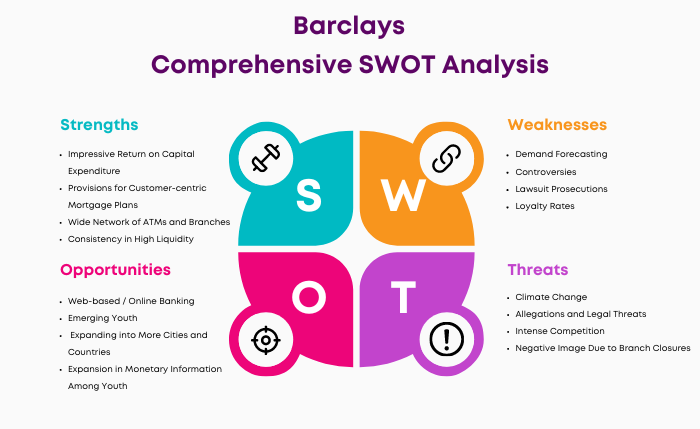

Let’s explore the SWOT Analysis of Barclays by understanding its strengths, weaknesses, opportunities, and threats.

Since the 17th century, Barclays PLC has been a global financial institution. As a multinational firm, it provides investment banking, personal banking, and wealth management to millions of consumers worldwide. Its significant presence and inventive strategy have made it a banking leader, responding to the digital age with speed and vision.

Due to its adaptability and strategic growth, the bank has survived economic cycles and regulatory changes. Barclays has led the industry in environmental and ethical banking. London-based, the bank is influential in global financial and community activities.

Overview of Barclays

- Industry: Banking, Financial services

- Founded: 17 November 17, 1690, 333 years ago, in the City of London, Kingdom of England

- Headquarters: One Churchill Place, Canary Wharf, London, England, United Kingdom

- Key people: Nigel Higgins (group chairman), C. S. Venkatakrishnan (group chief executive)

- Revenue: $8.817B (Q1, 2024)

- Operating income: $2.872B (Q1, 2024)

- Net income: $1.966B (Q1, 2024)

- Number of employees: 92,400 (2023)

- Divisions: Barclays UK, Barclays International

- Website: barclays.co.uk

Table of Contents

SWOT analysis of Barclays

Strengths of Barclays

1. Impressive Return on Capital Expenditure

Barclays monitors new project success and good capital expenditure returns. Barclays has achieved significant financial growth from its projects, generating more earnings and sales.

2. Provisions for Customer-centric Mortgage Plans

Barclays offers many mortgage plans to satisfy its customers’ demands. The bank’s competitive interest rates stand out, with over 80 options that provide two, three, five, or ten years.

3. Wide Network of ATMs and Branches

Barclays provides a smooth banking experience with over 4750 branches and 1600 offices in the UK and 50 countries internationally. As part of the worldwide ATM relationship, the bank allows users to withdraw cash from any ATM without additional fees.

4. Consistency in High Liquidity

Barclays is fully capitalized and has significant cash flow. The bank can invest and strengthen resources in innovative worldwide projects due to financial stability.

5. Focus on employee orientation

Barclays invests a lot in HR and staff development. A well-trained and engaged team helps the bank grow and innovate.

6. Strong Brand Recognition

One of the oldest banks in the world, Barclays, has a reputation for success around the globe. As of Feb 2024, Barclays had a brand value of roughly 13.3 billion U.S. dollars.

7. Comprehensive Product Portfolio

Barclays offers retail banking, investment and corporate banking,, wealth management, and credit cards to different market segments.

8. Global Footprint

Barclays bank operates in over 50 countries, giving them a broad customer base and sources of income.

9. Innovative Approach to Digital Banking

Barclays Mobile Banking and Pingit are cutting-edge digital banking services. This expertise offers a great digital consumer experience.

10. Robust Risk Management

Barclays’ risk management practices are carefully structured to protect its operations and customers’ investments.

11. Experienced Management Team

Barclays relies on a seasoned management team for strategic direction and operational effectiveness.

12. Strong Capital Position

Barclays has continuously kept a stable capital position, significantly contributing to the bank’s capacity for overall growth and stability. Barclay’s revenue for the March 31, 2024 quarter was $8.817B, and net income was $1.966B.

