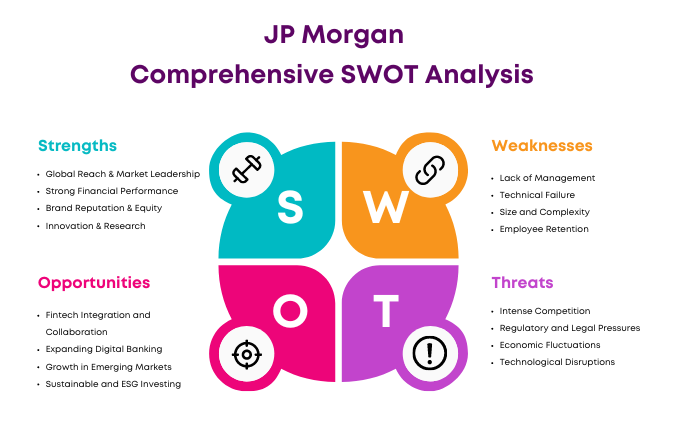

Let’s understand the SWOT analysis of J.P. Morgan by exploring its strengths, weaknesses, opportunities, and threats.

J.P. Morgan, a financial services sector giant, is part of J.P. Morgan Chase & Co., which provides a wide range of services, including investment banking and asset management. With a long history dating back to 1871, it has established itself as a trusted counselor to governments, institutions, and individuals worldwide. It is known for its financial knowledge and international reach.

The organization is well-known for its strategic flexibility and dedication to innovation. It responds to market changes through modern technologies and broad experience. J.P. Morgan values ethical principles and sustainability while prioritizing financial performance and positive social impact. As a result, it establishes a firm foundation for future growth, regardless of global economic fluctuation.

Overview of J.P. Morgan

- Company type: Public

- Industry: Financial services

- Founded: December 1, 2000; 23 years ago

- Headquarters: 383 Madison Avenue, New York City, U.S.

- Area served: Worldwide.

- Key people: Jamie Dimon (Chairman & CEO), Daniel E. Pinto (President & COO)

- Revenue: Increase US$158.1 billion (2023)

- Number of employees: 309,926 (2023)

- Website: jpmorganchase.com

Table of Contents

SWOT Analysis ofJ.P. Morgan

J.P. Morgan Strengths

1. Global Reach & Market Leadership

J.P. Morgan is a financial giant with operations in over 100 nations and is known for its capacity to serve a diverse clientele worldwide. This vast presence underlines its market leadership and provides outstanding commercial opportunities internationally.

2. Strong Financial Performance

The company’s financial position is highly robust. It consistently posts high profit margins, has a strong balance sheet, and maintains favorable capital ratios. This financial expertise defines J.P. Morgan as a pillar of strength in the banking industry.

In Q1 2024, Net revenue was reported at $42.5 billion, and Net income was $13.4 billion.

3. Brand Reputation & Equity

J.P. Morgan’s two-century legacy in the financial sector has shaped a brand associated with trust and excellence. This reputation attracts clients and some of the financial industry’s brightest brains, giving the firm a competitive advantage. JPMorgan Chase is in second place with over $3.5 trillion in total assets. JPMorgan Chase has the highest market valuation of any bank, at over $502 billion.

4. Innovation & Research

Deep investments in research offer J.P. Morgan cutting-edge market insights, allowing its clients to make better investment decisions. The company’s research findings are well acknowledged and considerably impact financial sectors worldwide. JPMorgan Chase invests $12 billion per year on technology.

5. Extensive Client Base

Catering to a wide range of clients, from individual account holders to large organizations and governments, gives J.P. Morgan a solid base and diverse development opportunities, allowing it to leverage its vast network for superior service delivery. JPMorgan Chase has over 60 million retail clients, whose needs enable the corporation to promote innovation and accelerate transformation.

6. Risk Management & Compliance

J.P. Morgan uses complicated risk management frameworks and compliance procedures to mitigate potential risks and maintain operational resilience in the path of global financial rules.

7. Investment in Sustainability

The bank’s active involvement in sustainable practices and commitment to environmental responsibility is consistent with the growing need for corporate sustainability and the principles of a socially conscious client.

8. Diversified Business Model

J.P. Morgan successfully responds to financial crises by offering various services, including consumer and investment banking, asset management, and commercial banking. This intended diversification across multiple financial domains is a buffer, ensuring regular revenue sources even during difficult economic conditions.

