Let’s explore a SWOT analysis of Delta Airlines, a key player in the global aviation sector, to understand its strengths, weaknesses, opportunities, and threats.

Delta Airlines, founded in 1924, has grown to become one of the world’s major airlines, transporting approximately 190 million passengers annually across six continents. With a fleet of over 800 aircraft, it is renowned for its excellent customer service, safety, and dedication to sustainability.

Delta’s strategic alliances and membership in the SkyTeam airline alliance provide extensive worldwide connectivity. It uses technology to improve operational efficiency and customer happiness, resulting in a robust business model that can agilely traverse industry challenges.

Overview of Delta Airlines:

- Founded: March 2, 1925, 99 years ago, as Huff Daland Dusters in Macon, Georgia

- Commenced operations: June 17, 1929

- Fleet size: 980

- Destinations: 305

- Headquarters: Atlanta, Georgia, United States

- Key people: Ed Bastian (CEO), Glen Hauenstein (president), Dan Janki (CFO), Mike Spanos (COO)

- Founder: C.E. Woolman

- Revenue: Increase US$58 billion (2023)

- Net income: Increase US$4.61 billion (2023)

- Employees: 95,000 (Jan 2023)

- Website: delta.com

Table of Contents

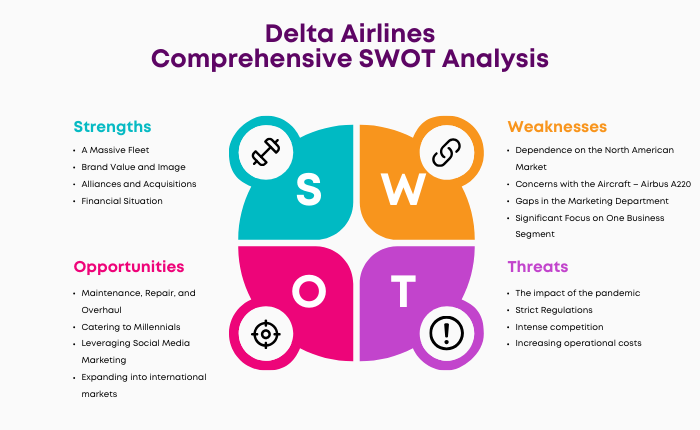

SWOT Analysis of Delta Airlines

Delta Airlines Strengths

1. A Massive Fleet

As of April 2024, Delta Airlines operated a fleet of 985 aircraft, making it the largest commercial airline fleet in the world. This huge fleet size allows Delta to offer vast flight schedules to various locations and effectively use aircraft, resulting in better operational efficiency and customer satisfaction.

2. Brand Value and Image

Delta Air Lines has systematically created a strong brand image over the decades. Delta has achieved the most valuable airline brand for six consecutive years. Delta (brand value up 21% to USD10.8 billion) retained 1st place among the most valuable airline brands in the 2024 rankings.

Brand image is a valuable asset in the airline sector. It allows Delta to maintain a competitive advantage, inspire customer loyalty, and command a premium in the market. Delta’s persistent branding efforts have cemented its position as a premier airline, instilling confidence and preference in passengers.

3. Alliances and Acquisitions

Delta’s strategic relationships and acquisitions have greatly expanded its operational horizons. Delta has effectively increased its global reach as a significant member of the SkyTeam alliance and through code-sharing arrangements with international airlines such as Czech Airlines, Korean Air, Virgin Atlantic, and Virgin Australia. Acquisitions such as Northeast Airlines and Western Airlines, among others, have enabled Delta to swiftly extend its network and client base, demonstrating a solid growth strategy.

4. Financial Situation

Delta Airlines has demonstrated exceptional financial management, with numerous revenue streams contributing to long-term cash flow. Delta’s financial strength allows it to invest in customer service, technology, and environmental programs. Delta’s Operating revenue as of March 2024 is $13.7 billion.

It also ensures good returns for its stakeholders. Diverse revenue streams, from passenger travel to cargo services and partnerships, demonstrate Delta’s proactive financial strategy.