13. Dedication to Sustainable Banking

Barclays has promoted responsible banking practices and green finance, indicating a solid commitment to sustainable banking.

14. Loyal Customer Base

Barclays’ long history and reputation in banking attract loyal customers. This consistent customer base gives the bank stable revenue. Barclays has 48 million customers and clients worldwide.

15. Technology Investment

Banking is changing. Therefore, adaptability is vital. Barclays invests in technology to improve its services and stay competitive in the digital era.

Weaknesses of Barclays

1. Demand Forecasting

Barclays has struggled to predict demand accurately, which has frequently led to much higher inventory levels inside the company and in distribution channels than its rivals. This forecasting challenge may result in higher expenses and decreased productivity, limiting the bank’s capacity to react quickly to market needs.

2. Controversies

The bank’s reputation has been damaged by its involvement in several scandals, including financing activities in Zimbabwe and international money laundering regulations violations. Such occurrences may have an ongoing negative impact on customers’ loyalty and confidence.

3. Lawsuit Prosecutions

Barclays’ history of facing lawsuits has further damaged its reputation as a brand. These lawsuits include claims of money laundering and its role in South Africa during the apartheid era. Legal problems cause financial losses and harm the organization’s reputation and the trust of its stakeholders.

4. Loyalty Rates

Barclays’s customer loyalty rates have been relatively low. Low loyalty rates can indicate underlying problems with service quality, customer experience, or sense of value in a service-oriented company where trust and customer satisfaction are critical, requiring prompt remediation.

5. Affecting Long-Term Growth

Barclays’s inability to predict demand accurately requires keeping larger inventory quantities, so the company must devote more cash to inventory management. This financial resource limitation may make it more difficult for the bank to invest in expansion potential, harming its growth prospects.

6. Ethical Tangles

Barclays encountered severe ethical issues when offering services to doubtful Zimbabwean individuals connected to Zanu PF. Such moral failings caused investors and clients to doubt the bank’s beliefs and ideals, which can negatively affect its reputation and possibly even its bottom line.

7. Director Pay is High

Barclays’s high director bonuses have drawn criticism from the public and investors, particularly during periods of economic downturn. This perception of mismatched compensation policies may impact the bank’s reputation and the trust of its stakeholders, attracting attention and criticism.

8. In the Market by ABN Amro

Significant financial losses resulted from ABN Amro’s 2006 rejection of Barclays’ attempts to join the Asian market, highlighting the challenges and expenses of expanding internationally, particularly when faced with regulatory and competitive obstacles.

9. Regulatory Challenges

Like numerous multinational financial institutions, Barclays has faced many regulatory obstacles and penalties in diverse jurisdictions. These difficulties affect the bank’s flexibility and responsiveness by adding to the complexity of operations and regulation and directly costing money.

10. Reputation Issues

Previous scandals, such as manipulating the London Interbank Offered Rate (LIBOR), have damaged Barclays’s reputation. Such scandals can result in lost revenue, sanctions from authorities, and long-term problems with investor and consumer trust.

11. Competitive Market

Due to intense rivalry in the banking industry, Barclays faces competition from up-and-coming fintech companies and other big banks. Because of the fierce competition, established banks with legacy systems and conventional banking models may need help staying innovative and adapting.

12. Operational Risks

Barclays is subject to various operational risks due to its size and global operations, such as IT malfunctions, cybersecurity attacks, and other logistical difficulties. Robust risk management procedures are essential since these risks have the potential to have significant adverse effects on operations and finances.

13. Reliance on Traditional Banking

Barclays’ traditional banking model is at risk due to the explosive expansion of fintech and alternative banking solutions. This bank’s dependence on traditional banking practices might make it more difficult to innovate and adapt to changing client demands in the digital era.

14. Economic Sensitivity

Because of its close ties to the world economy, Barclays’ performance is susceptible to economic changes. Economic downturns may negatively impact the bank’s profitability, emphasizing the significance of having a robust and diverse business model.

15. Complex Organizational Structure

Barclays’ worldwide reach is supported by a complex organizational structure that may cause inefficiencies, slow decision-making, and communication problems that compromise the bank’s efficiency and adaptability.