9. Cutting-edge Technology & Digital Platforms

J.P. Morgan is at the forefront of digital change, investing billions in technology. Its cutting-edge online and mobile banking technologies are praised for providing a seamless user experience, indicating a significant shift toward adopting financial technology and digitizing traditional banking services.

10. Expertise & Human Capital

J.P. Morgan’s extensive experience and dynamic staff position it at the leading edge of financial innovation and service excellence. Its ability to attract and nurture talent promotes a culture of expertise and understanding.

11. Strong Asset & Wealth Management Division

This affiliate maintains an extensive portfolio for institutional and high-net-worth clients, highlighting J.P. Morgan’s leadership in asset and wealth management and reinforcing its position in global finance.

12. Capital & Liquidity

The company’s substantial capital and liquidity reserves mean it is well-prepared to weather economic downturns and banking crises, highlighting its financial stability.

13. Community and Social Responsibility

J.P. Morgan’s commitment to community development and social activities considerably improves its corporate image, demonstrating a concern for societal well-being beyond financial concerns.

J.P. Morgan Weaknesses

1. Lack of Management

JP Morgan Chase has had its fair share of troubles in recent years, highlighting potential managerial problems. Between 2002 and 2009, the UK Financial Services Authority (FSA) penalized the bank $33.32 million for failing to protect billions of dollars in client wealth. These tragedies highlight the need for increased control and risk management to prevent future calamities.

2. Technical Failure

In February 2018, JP Morgan Chase faced a serious technical issue that exposed a security gap in their online banking system. Some individuals got unauthorized access to other clients’ account information, causing controversy on social media networks. Technical breakdowns are typical in large enterprises, yet they can dramatically weaken client trust in well-known companies.

3. Size and Complexity

JP Morgan’s vast worldwide network creates natural operational and structural challenges. While this offers them a significant presence, it can also cause efficiency bottlenecks and hinder their ability to react quickly to market changes.

4. Employee Retention

In today’s competitive job market, it might be difficult for J.P. Morgan to attract and retain top individuals. This issue may influence the bank’s long-term prospects if not appropriately addressed.

5. Limited Success Outside Core Business

Despite being an industry leader, J.P. Morgan Chase has faced significant difficulties expanding beyond its core business divisions. The company’s culture inhibits its potential to expand into other product categories.

6. Exposure to Volatile Markets

JP Morgan is subject to significant market volatility due to its extensive role in global financial markets. This weakness puts its trading earnings and total investment returns at risk.

7. Dependency on Key Personnel

Like many financial institutions, J.P. Morgan heavily relies on its top staff. The loss of such employees may leave a significant hole, affecting the company’s stability.

8. Interest Rate Sensitivity

J.P. Morgan is not immune to interest rate volatility. Like those experienced by other banks, interest rate fluctuations may impact JP Morgan’s revenue, notably from its lending operations, modifying its net interest margins.

J.P. Morgan Opportunities

1. Fintech Integration and Collaboration

The introduction of fintech helped speed up the growth of the financial services sector. J.P. Morgan could benefit from the change by creating strategic ties with fintech startups. This can be accomplished by purchasing promising companies or adding novel fintech financial services industry into its framework, increasing customer happiness and strengthening its market advantage.

2. Expanding Digital Banking

Changing to digital banking is unavoidable, providing an excellent opportunity for J.P. Morgan to broaden its digital banking services footprint. Optimizing online and mobile platforms by adding flexible features and fine-tuning user interfaces will exceed modern customer expectations, enhancing client loyalty and market share.

3. Growth in Emerging Markets

J.P. Morgan can profit from the opportunities of emerging markets in consumer banking, wealth management, and other investment banking services. It can diversify its revenue streams and achieve global brand dominance by developing new branches or strategic local ties, particularly in dynamic countries like Asia and Africa.

4. Sustainable and ESG Investing

J.P. Morgan is ideally positioned to gain from the significant shift toward investments based on environmental, social, and governance (ESG) principles. Expanding its ESG-focused product line and strengthening advisory services would enable it to fulfill rising market demand while positioning itself as a leader in responsible investing.

