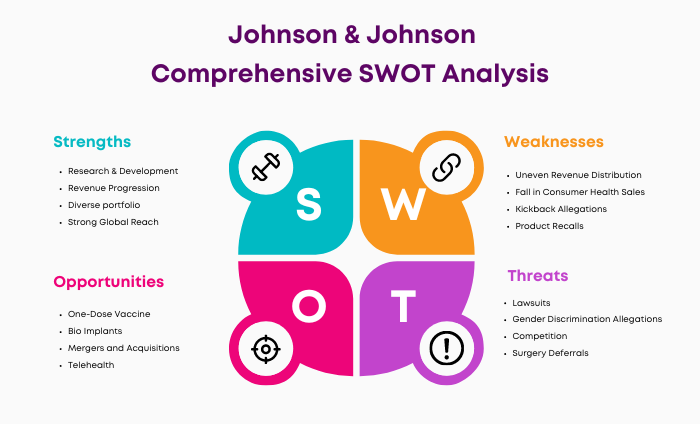

Let’s explore the SWOT Analysis of Johnson & Johnson by understanding its strengths, weaknesses, opportunities, and threats.

Johnson & Johnson, an American global corporation, has been a pioneer in the healthcare industry since 1886. It manufactures various pharmaceuticals, medical devices, and consumer health items, including well-known brands such as Band-Aid and Tylenol. The company’s commitment to innovation and comprehensive healthcare solutions has made it a global leader in improving individual well-being.

Despite the limitations of today’s healthcare climate, Johnson & Johnson displays resiliency and growth through strategic acquisitions and a concentration on research and development. With operations in over 60 countries and a presence in over 175, the company’s diversified portfolio and commitment to innovation keep it at the forefront of dealing with global health challenges.

Overview of Johnson & Johnson

- Company type Public

- Industry: Pharmaceutical, Medical Technology

- Founded: January 1886, 138 years ago, in New Brunswick, New Jersey, United States

- Founders: Robert Wood Johnson I, James Wood Johnson, Edward Mead Johnson

- Headquarters: Johnson and Johnson Plaza, New Brunswick, New Jersey, US.

- Area served: Worldwide

- Key people: Joaquin Duato (Chairman & CEO)

- Revenue: US$85.16 billion (2023)

- Website: jnj.com

Table of Contents

SWOT Analysis of Johnson & Johnson

Johnson & Johnson Strengths

1. Research & Development

Johnson & Johnson’s commitment to innovation is demonstrated by its massive expenditure on R&D. In 2023, the firm spent $15.1 billion in R&D, highlighting the importance of innovation in sustaining its leadership in the healthcare and pharmaceutical sectors. This dedication enables the ongoing development of modern, life-saving medications and products.

2. Revenue Progression

Johnson & Johnson recorded an excellent profit of $58.606Fspam billion, beating its main competitor, Pfizer. This significant revenue margin demonstrates the company’s dominant industry position, excellent business strategy, and operational efficiency. Johnson & Johnson’s annual revenue for 2023 was $85.159B. Johnson & Johnson’s financial strength is shown in its constant revenue and profitability growth. The company’s fiscal stability boosts shareholder trust and attracts potential investors, strengthening its economic resilience and ability to invest in future growth.

3. Diverse portfolio

The company’s portfolio includes a variety of consumer health goods, medical equipment, and pharmaceutical items, including well-known brands such as Listerine, Band-Aid, Tylenol, and Pepcid. Johnson & Johnson’s strength originates from its diverse product offering, which serves a wide range of consumers while expanding its market position.

4. Strong Global Reach

Johnson & Johnson’s global presence, which includes operations in over 60 countries and product availability in over 150 countries, demonstrates its broad reach and global demand for its products. This global presence diversified revenue streams and increased brand visibility worldwide.

5. Stable Market Performance

As of April 2024, Johnson & Johnson has a market cap of $348.09 Billion. Johnson & Johnson’s market stability has been characterized by consistent profit generation for the past 58 years. A significant portion of its sales comes from items with the #1 or #2 global market share, demonstrating the company’s competitive advantage and strong customer loyalty. Johnson & Johnson is one of the world’s most valuable companies and one of only two U.S.-based companies with a prime credit rating of AAA.

