Let’s study the SWOT analysis of BP by understanding its strengths, weaknesses, opportunities, and threats.

BP PLC, a global energy powerhouse, excels throughout the oil and gas value chain, from exploration to commercialization. BP is one of the world’s most prominent “supermajors” in more than 70 countries. In response to growing environmental concerns, BP focuses on renewable and low-carbon energy.

BP’s broad portfolio and considerable investments in innovative mobility technologies in wind, solar, oil, and gas products demonstrate its resilience in market and geopolitical concerns. Its commitment to innovation, safety, and environmental responsibility makes it a crucial partner in the global energy transition.

Overview of BP

- Company type: Public

- Industry: Oil and gas

- Founded: 14 April 1909, 115 years ago

- Founders: William Knox D’Arcy, Charles Greenway

- Headquarters: London, England, UK

- Area served: Worldwide

- Key people: Helge Lund (Chairman), Murray Auchincloss (CEO)

- Website: bp.com

Table of Contents

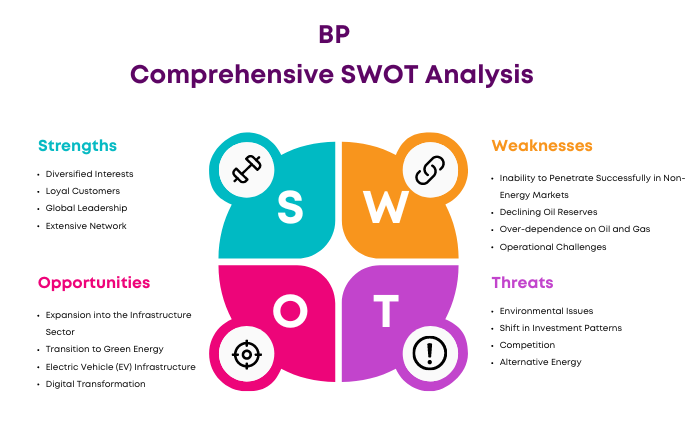

SWOT Analysis of BP

BP Strengths

1. Diversified Interests

BP’s strategy goes far beyond its core oil and gas businesses, expanding into lubricants, renewable energy technologies, aviation fuel, and information technology. The corporation has effectively dispersed its interests by holding subsidiaries such as Amoco, Arco, BP Express, and BP Connect. This diversification demonstrates BP’s ambition and a practical approach to reducing risks in the uncertain energy market.

2. Loyal Customers

One of BP’s most important assets is its devoted client base. Many BP customers in the oil business have provided consistent support over the years, entrusting the corporation with their energy needs. This level of loyalty demonstrates BP’s ability to develop and maintain strong, long-term client relationships, which are critical for consistent revenue and growth.

3. Global Leadership

BP’s market dominance is significant, particularly in the United Kingdom, which is the leading oil and gas business. Its influence is global, with a considerable impact on regional economic stability. In the United States, BP has the highest gasoline sales volume. This leadership position highlights BP’s competitive advantage and ability to set industry standards.

4. Extensive Network

BP’s operational network spans Europe, North America, South America, Africa, and Asia Pacific. The corporation offers its products via subsidiaries such as AMOCO in the east and ARCO in the west.

With 18700 service stations dispersed across various regions and 11,850 BP-branded service stations worldwide, including 1,525 in the United Kingdom alone, BP’s accessibility is unmatched. The distribution of Castrol-branded lubricants in around 70 countries indicates BP’s broad market reach.

5. Strong Management Team

At the heart of BP’s success is a powerful management team whose strategic brilliance has propelled the business to unprecedented financial success while maintaining socially responsible operations. This leadership capability has been critical in navigating the complicated energy business, distinguishing BP from competitors, and reinforcing its position as an industry leader.

BP Weaknesses

1. Inability to Penetrate Successfully in Non-Energy Markets

While BP has an extensive portfolio focused on the energy sector, it must establish a substantial presence in non-energy industries. This limitation could delay BP’s long-term diversification initiatives, rendering it more vulnerable to sector-specific hazards.

2. Declining Oil Reserves

Like its competitors in the business, BP is dealing in reserves and increasing oil reserves. The search and development of new reserves are difficult, posing a constant threat to the company’s supply chain and future revenue sources.

3. Over-dependence on Oil and Gas

Despite efforts to diversify into the renewable energy sector, oil and gas account for a significant percentage of BP’s earnings. This reliance exposes BP to the whims of unpredictable oil prices, which directly affects its financial stability.

4. Operational Challenges

BP’s global operations in politically unstable locations carry substantial risks. These concerns compromise employee safety and infrastructure, raise operational costs, and complicate project timeframes.

5. Debt Levels

BP PLC has a net debt of $20.9 billion; this elevated debt level may limit BP’s investment capacities and operational flexibility.

6. Fluctuating Profit Margins

The volatility of global oil prices has a direct correlation with BP’s profitability. These price fluctuations result in periods of declining profit margins, affecting BP’s financial health and investor attractiveness.

7. Controversies

BP has been involved in numerous oil spill-related scandals around the world. These accidents have lowered BP’s sustainability scores and harmed its reputation among stakeholders. The environmental consequences of oil spills, particularly the disastrous impact on marine life and ecosystems, have added to the company’s problems.

8. Ethical Issues

Scandals involving dishonest employee transactions and poor management of oil spills and leak scenarios have tarnished BP’s reputation. Such ethical breaches demonstrate a lack of genuine care for societal and environmental well-being, undermining public trust and company integrity.