5. Reward Programs

Delta’s reward programs, such as the renowned SkyMiles, are critical for customer retention. They increase client loyalty and encourage frequent travel, making a dedicated customer base more inclined to choose Delta over competitors.

6. Wide-ranging Routes

Delta’s operation of over 4,000 daily flights to more than 290 destinations on six continents demonstrates its ambition and operational capability. Offering flights to a wide range of destinations ensures that Delta serves the travel needs of a diversified client base, considerably increasing its market attractiveness and customer convenience.

7. Customer Popularity

Delta’s substantial brand value and customer popularity serve as severe barriers to competition. Delta’s long-standing reputation and the trust it has created among its consumers make it more resistant to losing customers to established competitors and new entrants in the airline sector.

Delta served more than 190 million customers in 2023 — safely, reliably, and with industry-leading customer service innovation – and was again recognized as North America’s most on-time airline by Cirium.

8. Extensive Network

Delta’s broad domestic and international network, which outperforms many competitors, gives considerable operational benefits. This allows Delta to offer additional routes and connections, serving various travel needs and tastes.

9. Operational Efficiency

Delta’s operations have been streamlined by investments in technology and infrastructure, resulting in better on-time performance and fewer cancellations. As reliability is a crucial deciding factor for customers when selecting an airline, such operational efficiency improves customer happiness and loyalty.

10. Loyal Customer Base

The SkyMiles loyalty program has a vast membership base, guaranteeing Delta receives repeat business. This committed client base demonstrates Delta’s effective relationship management and customer service techniques.

11. Strategic Alliances

Among other collaborations, Delta’s participation in the SkyTeam alliance broadens its global reach and operational capabilities in airline services. These strategic collaborations provide customers with more destination options and seamless travel experiences, boosting Delta’s competitive position.

12. Robust In-flight Services

Delta’s focus on providing competitive in-flight services, including entertainment, Wi-Fi, and premium seating, dramatically improves the travel experience. Delta Airlines offers various inflight services with five fare options – Delta One, First Class, Delta Comfort Plus, Main Cabin, and Basic Economy Fare.

These services include exclusive dishes and wines, amenity kits, noise-canceling headsets, priority boarding, additional overhead space, seats with extra legroom, complimentary premium snacks, wine and beer, and inflight Wi-Fi and entertainment. Delta Airlines offers Starbucks Coffee on every flight in its global network, with five coffee choices available. These services help Delta stand out in a competitive industry, increasing passenger happiness and preference.

13. Dedicated Employee Workforce

Delta’s awareness of a dedicated and customer-friendly team is critical to its operational performance. A motivated and service-oriented personnel base improves the client experience, increasing customer loyalty and satisfaction. As of December 31, 2023, it had approximately 103,000 employees.

14. Investment in Technology

Technological expenditures have updated Delta’s booking system, check-in procedure, and overall customer management. These technological innovations increase operational efficiency and improve the client experience, making travel more convenient and accessible.

15. Environmental Initiatives

Delta’s efforts to lower its carbon footprint, such as investing in fuel-efficient aircraft and researching sustainable fuel alternatives, demonstrate its dedication to environmental responsibility. These measures address growing environmental concerns and establish Delta as a sustainability leader in the aviation sector.

In 2020, Delta pledged to spend $1 billion on sustainability efforts, including the Sustainable Skies Lab, a first-of-its-kind innovation lab to accelerate research, design, and testing toward more sustainable air travel. The lab focuses on Delta’s goal of achieving net-zero emissions by 2050.

16. Maintenance and Repair Capabilities

Delta TechOps, a subsidiary, generates additional revenue by providing maintenance, repair, and overhaul (MRO) services to other airlines while ensuring Delta’s fleet meets rigorous maintenance requirements. This twofold advantage demonstrates Delta’s operational resiliency and diversification.

17. Diverse Revenue Streams

Delta’s diversified revenue streams, which include passenger travel, cargo services, credit card partnerships, and MRO services, form a balanced and sustainable financial strategy. Delta’s variety enables it to reduce risks and capitalize on numerous growth opportunities in the aviation sector.

