Let’s explore the SWOT Analysis of Asian Paints by understanding its strengths, weaknesses, opportunities, and threats.

In India and worldwide, Asian Paints is a paint and coatings giant that values innovation, quality, and client happiness. It has developed from a small beginning in 1942 to become India’s largest paint company and Asia’s third-largest paint manufacturer, pioneering trends and offering a wide range of goods and services. Sustainability and community participation reinforce the company’s forward-thinking and socially responsible corporate image.

Overview of Asian Paints

- Industry: Chemicals

- Founded: 1 February 1942, 82 years ago

- Founders: Champaklal Choksey, Chimanlal Choksi, Suryakant Dani, Arvind Vakil

- Headquarters: Mumbai, Maharashtra, India

- Area served: Worldwide

- Key people: Manish Choksi (Vice Chairman), Amit Syngle (CEO)

- Revenue: ?36,183 crore (US$4.3 billion) (2024)

- Operating income: ?7,215 crore (US$860 million) (2024)

- Net income: ?5,558 crore (US$670 million) (2024)

- Total assets: ?29,924 crore (US$3.6 billion) (2024)

- Total equity: ?19,424 crore (US$2.3 billion) (2024)

- Number of employees: 7,160 (2021)

- Website: asianpaints.com

Table of Contents

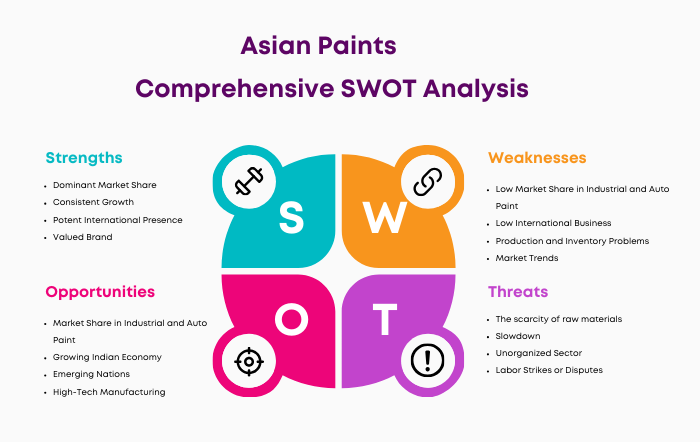

SWOT Analysis of Asian Paints

Strengths of Asian Paints

1. Dominant Market Share

Asian Paints leads the Indian paint business with over 50% market share. This huge lead shows their market power and leaves competitors behind. It’s proof of the brand’s consumer confidence and loyalty and a model for market leadership with focused strategy and great products.

2. Consistent Growth

Over the past five years, Asian Paints has grown financially at 8–12%. This sustained financial development has helped Asian Paints maintain its leadership position and provide the groundwork for future growth and expansion.

3. Potent International Presence

Asian Paints has gone beyond India. The top five paint businesses in Asia operate in 15 countries with over 27 manufacturing units and serve over 60 countries. The brand’s strong international presence, reputation and broad consumer base suggest global expansion.

4. Valued Brand

Asian Paints was named 20th in The Economic Times’ Interbrand’s Top 20 brands study. It was named one of the Top 20 Most Innovative Companies in the World, solidifying its global status. As of 2024, its brand value is USD1.5 billion. Recognitions show the brand’s dedication to innovation and quality, improving consumer preference.

5. Technological advancements

Asian Paints dominates the Indian sector due to its close competition with technology. Their 1970s supercomputer adoption, ten years before ISRO, shows their leading attitude. This investment gave them a competitive edge by enabling massive and deep data collection.

6. Diverse Product Range

Asian Paints’ diverse product offering serves more than just residential paint. They’ve succeeded in both industrial paints and coatings, ornamental paints, Asian Paints Royale, painting additional services, and more. This diversification has allowed them to address more client needs, boosting their customer base and market reach.

7. Innovative Marketing

Asian Paints’ marketing methods have helped sustain the brand reputation and raise exposure. Their creative advertising and celebrity endorsements from Saif Ali Khan and Deepika Padukone have reached consumers across groups.

8. Efficient Supply Chain Management

Asian Paints uses cutting-edge technology to improve its supply chain. SAP ERP powers their complete supply chain management system, which integrates regional distribution and plants. This strategy has improved operations and product availability, boosting the brand’s competitiveness.