9. Deepwater Horizon Incident

The 2010 Deepwater Horizon oil leak is one of the darkest moments in BP’s history. Despite efforts to limit environmental damage and strengthen safety measures, the disaster has had a lasting impact on BP’s reputation, emphasizing the importance of rigorous risk management and operational monitoring.

BP Opportunities

1. Expansion into the Infrastructure Sector

BP may improve its portfolio and brand image by exploring alternative and renewable energy projects and solutions in partnership with developing economies to address infrastructure difficulties. This collaboration promotes corporate success while highlighting BP’s commitment to environmental sustainability.

2. Transition to Green Energy

The global paradigm shift toward renewable energy presents an excellent opportunity for BP. Additional investments in wind, solar, and other renewable energy sources would enable BP to diversify its business operations while decreasing its dependency on traditional fossil fuels.

3. Electric Vehicle (EV) Infrastructure

The global increase in electric car adoption is an excellent opportunity for BP. Given the increasing popularity of electric vehicles, investing in EV charging stations, both at existing BP stores and in other public areas, might be a profitable enterprise.

4. Digital Transformation

Adopting advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and blockchain can benefit BP. It might boost operational efficiency, enable predictive maintenance, and promote data-driven decision-making, putting BP ahead of the competition.

5. Biofuels and Hydrogen

Developing and commercializing biofuels and hydrogen as alternative fuel sources might significantly boost BP’s growth. By entering these unexplored areas, BP might create a new vertical and future-proof its business.

6. Energy Storage Solutions

Demand for practical energy storage systems has skyrocketed with an apparent global increase in renewable energy. This growing demand could present a profitable market opportunity for BP.

7. Strategic Partnerships

BP can develop strategic alliances and joint established ventures by entering new markets and using technology. Partnerships with tech industry leaders or other energy sector corporations could effectively battle market saturation and open new growth opportunities.

8. Emerging Markets

Pioneering in emerging areas could reduce BP’s reliance on oversaturated markets by creating new revenue streams. Considering these markets’ evolving energy needs could result in significant business returns.

9. Carbon Capture and Storage

As most businesses strive to reduce their carbon footprint globally, BP may invest in carbon capture and storage technology. This investment might have a twofold advantage: addressing environmental problems while providing potentially valuable economic opportunities.

BP Threats

1. Environmental Issues

BP’s environmental disasters, such as the Deepwater Horizon oil leak, highlight the importance of improving workplace safety and environmental stewardship. Failure to incorporate adequate ecological safeguards into the company’s framework may result in additional accidents, causing considerable legal, financial, and reputational damage.

Demonstrating corporate social responsibility is both ethical and a critical strategic safeguard against potential consequences.

2. Shift in Investment Patterns

In today’s financial landscape, ESG criteria are increasingly influencing investment decisions. As investors shift away from areas viewed as unsustainable, BP faces a drop in investment, limiting its capacity to mobilize resources for innovation and expansion. This move reflects a more significant trend, changing financial paradigms across industries.

3. Competition

BP’s competitive advantage may be damaged by competitors such as Shell and Chevron, which have purportedly handled environmental difficulties more effectively and strengthened their brand equity. This competition goes beyond operational elements, including consumer views and trust, valuable currencies in today’s market.

4. Alternative Energy

The development of alternative energy supporters heralds a strong force against traditional oil and gas stalwarts. Companies specializing in solar, wind, and other renewable energy sources are gaining traction, tempting customers with more sustainable and, increasingly, cost-effective solutions. This progression may reduce BP’s customer base, forcing the business to diversify its energy portfolio.

5. Volatile Oil Prices

Oil price volatility remains a specter in the oil business, with effects ranging from geopolitical tensions to fluctuations in supply and demand. This means that BP’s revenues and profit margins will be uncertain, making financial forecasting difficult and necessitating robust risk management techniques.

6. Lawsuits and Penalties

Environmental neglect and safety oversights are a guaranteed formula for legal trouble. Persistent issues in these areas can result in litigation and hefty fines, harming BP’s finances and reputation. The company’s future depends heavily on its ability to overcome these shortcomings while maintaining strong safety and environmental standards.

7. Renewable Energy Transition

As the call for green energy grows worldwide, the oil and gas industry has to ask itself if it is still relevant. BP has to make it through this change or risk its old ways of doing things becoming obsolete, which means it has to adapt and change on the fly.

8. Climate Change

The threat of climate change sets off a chain reaction that makes rules stricter, changes people’s feelings, and increases the fossil fuel industry’s image risks. As a significant player, BP is right in the middle of this situation, meaning it needs to change its policies and practices immediately.

9. Technological Disruptions

In a time of fast technological change, keeping things the same is the same thing as becoming obsolete. BP must keep up with the latest technological advances that are changing how oil and gas are explored, produced, and refined. Using cutting-edge technologies is not a choice but a must for long-term business success.

Conclusion

BP, a giant in the energy world, is at a crossroads because of its long history in oil and gas and the urgent needs of a changing world. It is more important than ever for BP to be strong and have a long-term plan as it deals with the rough seas of environmental scrutiny, changing technology, and the inevitable shift toward renewable energy.

BP is in a great position to handle the challenges of unstable markets and geopolitical uncertainty and lead the global energy transition. Its robust portfolio includes traditional fuels and renewable energies, and its international presence shows it is the market leader.

Liked this post? Check out the complete series on SWOT