18. Continuous Improvement Initiatives

Delta’s commitment to continual improvement is visible in its operations, services, and customer interactions. Delta remains at the forefront of airline innovation by constantly researching new methods to improve efficiency and customer happiness.

19. Strategic Acquisitions and Investments

Delta’s strategic investments and acquisitions, which include holdings in LATAM Airlines Group and Virgin Atlantic, have improved its global position. These developments broaden Delta’s network and operational capabilities and highlight the company’s proactive attitude to expansion and market leadership.

20. Safety Record

A good safety record is essential in the airline industry, and Delta’s outstanding safety performance enhances consumer confidence. This dedication to safety reassures travelers about their well-being, cementing Delta’s position as a preferred airline.

Delta Airlines Weakness

1. Dependence on the North American Market

Delta Airlines has a major market in North America, which makes it highly dependent on the region’s socioeconomic and political situation. This specialization may be harmful in a sector where diversification reduces risk. The North American market is vulnerable to changes and events that can reduce travel demand, such as the current COVID-19 pandemic, political changes, or economic downturns.

Demographics also imply that developing countries have growing travel demand; consequently, Delta’s underrepresentation in these areas implies it must fully leverage global development potential.

2. Concerns with the Aircraft – Airbus A220

Delta’s fleet contains several Airbus A220 planes that have lately been scrutinized owing to engine difficulties. The Federal Aviation Administration (FAA) has issued new inspection rules for these aircraft. Delta faces an operational hurdle because it must comply with new standards immediately while dealing with public perception and potential safety issues.

Given the magnitude of Delta’s operations, this issue poses a logistical and reputational concern, emphasizing the necessity for strong safety measures and possibly a rethinking of fleet strategy.

3. Gaps in the Marketing Department

Despite strong sales results, Delta struggles to effectively market its varied product lines. A diversified marketing strategy suited to different categories could boost Delta’s sales. Marketing is at the forefront of brand representation and customer involvement; failing to capitalize on it can result in potential revenue loss.

Delta could benefit from new marketing initiatives that appeal to younger travelers or tech-savvy consumers to grow its customer base and increase worldwide recognition.

4. Significant Focus on One Business Segment

Delta’s commercial strategy generally focuses on the North American market, resulting in limited regional concentration and client segmentation diversity. Although the airline operates overseas, it has a different scope and focus than North America.

Overreliance on a single segment can expose weaknesses if that section experiences difficulties. Expanding into new overseas markets and diversifying business areas may be critical to assuring long-term growth and profitability.

5. The Dwindling Workforce

Delta has experienced difficulties in retaining a stable and large staff. A sufficient workforce can help operations, customer service, and business growth. Various external factors, such as labor relations, industry attractiveness, or remuneration schemes, could cause this issue. While Delta has maintained profitability, the airline requires a long-term staff development strategy to avoid operational strain and ensure service quality.

Delta’s current employee retention rate is 92.2%, as indicated by an attrition rate of 7.8% for 2022. Delta has been recognized as one of the top five Fortune 100 companies with the lowest Talent Retention Risk (TRR) Scores, which are used to predict employee retention rates.

6. Palpable Tension with the Marketing Department

Despite a solid sales record, Delta’s marketing department must still perform. Effective marketing could be a catalyst for more incredible sales growth. Delta may be missing out on potential revenue by not fully utilizing marketing media and methods that could increase brand presence, particularly in diverse areas. New marketing activities may address market segments and niches that are currently disregarded.

7. Vulnerability to External Shocks

Delta is highly vulnerable to external shocks such as global health crises, geopolitical tensions, and economic cycles like its counterparts. Events such as the COVID-19 epidemic have significantly impacted the aviation sector. This vulnerability emphasizes the significance of strong risk management techniques and the ability to respond swiftly and efficiently to unanticipated events.

8. High Fixed Costs

The airline industry’s intrinsic vulnerability is the structurally high fixed aircraft maintenance and operation costs, personnel expenses, and airport taxes. Delta faces substantial financial difficulties in low-demand conditions, which affects overall profitability.