16. Cultural Differences

Dealing with cultural differences presents difficulties while conducting business internationally. These distinctions may cause miscommunications, inconsistencies in business procedures, and challenges in maintaining an integrated, business structure and culture.

17. High Operating Costs

Barclays’s high operating costs result from its vast global network of branches and operations. In a market where efficiency is crucial and competition is fierce, these expenses can work against Barclays.

18. Legacy Systems

Barclays has a big issue because it relies on outdated IT systems. The bank may find it more challenging to develop and maintain operational excellence with legacy systems since they are often less reliable and more prone to problems than modern ones.

Opportunities for Barclays

1. Web-based / Online Banking

In a digital age, Barclays may dominate internet banking. Since investing heavily in its web platform, the company has gained a new sales channel and can use big data analytics. This skill may help Barclays understand and answer customers’ needs with unprecedented accuracy. Internet and business banking could revolutionize banking, given today’s consumers’ demand for convenience and efficiency.

2. Emerging Youth

Thanks to easily accessible information and a greater awareness of financial wellness, today’s youth are more knowledgeable about investments than any previous generation. Barclays has the chance to appeal to this group by offering them specialized investment solutions that align with their particular requirements and goals. By concentrating on this market, Barclays could encourage long-term loyalty among people just starting their financial journey.

3. Expanding into More Cities and Countries

Barclays is well-positioned for additional geographic growth, given its presence in over 50 countries and strong workforce. Rising markets offer new consumer categories and sources of income, making them ideal for expansion. By expanding into new markets, Barclays may further enhance its position as a major player in finance by utilizing its huge knowledge and global reputation.

4. Expansion in Monetary Information Among Youth

Young people have already strongly recollected the Barclays brand thanks to its association with sports, especially the sponsorship of the English Premier League. In addition, this group is becoming more financially literate, giving Barclays a rare chance to interact with young investors early in their financial careers and turn them into lifetime clients.

5. Fintech Collaborations

The fintech revolution has brought about a new banking era, marked by creativity, quickness, and customer-centric solutions. By working with fintech companies, Barclays can bring innovative technology and methods to the banking giant, improving customer service and putting Barclays at the forefront of the digital banking revolution.

6. Emerging Markets

Moving into these areas will give Barclays access to a new customer base and broaden its market exposure. These areas have developing economies and growing middle classes, giving Barclays a platform to market its financial services to more people.

7. Sustainable Banking

Due to the increased emphasis on sustainability worldwide, there is a greater need than ever for green banking solutions. Barclays has the potential to capitalize on this by providing environmentally conscious goods and services, which will draw in a customer base concerned about protecting the environment.

8. Wealth Management

Since the wealth management industry is growing, Barclays has the opportunity to broaden its services to include high-net-worth people and institutions. This market offers the opportunity to develop close, collaborative connections with clients and profitability.

9. Blockchain and Cryptocurrency

By investigating these areas, Barclays may establish itself as a leader in the financial product market in terms of innovative payment methods and blockchain technology. This action might draw in tech-savvy clients and create new sources of income.

10. Personalized Banking

Data analytics can greatly increase customer happiness and loyalty by personalizing banking solutions. Barclays may use this technology to give consumers a more personalized banking experience that makes them feel valued and understood.

11. Financial Education

Barclays can strengthen client relationships and earn their trust by offering financial literacy and education programs. Consumers with more excellent education are likely to make better financial judgments.

12. Diversification

By expanding the range of goods and services it offers, Barclays can lessen the risks associated with depending on just one source of income. Diversification across different financial services providers might help maintain growth and stable revenue.

13. Acquisitions and Mergers

Barclays can access cutting-edge technology, a more extensive customer base, and a more substantial market presence by purchasing or merging with other financial institutions and fintech businesses. This method of planning can accelerate Barclays’ efforts to innovate and grow.

Threats to Barclays

1. Climate Change

Barclays has faced environmental criticism in the past. In 2017, campaigners protested their stake in Third Energy. This company will use fracking to extract natural gas from Kirby Misperton in Yorkshire. However, Barclays sold Third Energy in 2020. Environmental sustainability and profitability have made reconciling business interests and environmental responsibility difficult for institutions like Barclays.