Weaknesses of Asian Paints

1. Low Market Share in Industrial and Auto Paint

Despite its long history, Asian Paints has 15% and 20% market shares in industrial and the auto paint sectors. This is far lower than niche players Kansai Nerolac and AkzoNobel. Competition and Asian Paints growth and expansion potential are shown below. Understanding these industries’ needs and creating personalized solutions may help them compete.

2. Low International Business

Asian Paints is one of Asia’s top 5 paint companies, exhibiting its size and reputation. Its global footprint is weak when examining market dynamics. Poor overseas performance suggests the organization requires a better global strategy or tailored solutions that appeal to different international markets. To grow global, it must adapt to different cultures and regulations and increase its product line.

3. Production and Inventory Problems

Decorative paints evolve swiftly with consumer tastes. This unstable market makes production planning and inventory management difficult for Asian Paints. Forecasting demand in a world of changing tastes is difficult. Demand forecasting analytics, agile production, and flexible inventory management may cut waste and adapt swiftly to market demands.

4. Market Trends

Like manufacturing and inventory issues, fast-changing customer trends in the decorative colors business are a constant concern. Trends change, thus today’s hot products may not be popular tomorrow. To meet consumer needs, production lines and inventory must be adjusted continuously, requiring proactive trend forecasting and product innovation.

5. Potential Over-reliance on Physical Retail

Asian Paints has a large network of physical retail shops, which is a strength in the current industry. As the digital revolution sweeps industries, this huge physical footprint could become a risk if customer buying habits shift online. Digital commerce and omnichannel strategies can balance offline and online sales platforms and protect against market fluctuations.

6. Infrastructure Maintenance

Asian Paints’ massive production, warehouse, and retail facilities require significant resources. This extensive infrastructure allows market penetration and supply chain efficiency but requires expensive maintenance. Technology and sustainability can assist optimize these operations and reduce overheads, enhancing profitability.

7. Labor Relations

Asian Paints’ manufacturing-based business makes it subject to labor disputes that might interrupt operations. Labor disputes can reduce production, therefore good ties are essential. To reduce such dangers, progressive labor regulations, healthy work environments, and honest communication are crucial.

8. Environmental Concerns

Asian Paints and the paint industry have been criticized for VOC emissions. Maintaining compliance with stricter environmental rules requires investing in greener technologies. This is to meet legal standards and meet consumer demand for eco-friendly items. Managing this issue involves sustainable practices and product formulation breakthroughs, which may provide you an edge in an eco-conscious market.

Opportunities for Asian Paints

1. Market Share in Industrial and Auto Paint

Asian Paints has a great opportunity to grow its industrial coating and automotive paint businesses. Due to its financial strength and innovation, Asian Paints can meet these sectors’ desire for cutting-edge technologies. The company can address industry needs with high-performance coatings and R&D strengths, thereby increasing its market share.

2. Growing Indian Economy

Rapid infrastructural development and rising consumer spending provide Asian Paints a huge growth opportunity. Expanding into underserved smaller communities can attract new customers and boost revenue. It’s a good time to use this economic upturn to boost industrial paint product demand through infrastructure growth.

3. Emerging Nations

Asian Paints could gain a first-mover advantage in rising economies hungry for superior building materials and finishes. Early entry into these unexplored markets might strengthen Asian Paints’ leadership and expand its revenue streams outside saturated markets.

4. High-Tech Manufacturing

Innovative brands will succeed. Asian Paints can get a competitive edge by investing in high-tech manufacturing processes that improve production efficiency and sustainability and offer products with qualities and precision that rivals cannot match.

5. Government Policies

Pro-building and urbanization policies, incentives like the CLSS plan, and simpler house credit availability boost construction and paint demand. Asian Paints can capitalize on policy positive winds with its large dealer network and creative product line.

6. Product Diversification

Expansion into home décor and industrial coatings is strategic. This spreads risk and allows Asian Paints to offer a broader solution, boosting customer loyalty and market proposition.

7. Eco-friendly Products

Low-VOC paints are needed for environmental sustainability. Asian Paints can reach a rising customer group and align itself with global sustainability goals by pioneering green innovation, creating goodwill and potentially premium pricing.