6. Strong Brand Recognition

Johnson & Johnson’s market leadership is strengthened by its excellent brand recognition. Renowned brands under its umbrella, such as Johnson’s Baby and Neutrogena, demonstrate the company’s strong reputation and consumer confidence. In 2023, the company was ranked 40th in the Forbes Global 2000.

7. Robust Supply Chain

The company’s well-established supply chain framework enables efficient operations and management, allowing for worldwide timely and cost-effective product distribution. This logistical expertise significantly contributes to Johnson & Johnson’s operational excellence and customer happiness.

8. Commitment to Corporate Social Responsibility

Johnson & Johnson’s commitment to sustainability, diversity and inclusion, and social impact projects has increased goodwill and reinforced its brand equity. Recognition for its corporate social responsibility efforts enhances its reputation and builds stakeholder trust.

9. Experienced Management Team

Johnson & Johnson’s leadership staff brings a wide range of experience to the company, which is crucial to its long-term success. The company’s management’s strategic insight and business understanding have helped it overcome several challenges and preserve its position as an industry leader.

10. Regulatory Expertise

The company’s ability to manage the complex regulatory frameworks of healthcare and pharmaceuticals is a significant advantage. Johnson & Johnson’s regulatory expertise ensures compliance, reduces legal risk, and boosts its market position.

11. Effective Marketing and Advertising

Johnson & Johnson’s effective marketing strategies and advertising skills have played an essential role in ensuring their products connect with their target demographic. Communication effectiveness improves product reach and consumer engagement.

12. Extensive Collaborations and Partnerships

The company’s strategy of developing partnerships and collaborations expands its operating breadth while increasing innovation. These relationships broadened Johnson & Johnson’s reach and improved its R&D skills.

13. Skilled Workforce

Johnson & Johnson’s success is built on an expert staff that supports innovation, customer service, and operational efficiency. The devotion and experience of its employees are critical in advancing Johnson & Johnson’s purpose and objectives. Johnson & Johnson’s total number of employees in 2023 was 134,400.

14. Innovative Product Pipeline

The company’s focus is on constantly inventing and producing new goods that respond to changing consumer demands and advances in medical science. Johnson & Johnson’s inventive pipeline keeps the company at the forefront of healthcare advancements, solidifying its position as a significant leader in the sector.

15. Strong Intellectual Property

Johnson & Johnson maintains a competitive advantage in healthcare because of its substantial patent and proprietary technology portfolio. These intellectual assets safeguard the company’s exclusive rights to manufacture and sell its distinct products, acting as an essential obstacle against potential competitors.

Johnson & Johnson Weaknesses

1. Uneven Revenue Distribution

Johnson & Johnson’s pharmaceutical business generates nearly half (50%) of its revenue, with immunology accounting for a sizable portion (32%). Due to its overreliance on specialized sectors and a limited number of products, the company’s profitability is subject to possible income drops when patents expire and competition heats up.

2. Fall in Consumer Health Sales

The company’s three primary sectors are pharmaceutical, medical, and consumer healthcare, with the latter generating the most minor income. Increasing sales in the consumer healthcare industry has the potential to diversify the company’s portfolio and improve profitability.

3. Kickback Allegations

Whistleblower claims of kickback schemes involving two medications, Remicade and Simponi, have harmed Johnson & Johnson’s reputation. These purported attempts to affect doctors’ medication preferences reveal a significant weakness in the corporation.

4. Product Recalls

Recalls of Johnson & Johnson goods have harmed the company’s reputation and financial stability, causing consumer trust to wane and hurting its image.

5. Litigation Risks

Legal consequences and government investigations into product liability allegations could result in significant financial obligations and reputational harm.

6. Dependence on Key Products

Overreliance on a small number of essential goods raises the risk of revenue decline in the case of tightened market competition or patent expiration.