5. Wealth Management for the Growing Affluent Class

The increasingly affluent population needs specialist financial services, especially in emerging economies. J.P. Morgan has the opportunity to cater to this segment with its top-tier wealth management and private banking products, resulting in a devoted client base and increased revenue opportunities.

6. Blockchain and Cryptocurrency

With J.P. Morgan at the top of the banking industry, incorporating blockchain technology has the potential to transform its service offerings. This includes the possibility of offering Bitcoin services and utilizing blockchain to improve transactional speed and security, putting J.P. Morgan at the forefront of technological advancements and innovation in the financial sector.

7. Diversification of Service Offerings

J.P. Morgan’s expansion into unknown financial products or niche markets provides new revenue growth opportunities. Inventing and diversifying its offerings may help it stay ahead of consumer demands and generate new revenue sources.

8. Enhancing Data Analytics and AI

Using data analytics and artificial intelligence, J.P. Morgan could further streamline its operations. This may improve customer insights, personalize banking experiences, facilitate risk management, and increase overall operational efficiency, translating into a competitive advantage.

9. Cybersecurity Solutions

The increased cyber-attack threat enables J.P. Morgan to strengthen its defenses and offer cybersecurity services. Investing in cutting-edge protection technology can assist in protecting its operations while providing clients and partners peace of mind, enhancing its reputation as a secure banking institution.

10. Regulatory Arbitrage

J.P. Morgan can take advantage of the changing landscape of global finance rules. Staying updated on regulatory changes and differences between locations allows strategic realignments to capitalize on regulatory arbitrage opportunities, ensuring a competitive position in the worldwide market.

JP Morgan Threats

1. Intense Competition

J.P. Morgan constantly competes with other banks and institutions for the same financial market share. The development of technologically savvy players is altering the competitive landscape since they can beat established institutions with their new services and solutions.

2. Regulatory and Legal Pressures

Global banking giants like J.P. Morgan must negotiate a complex regulatory environment. Changes in these regulations or more scrutiny may increase compliance costs and potential fines, impacting their bottom lines.

3. Economic Fluctuations

An economic downturn, recession, or financial crisis can adversely affect banking giants like J.P. Morgan. In such cases, companies see a decrease in loan activity, a drop in investment returns, and an increase in default rates, all of which harm their overall performance.

4. Technological Disruptions

With the rapid expansion of fintech startups and digital-only banks, the threat to J.P. Morgan is real and severe. These disruptors may attract customers with their flexible and innovative solutions, reducing J.P. Morgan’s market share, particularly in the consumer banking category.

5. Cybersecurity Risks

J.P. Morgan is a sensitive target for cybercriminals because of its large financial operations. A significant cyber breach may considerably raise financial losses, harm the bank’s reputation, and cost them dearly in terms of client trust.

6. Geopolitical Tensions

The effects of geopolitical upheavals, trade disputes, or hostilities can be far-reaching, affecting global financial markets. Such changes add difficulty to J.P. Morgan’s overseas business and investment strategies.

7. Market Disruptions

Stock market breakdowns, bond market irregularities, and irregularities in trading algorithms pose significant risks to the bank’s investment and trading operations. Such disasters can disrupt operations and cause substantial financial damage.

8. Credit Risks

An economic downturn or changes in specific industry sectors might increase loan default rates. This ultimately stresses the bank’s balance sheet and threatens its profitability, providing a severe credit risk to J.P. Morgan.

Conclusion

J.P. Morgan Chase & Co. is a dominant force in the global financial sector, showcasing strength and adaptability across its diverse spectrum of services. With its long history and commitment to innovation, the bank is well-prepared to tackle the complexity of today’s financial landscape.

Despite facing technological changes and regulatory pressures, J.P. Morgan remains committed to using its strengths—such as global reach, solid financial performance, and strategic investments in technology and sustainability—to maintain its industry leadership. J.P. Morgan is well-positioned to build on its record of expertise and influence in global finance by seizing possibilities in digital banking, fintech, and developing markets.

Liked this post? Check out the complete series on SWOT

what is the website publissher

Sorry. I didn’t get you. The website is Marketing91 which is handled by Me – Hitesh Bhasin. So I am the publisher as it says just below the post title – By Hitesh Bhasin. So hope this helped :)

yo im still waiting on the website publisher. i commented last week

where are your sources? how are we to know that what you say is true?

Do you have older versions: I am searching for 2008 financial crisis Company SWOTS to compare.