9. Debt Levels

Like many other airlines, Delta has had to incur significant debt to get through COVID-19. This level of debt can impair Delta’s financial agility, limit future investment opportunities, and obligate the corporation to make hefty interest payments. Delta Air Lines’ total long-term debt, as of 2023, was $17.071 billion.

10. Labor Union Dependence

While labor unions play an important role in lobbying for employee benefits, Delta’s reliance on a heavily unionized staff poses operational and financial risks. Labor conflicts, contract discussions, or strikes could cause interruptions affecting finances and reputation.

11. Aging Fleet

Delta maintains a diverse fleet, but the issue of aging aircraft must be addressed. Older planes have higher maintenance expenses, are more susceptible to operational setbacks, as well as worse fuel efficiency when compared to newer versions.

12. Complexity in Operations

Due to managing a large and diverse fleet across numerous destinations, Delta’s everyday operations become more difficult. Any inefficiencies can drive up prices and lower overall performance. This complicated necessitates specialized management systems and constant monitoring to avoid interruptions.

13. Intense Competition

The airline sector is highly competitive. Delta competes with other airlines that provide equivalent or greater services, which can reduce fares and profit margins. Staying ahead necessitates ongoing innovation and service excellence.

14. Regulatory and Compliance Risks

Airlines, especially Delta, face complex regulatory landscapes. These rigorous restrictions imposed by various regulatory bodies can increase compliance risks and place an additional burden on resources due to the necessity for ongoing monitoring and adherence.

15. Fuel Price Dependency

The volatility of fuel costs creates a considerable risk to Delta’s cost structure. Gasoline costs account for significant operating expenses, so gasoline price fluctuations directly impact profitability.

16. Customer Service Complaints

Customer complaints about service delays, baggage handling, or general unhappiness might hurt Delta’s reputation. In an era where social media magnifies client criticism, such concerns can have a far-reaching impact.

17. Technological Vulnerabilities

As Delta uses technology to improve operations and customer experiences, any technical issues or cybersecurity attacks create additional risks. The airline’s digital infrastructure must be safe and strong to avoid breaches that could result in operational outages or data compromises.

18. Limited Presence in Key Markets

Delta’s network, while broad, needs to gain dominance in many key international markets. These missed opportunities may harm prospective revenue streams and reduce the airline’s global market share.

19. Challenges with Alliances and Joint Ventures

While partnerships and joint ventures provide expansion potential, they often provide coordination issues. Ensuring smooth operations and sustaining harmonious relationships necessitates diplomatic skills and significant management attention.

20. Potential Integration Challenges

Delta faces possible challenges when it integrates operations following acquisitions or partnerships. Merging systems, cultures, and procedures takes time and might result in short-term inefficiencies and disagreements.

21. Dependence on Key Hubs

Delta’s operations rely primarily on its primary hubs. Any disruption in these hubs due to weather, technological problems, or labor issues can have far-reaching consequences for the network, resulting in operational and financial losses.

Delta Airlines Opportunities

1. Maintenance, Repair, and Overhaul (MRO).

Delta’s MRO department is a valuable asset that provides service worldwide. Expanding on these capabilities, Delta may position itself as a maintenance service provider for other airlines, generating an additional revenue stream while maintaining excellent aircraft performance.

2. Catering to Millennials.

Millennials are the largest airline usage demographic, surpassing all other generations. As their proportion grows, offering personalized incentives and initiatives for millennials could allow Delta to capitalize on this rapidly expanding population.

3. Leveraging Social Media Marketing

Companies that fully utilize social media marketing may stimulate client involvement in ways that traditional marketing strategies cannot compete. Delta can use this strategy to boost its brand value and increase consumer engagement.

4. Expanding into international markets.

Delta’s major concentration remains on the US market. However, by expanding its focus on international routes to new geographical areas, Delta could increase its sales and financial success rate.