Due to its $85 billion investment in fossil fuel production and $24 billion in related activities, the bank may be criticized and fined for environmental rules.

2. Allegations and Legal Threats

Over time, Barclays has had many legal challenges. The bank’s share price fell 5% in June 2014 after New York sued it for dark pool fraud. In 2014, the Financial Conduct Authority fined the bank £26 million for manipulating gold prices between 2004 and 2013. March 2009’s $298 million bank settlement for money laundering was worse. These past and potential legal issues harm its reputation, revenue, and investor trust.

3. Intense Competition

The global banking sector is known for its intense competition. Rivals competing for new and old market shares put ongoing stress on banks like Barclays. If not properly managed, the increased competition may result in smaller profit margins and significantly reduce the bank’s earnings.

4. Negative Image Due to Branch Closures

When Barclays closed several branches in 2000, it came under heavy criticism. Due to the widespread perception that this action was anti-customer, competing banks took advantage of it and positioned themselves as more customer-friendly businesses. Even though Barclays has dramatically enhanced its customer care since then, the bank still needs to get past this outdated belief.

Barclays has revealed 22 further branch closures, taking the total due to close this year to 90 and the total due to shut in 2025 to six.

5. Weak Presence in Asia

Barclays’s position in Asia is weaker than in Europe. In this strategically significant area, the bank faces competition from long-standing established companies and constantly changing market conditions, which puts its expansion and growth plan to the test.

6. Economic Stability

Like the majority of banks, Barclays is highly dependent on shifts in the macroeconomic landscape. Economic fluctuations can rapidly change the financial environment, impacting a bank’s profitability, liquidity, and general health.

7. Regulatory Changes

The banking industry is subject to strict regulation. Modifications to tax laws, government policies, or new regulations impact Barclays’ operations, profitability, and development prospects.

8. Fintech Disruption

Traditional banking institutions face a serious and convincing challenge from the growing popularity of fintech startups. The younger generation finds these creative firms’ flexible and tech-forward approach attractive, and they provide more affordable and convenient banking alternatives, which puts Barclays’ market share at risk.

9. Cybersecurity Threats

Cybersecurity risks have increased dramatically since the introduction of digital banking. For Barclays, a data breach or cyberattack could have serious implications, harming the company’s brand and consumer trust and potentially resulting in significant financial losses.

10. Interest Rate Fluctuations

Changes in interest rates may directly impact the bank’s net interest margins and overall earnings. Like all banks, Barclays must successfully manage this risk to maintain financial stability.

11. Reputational Risks

Barclays’ reputation is constantly at stake because of the scope of its business and the nature of the banking sector. Previous conflicts and any unfavorable news or social media posts in the future could damage consumer confidence and harm the brand.

12. Operational Risks

Due to its size, Barclays is subject to several operational risks, such as employee errors, problems with IT or service delivery, and delays brought on by natural or man-made disasters.

13. Geopolitical Risks

Barclays is subject to geopolitical risks as a result of its foreign operations, including as political unrest, modifications to trade laws, and the results of restrictions or sanctions.

14. Changing Consumer Preferences

The banking sector is changing quickly due to shifting consumer tastes and expectations. For Barclays to be current and competitive, it must adjust to the growing customer demands for greater ease, personalization, and transparency.

Conclusion

Barclays PLC is a powerful force in the global banking market thanks to its extensive heritage, well-known brand, and creative edge. Despite facing difficulties, including competitive threats, regulatory restrictions, and the requirement to adjust to the digital transition, Barclays demonstrates courage and strategic vision. The bank is well-positioned for future growth due to its dedication to sustainability, emphasis on growing digital services, and entry into emerging countries.

Barclays’ ability to continue to grow in the face of changing market dynamics and customer expectations is highlighted by its combination of historical capabilities and adaptable methods, which it uses to navigate the complexity of the financial sector. By carefully balancing the use of opportunities and risk mitigation, Barclays is positioned to maintain and grow its heritage in the rapidly evolving finance industry.

Liked this post? Check out the complete series on SWOT