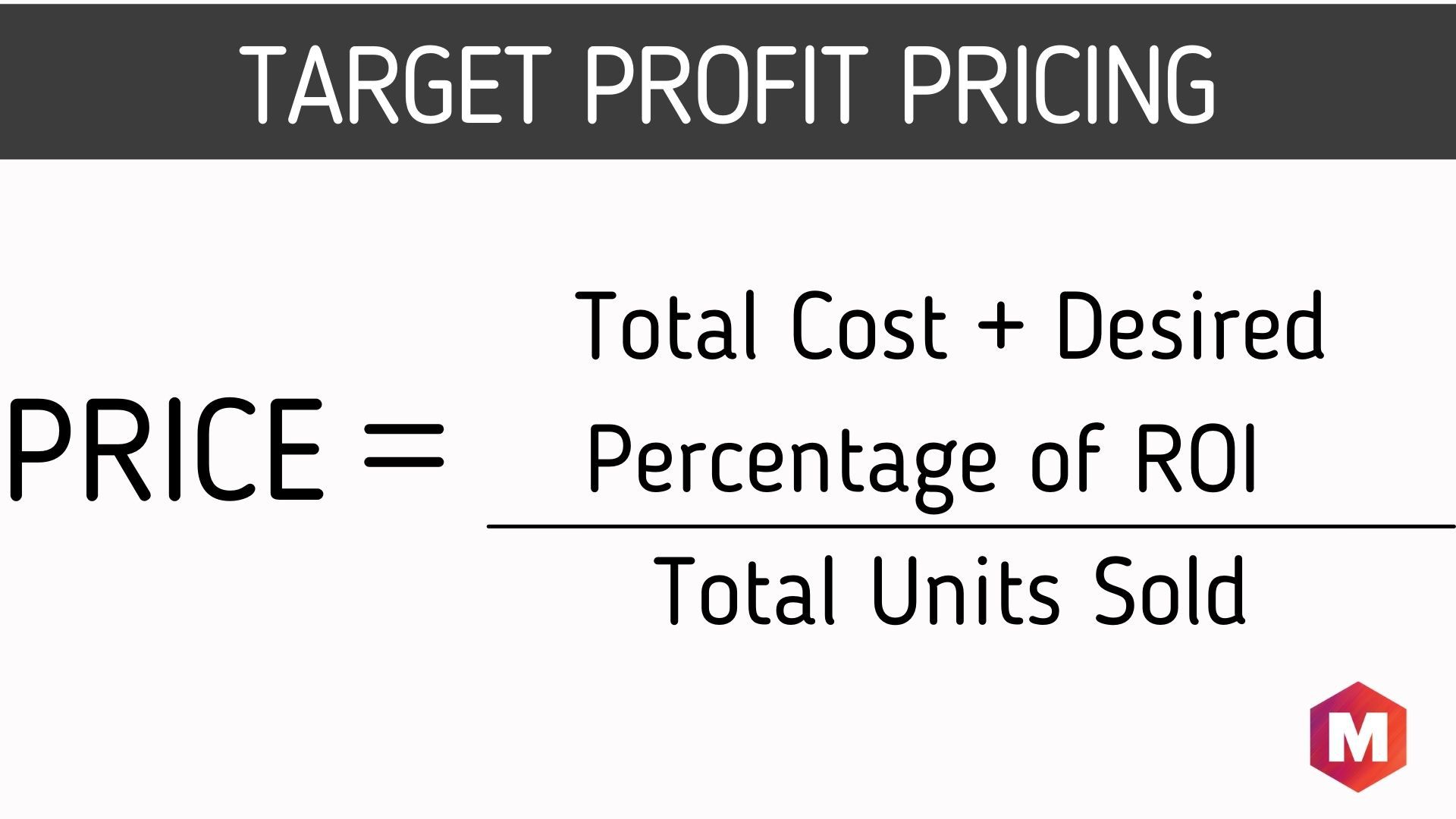

4. Target Profit Pricing

Under the target-profit pricing method, a company will first determine the target profit they want to achieve in a month, quarter, or even a financial year. As per this target profit, the selling price is determined. This method even determines the number of units to be sold to achieve the predetermined profits.