5. Investing in Fleet Modernization

Shifting to a more fuel-efficient fleet reduces operational costs while attracting environmentally concerned customers, resulting in a double benefit. In this era of growing environmental awareness, such actions could considerably improve Delta’s brand image.

6. Strengthening Strategic Alliances

Delta would benefit from increasing its worldwide reach and route optimization by expanding current strategic alliances, pursuing acquisitions, or forming new joint ventures.

7. Digitalizing the Customer Experience

Investments in digital infrastructure for better online booking experiences, in-flight entertainment, and other touchpoints can enhance the consumer experience and increase brand loyalty.

8. Implementing green initiatives

Delta might position itself as an industry leader in environmental responsibility by focusing on sustainability, such as employing biofuels or supporting carbon offset programs.

9. Diversifying Services

Opportunities extend beyond passenger travel. Potential expansion options include expanding cargo operations, providing charter services, and investigating supplementary travel-related enterprises.

10. Improving Customer Service Initiatives.

Delta can increase brand loyalty and customer happiness by consistently innovating its customer service techniques.

11. Enhancing the SkyMiles program

Delta’s loyalty program, SkyMiles, can be expanded with new partnerships and rewards for an even larger network of loyal consumers.

12. Targeting Niche Markets.

There is potential for catering flights to specialized sectors such as luxury travel, adventure tourism, or specific demographic groups, resulting in a broad customer portfolio.

13. Increasing operational efficiency.

Delta can continuously improve operational efficiencies (ground operations and in-flight processes) to further reduce costs and improve service.

14. Prioritizing employee development.

Investment in staff training promotes service improvements, operational efficiencies, and increased employee retention, all of which contribute to a better organizational climate and market presence.

15. Capitalizing on Competitor Weaknesses

Delta can strategically position itself to address any holes or vulnerabilities in the industry by tracking the issues its competitors confront.

16. Providing personalized services

Delta’s passengers could benefit from a more focused, tailored travel experience thanks to advances in data technology.

17. Investigating Alternative Revenue Streams

Monetizing Delta’s technology infrastructure, or Delta TechOps, could benefit other sectors or airlines, creating new income opportunities.

18. Emphasis on Health and Safety

Following the COVID-19 epidemic, passengers have expressed a strong preference for increased health and safety measures. Delta can lead by providing travelers with safety-focused services or guarantees, raising industry standards.

19. Leveraging Promotional and Marketing Initiatives

Delta can expand its consumer base and strengthen its brand identity by implementing cutting-edge marketing strategies or platforms.

Delta Airlines Threats

1. The impact of the pandemic

The COVID-19 epidemic has caused enormous economic upheaval, with airlines among the hardest affected. Flight limitations, lockdowns, and widespread fear about travel harmed the airline industry’s revenue streams. Delta Airlines is not immune and has suffered significant financial setbacks, but recent recovery trends demonstrate perseverance and adaptation.

2. Strict Regulations

The aviation industry is highly regulated to maintain safety, security, and environmental compliance. Following the pandemic, such controls became even more rigorous. Delta, which operates globally, must comply with a slew of rules, which can result in increased operational expenses, legal complications, and administrative constraints, limiting flexibility and responsiveness to market developments.

3. Intense competition

Delta competes with both the other major airlines and new low-cost carriers. Competition always influences strategic price, service quality, and network decisions. Staying ahead frequently necessitates significant investment in customer service, marketing, and technology—a costly proposition constantly squeezing profit margins.

4. Increasing operational costs.

The rising costs of vital inputs, such as jet fuel, labor, and materials, threaten profitability. Price fluctuation, particularly in oil, can significantly impact cost structures. These increases compel airlines to make difficult decisions between passing costs onto customers, which might influence demand, and absorbing them, which can reduce profit margins. The airline has implemented various measures to mitigate these costs, such as negotiating with suppliers for long-term contracts at fixed prices, exploring alternative input materials or suppliers, and improving operational efficiency. However, the persistent threat of rising input costs remains challenging for Delta and the airline industry.

