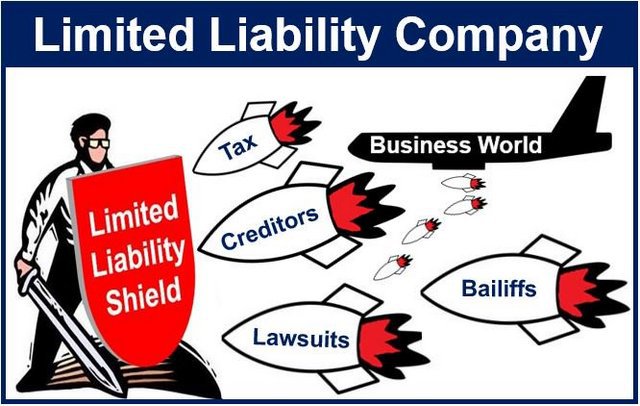

A limited liability company (LLC) is a business entity or corporate structure in which the members of the organization cannot be personally held responsible or liable for the debts of the company or its liabilities. Essentially, these types of companies are hybrid entities that are a combination of the qualities or characteristics of a sole proprietorship or partnership and a corporation.

Table of Contents

Characteristics of a Limited Liability Company

Some of the characteristics that define LLCs include the following:

- Separate legal entity: An LLC is legally separate from its members. The continued existence of an LLC is not affected by changes in membership. However, if an LLC continues to operate for six months or more with only one member, then the limited liability benefits are lost.

- Designated members: Designated members have certain duties and responsibilities which are closely related to those that are normally carried out by a secretary or director of any other business form. An LLC must have, at the minimum, two designated members.

- Disclosure requirements: All LLCs must affix their names outside their offices or places of operations in a manner that is conspicuous and legible. Business documents should also bear the name.

- Floating charges: In the same manner as a company, an LLC can give fixed charges and issue debentures and can also issue or give floating charges over any or all of its assets.

- Taxation: For taxation purposes, an LLC is treated as a partnership even though it is a separate entity from its shareholders. Each member is responsible for the tax on their own part of the income of the LLC.

LLCs are a fast-growing form of business entity because of its simpler operations model as compared to other forms of business. However, a limited liability company should not be mistaken for or confused to be a corporation as there exist many differences between the two business forms.

How to Start a Limited Liability Company?

The following is an outline of how to start a limited liability company:

Did you know about the recent trends in LLC formations?

According to the IRS, the formation of LLCs has become more popular over the past decade due to the flexible structure they offer. As of 2021, over 2.5 million LLC tax returns were filed in the United States, showcasing a substantial increase from previous years. This trend highlights how entrepreneurs appreciate the benefits of personal asset protection combined with tax advantages. With the growing gig economy and the rise of small business trends globally, LLCs are expected to remain a preferred structure for new business owners. (Source: IRS Statistics of Income 2021)

For aspiring business owners considering an LLC structure, a practical piece of advice is to maintain clear documentation of all business decisions. This includes keeping detailed meeting minutes and financial statements, as this can protect your limited liability status and reduce potential legal challenges. A resource many new LLCs find helpful is LegalZoom—a comprehensive platform offering legal advice and services to ensure all necessary paperwork and requirements are completed efficiently. Making use of such tools can ease the burdens of legal compliance and focus your energies on growing your business. (Source: LegalZoom)

- Choose a name that will be used to legally identify your company and reserve the name with the relevant authorities according to the laws of your state or nation.

- Write all the articles of incorporation that you need and file them with the relevant authorities.

- Decide who and how the business will be operated. Will it be run by members of the company or by hired managers?

- Decide on the number of owners who will form part of the limited liability company(LLC)

- Next, apply for a license that will legalize your business and any other industry-specific certificate that will be needed before commencing operations.

- Apply and obtain a unique number that will be used to identify your business as an employer. This number is called the Employer Identification Number (EIN).

- Ensure to apply for any other identification numbers as required by the laws of your state and all the local government agencies that will be involved. For example, forming an LLC in Texas requires obtaining a Sales Tax Permit if selling taxable goods, while in California, an LLC must also register for a State Employer Account Number if it hires employees, in addition to the federal EIN.

Requirements are different from one area to another but in general, your enterprise will most likely be required to pay disability, unemployment and all payroll taxes.

As with all the other forms of business, limited liability companies have the pros and cons. Outlined below are some the merits and demerits of limited liability companies:

Advantages of a Limited Liability Company

- Limited liability: Just as the name suggests, liabilities of the members for the obligations and debts of the company are limited to their level of investment in the company, meaning that in the event that the LLC is sued, personal assets like real estates, bank accounts, and others are protected. The only thing lost is your investment in the company. However, this limited liability is not all-encompassing. One can still be held responsible for behavior deemed to be criminal or failure to adhere to rules about management of the business.

- Pass-through taxation: With limited liability companies, income from the business can sometimes be treated as personal income and as such is not subjected to some taxes that corporations are required to pay as a result of their operations.

- Limitless ownership: While some if not most legal structures have a limit to the number of members allowed to file for ownership rights, this is not the case with limited liability companies. LLCs have no threshold for the number of owners, can range from only one to hundreds and hundreds of owners.

- Allocation flexibility: In a limited liability company, the amount of investment does not necessarily reflect the percentage of ownership by the investor. For instance, an investor can be financing up to half of the business operations without necessarily owning half of the company.

- Freedom in management: Limited liability companies, unlike other businesses, are not required to hold annual meetings, adhere to strict booking keeping requirements or even have a board. This frees up extra time to allow for easy and stress operation of the company.

Disadvantages of a Limited Liability Company

- Building capital: Unlike other forms of business that can increase their funds by issuing stock, LLCs must find willing investors and other sources of funds because of the legal obligations required when adding a new member to the company.

- Higher fees: Limited liability companies typically pay extra registration fees as compared to other business entities. Additionally, they are required to pay yearly renewal fees.

- Government regulation: Some business types can sometimes be barred from registering as LLCs. Because of the limited liability businesses that are sensitive such as banks, medical service providers and even insurance companies can sometimes be barred from registering as LLCs.

- Lack of case law: Not many cases concerning LLCs have been determined since the business form is relatively new. As a result of this, there are a lot of vulnerabilities that are associated with the operations of an LLC. Case law is crucial because of predictability.

- Taxation: Although LLCs provide for avoidance of federal taxes to its owners, the company may sometimes end up paying more than necessary compared to if it were operating differently.

Liked this post? Check out the complete series on Business