The formula for target profit pricing is-

Price = (Total Cost + Desired Percentage of Return of Investment) / Total Units Sold

How to use Cost-based Pricing?

When setting prices, a company determines the floor and ceiling prices which are the minimum and maximum prices they can charge, respectively. Based on the market situation, the final selling prices are determined that the seller charges for its product or service.

As per the cost-based pricing method, the company determines only the floor price or the minimum possible price they wish to charge their customers.

Benefits of cost-based Pricing Method

The following are the advantages or benefits of a cost-based pricing method:

- Easy to understand and easy to calculate

- Ensures that a company generates profits even when costs rise by charging a markup that meets all expenses

- Covers all incurred costs such as production and overhead costs

- Can be applied to different products and services like customized products and even new and innovative products

- Offers a fair and logical way to price products. If customers are aware of the costs of the product, then they will understand such prices

- Allows companies to bid for large projects quickly as it simplifies investment appraisal decisions.

- A price increase can easily be justified with this pricing method. A company can inform its customers that the costs to produce the product or service have increased. This is why the prices have too

Disadvantages of cost-based pricing methods

The following are the disadvantages or drawbacks of a cost-based pricing method:

- Disregards demand and price elasticity of demand. This reduces the bargaining power and the importance of the consumer

- Turns a blind eye towards the prices charged by competitors. As a result, it ignores the competition

- Ignores the demand, it is inflexible when there are changes in demand levels. Prices do not change with changes in demand levels

- Takes sunk costs and unavoidable costs in its calculation as well

- Prone to underpricing or overpricing

- Reduces the incentive to be more efficient

- Allows companies to pass their costs on to their customers

- Ignores the opportunity cost or the cost of the following best alternative foregone investments

To overcome these disadvantages, value-based pricing can be a befitting alternative pricing strategy. This pricing strategy is based on the amount customers are willing to pay as per the value of the product. The selling price is determined by understanding the perceived value of a product or service in the target market. Given that the determination of the true value to a customer is more qualitative than quantitative, the value is based on the benefits offered by the product or service.

Since this strategy is laser-focused on the customers, sellers that offer higher value or better features can charge higher prices. Sellers that sell rather basic commodities may not benefit as much from this pricing strategy. Marketing techniques can determine the pricing value. An example of this can be that luxury vehicles have high prices as the consumers greatly value these cars and notice an enhancement in their self-worth and image.

Here is a video by Marketing91 on Cost-Based Pricing.

Cost-based Pricing vs Value-based Pricing

Value-based pricing is commonly regarded as the better pricing approach, especially when compared to cost-based pricing. This is because cost-based pricing blatantly ignores what customers want or need. Companies need to give some importance to their customers. It even ignores competitor’s prices.

Cost-based pricing reduces the incentives for the seller to work towards generating a higher quality of products. Companies need to provide their customers some value for their money.

The following are the differences between the two pricing strategies:

https://docs.google.com/document/d/1SzXiOCROaqsja2_tPRpTNEugDmshyXMiEaToiemB520/edit

Examples of Cost-based Pricing

Let’s assume that the total cost of the product of a company is $1000. Furthermore, let’s take that the profit margin or the markup is 15%.

Now, the minimum selling price will equal the total cost of the product along with this margin. As a result, the selling price will be $1000+150(15% of $1000) or $1150. This $1150 will be the floor price or selling price.

Let us have a look at the practical and tactical use of cost-based pricing by a successful brand. Everlane, A San Francisco-based clothing company, uses cost-based pricing very strategically that also empowers them in gaining the trust of their target audiences.

The company has credibility in the market for being transparent with its pricing. – And for this, they disclose the actual cost of their products along with labor, materials, and transportation details. Then, accordingly, they reveal their mark-up on the actual cost.

Conclusion!

Now, on the concluding note, it is clear that cost-based pricing is a pricing method that calculates the price of a product or service by adding the percentage of profit in their total cost to find out the final selling price.

Adeptly using cost-based pricing through strategical implementation will for sure offer upsides to the businesses opting for this pricing method.

Which one would you prefer in between cost-based pricing and value-based pricing?

Liked this post? Check out the complete series on Pricing

I love following your publishes. thanks a lot for the job well done.