8. Digital Engagement

AR for color visualization and consultancy and e-commerce platforms can improve consumer experience. Such efforts can differentiate Asian Paints, build brand loyalty, and broaden its reach in a digital age.

9. DIY Trend

Western countries’ DIY movement offers development potential. Asian Paints can catch the interest of this growing market segment with user-friendly painting kits and instruction, boosting brand adoption through new product solutions.

10. Strategic Acquisitions

Acquiring smaller or related companies helps accelerate growth and diversification. Such purchases can boost Asian Paints’ growth by adding customers, technology, or locations.

11. Smart Cities and Homes

Developing smart home technology with partners is interesting. Asian Paints could take advantage of the smart construction boom to attract tech-savvy homeowners by merging paint solutions with current housing systems.

12. Rural Market Penetration

Rural markets, especially in India, are underdeveloped, offering growth potential. These markets require unique products and marketing tactics, which can generate new revenue.

13. Industry Partnerships

Asian Paints can maintain product demand by partnering with real estate and construction players like developers, interior designers, and architects. Asian Paints may maintain growth by entering the building and renovation value chain through these agreements.

Threats of Asian Paints

1. The scarcity of raw materials

Competitive production depends on raw material supply and price. Asian paintmakers worry. Paint production capacity and pricing depend on raw ingredients. Natural shortages, geopolitical wars, and other unexpected events raise the cost of these essentials.

Paint businesses must raise prices to profit. Product price increases may lower customer demand and income. Paint component titanium dioxide may climb significantly, hurting Asian Paints’ pricing and profitability.

2. Slowdown

Pandemics and geopolitical wars slow all industries. The impact is double for Asian Paints. An economic downturn hits the building sector, a major paint market. Low construction lowers paint sales. Second, import-dependent enterprises may experience supply chain disruptions.

Asian Paints was subject to external economic shocks because to COVID-19 lockdowns and foreign trade restrictions that hurt suppliers and workers.

3. Unorganized Sector

Asian Paints competes with the unorganized sector, which accounts for 35% of the market, despite being a market leader. These smaller, sometimes local, firms can operate at reduced costs and offer competitive pricing, attracting to a subset of consumers and threatening established players. This competition may limit Asian Paints’ market share and pricing and profitability.

4. Labor Strikes or Disputes

Asian Paints is a manufacturing company, thus labor unrest is a danger. Strikes, disagreements, and labor dissatisfaction can stop production, delay delivery, and reduce operational efficiency. This has immediate financial consequences and long-term effects on consumer relationships and brand reputation.

5. Imitation

Success generates imitation, and Asian Paints, the industry leader, faces continual imitation. Competitors may emulate Asian Paints’ product formulae, marketing techniques, or packaging designs to gain market share. Imitation is flattering, but it can degrade brand identity and value, declining customer loyalty and market share.

6. Increasing Bargaining Power of Suppliers

Supplier power dynamics can dramatically affect manufacturing costs. Asian Paints can raise prices if key raw material suppliers consolidate or gain bargaining strength. If the corporation cannot fully pass on higher production costs to consumers, profit margins may suffer.

7. Legal Challenges

Large companies like Asian Paints face legal attention. Litigation over product quality, environmental rules, or other business activities can be costly and damage the brand’s reputation. Legal concerns are serious since one high-profile case can damage consumer trust and sales.

8. A trend towards Minimalism

modern interior design trends toward simplicity and neutral colors threaten the decorative paint industry in subtle ways. As consumers choose less bright interiors, demand for a variety of decorative paints may fall. Asian Paints, which offers a wide range of colors and finishes, may need to reconsider its strategy to keep up with shifting tastes and stay relevant.

Conclusion

Due to its extensive history of invention, market leadership, and diverse portfolio, Asian Paints became a global paint giant. The company’s strengths and potential offer a solid path for sustainable growth and expansion despite industrial paint sector obstacles like raw material scarcity and consumer preferences.

Asian Paints is a market leader and a visionary due to its ability to navigate market challenges, plus its forward-thinking approach to sustainability, digital engagement, and worldwide expansion. As the company paints the world with quality, its journey combines heritage and innovation, establishing a colorful way forward in the ever-changing paint industry segment.

Liked this post? Check out the complete series on SWOT