5. Regulatory Compliances

Following the epidemic, airlines face new health and safety rules, necessitating greater investment. Delta must continually channel funds into compliance to avoid costly fines and maintain operational authorization, which may significantly strain resources.

6. Existence of substitutes

Aside from aircraft, there are various other possibilities in the travel business, such as high-speed trains, which constantly improve in cost, convenience, and environmental impact. For shorter itineraries, these alternatives pose a serious challenge to traditional airline use, particularly among cost-conscious consumers.

7. Economic downturns

Discretionary expenditure is one of the first casualties when the economy struggles, with travel frequently regarded as a luxury. In economic downturns, corporations slash travel budgets, and holidaymakers postpone vacation plans, directly influencing airline profits. Delta is vital but not immune to the broader economic trends.

8. Regulatory changes

Airlines must constantly adjust to changing rules, which can contribute to high operating costs due to operational inefficiencies. Modifications, such as new equipment, procedures, or training requirements, can raise expenses.

9. Global Security Risks

Terrorist acts or geopolitical instability might quickly reduce the public’s desire to travel. Specific routes may become less viable or economical, and turbulence in a given region might impact travel patterns, adversely impacting an airline’s strategic network and profitability.

10. Environmental Pressures

Growing environmental concerns have put airlines under pressure to cut carbon emissions. This pressure can lead to extra expenditures in new, greener technologies or, in some instances, carbon offsets, increasing operational expenses.

11. Technological Disruptions.

Technological advancements may render traditional air travel obsolete. For example, video-conferencing technology has already lowered the demand for business travel, and advancements in other modes of transportation may have an even more significant influence on aircraft utilization.

12. Labor concerns

With a strongly unionized staff, Delta is vulnerable to labor conflicts that might result in strikes and operational disruptions. These disputes can also increase salary demands during labor negotiations, increasing operating costs.

13. The Impact of Natural Disasters

Natural disasters can interrupt particular flights and entire regions and hubs, resulting in operational turmoil, increased customer service demands, and, ultimately, revenue loss.

14. Reputation and PR

Delta’s brand reputation can be damaged by a variety of circumstances, including as service failures, accidents, or unwanted publicity. As a customer-facing organization, keeping a positive image is vital, and setbacks in this area can have long-term consequences.

15. Cybersecurity Risks.

Delta relies heavily on digital systems for everything from bookings to flight operations. Therefore, the potential for cyber-attacks is significant. A major breach could cause interruptions and undermine customer trust.

16. Currency fluctuations.

Delta’s foreign operations expose the company to currency exchange risks, which can have unpredictable effects on expenses and revenues, causing financial instability. Delta’s international transactions are primarily exports, such as foreign airfare ticket sales. The company uses derivatives like forward contracts to hedge against foreign currency exchange rate risks.

17. Increasing Airport Charges

Increases in airport fees can substantially impact Delta’s operational costs. These charges are frequently passed on to passengers, potentially making air travel less appealing.

18. International Operating Constraints

Political tensions can result in limits or prohibitions on foreign routes, directly affecting multinational airlines and regional carriers like Delta.

19. Legal hurdles

Delta must traverse various legal environments; any outstanding litigation or lawsuits can result in financial losses and reputational damage.

20. The emergence of low-cost competitors.

The growing presence of budget airlines poses substantial difficulties to full-service carriers such as Delta, particularly in competitive markets where price is a major factor in customers’ choice of airline.

Conclusion

Delta Airlines is an outstanding example of perseverance and creativity in the ever-changing aviation sector. Delta has secured its position as a worldwide air transport leader through its huge fleet, strategic collaborations, and a strong focus on customer happiness. The airline company’s expert navigation of financial, operational, and environmental difficulties demonstrates a business model founded on agility, foresight, and a never-ending quest of perfection.

Despite being vulnerable to market changes, regulatory barriers, and growing competitors, Delta’s commitment to safety, sustainability, and technology innovation positions it well to capitalize on future opportunities. Delta Airlines offers an upgraded travel experience and sets a plan for long-term growth and industry leadership.

Liked this post? Check out the complete series on SWOT