7. Slow Growth in Some Segments

The medicines segment’s growth rate has decreased due to solid rivalry and rising pricing pressure, reducing overall revenue growth.

8. Currency Risks

Johnson & Johnson, as a multinational corporation, is exposed to the risk of currency fluctuations, which could harm financial performance.

9. Patent Expirations

The expiration of patents for certain significant items may lead to increased competition and pricing pressure.

10. Competitive Markets

Intense rivalry, particularly in the consumer products sector, can reduce market share and profitability.

11. Supply Chain Disruptions

Supply chain delays would impair production and distribution, resulting in a possible weakness.

12. Regulatory Hurdles

The healthcare industry’s rigorous rules might cause product delays and increased expenses.

13. Reputation Management

Maintaining a positive public perception of several issues demands concentrated attention and intelligent management.

14. Integration Challenge

Johnson & Johnson’s growth and expansion through several acquisitions have periodically been hampered by challenges in integrating corporate cultures, synchronizing operations, and achieving profitability.

15. Pricing Pressures

The corporation faces significant pressure to lower pricing and execute cost-cutting measures, particularly in markets where healthcare costs are a considerable concern.

16. Generics and Biosimilars

As significant patents expire, Johnson & Johnson’s products must compete with less expensive generic equivalents and biosimilars, potentially resulting in considerable revenue loss.

17. Potential Over-Reliance on US Market

Johnson & Johnson generates a sizable portion of its sales in the United States, so changes in the region’s economic or regulatory climate might impact the company’s bottom line.

18. Challenges in Emerging Markets

Although emerging economies provide growth potential, they also offer a unique set of challenges, such as unclear legislation, currency value changes, and fierce rivalry from local enterprises.

Johnson & Johnson Opportunities

1. One-Dose Vaccine

While other pharmaceutical companies, such as Pfizer and Moderna, released two-dose vaccines, Johnson & Johnson’s advantage rose from their single-dose COVID-19 vaccine. This distinction simplifies the administrative procedure and positions Johnson & Johnson for increased reach and profitability.

2. Bio Implants

Demand for bio-implants, artificial body parts created from biosynthetic materials such as collagen and artificially engineered tissue and skin, is expected to rise by 2030. For Johnson & Johnson, this trend represents a fantastic opportunity for diversification and a significant revenue stream.

3. Mergers and Acquisitions

Johnson & Johnson has wisely utilized the power of strategic acquisitions, considerably boosting their position. For example, their $65 billion acquisition of Momenta strengthened their position in discovering and manufacturing autoimmune illness drugs.

4. Telehealth

Telehealth, which provides health care through electronic media, represents untapped potential for Johnson & Johnson. Their recent investment in Thirty Madison, a Telehealth startup, demonstrates their dedication to digital health innovation.

5. Aging population

As the world’s population ages, the increasing demand for healthcare products and services might be a major growth driver for Johnson & Johnson. By adapting their products to the needs of the elderly, they can capitalize on this growing market group.

6. Emerging Markets

Johnson & Johnson’s expansion into emerging regions with significant populations and expanding spending power provides tremendous growth possibilities. Their dedication to supplying healthcare goods and services corresponds to the increased demand in these areas.

7. Digital Health

As digital health becomes popular, Johnson & Johnson can use it to develop new products and services that improve patient care and generate money. These digital innovations have the potential to transform patient outcomes and healthcare delivery practices around the world.

8. Personalized Medicine

The emerging trend of personalized medicine—unique treatments based on an individual’s genetic composition—presents significant opportunities for J&J to develop focused medications and diagnostic tools, ultimately improving patient outcomes.

9. Sustainability

Transitioning to sustainable healthcare products and practices might provide a significant economic opportunity. Johnson & Johnson may capitalize on this trend by investing in eco-friendly pharmaceutical products, and sustainable procedures, offering them a competitive advantage in an increasingly environmentally conscious market.

10. Biosimilars Market

As biologic medication patents expire, the market for biosimilars expands. Johnson & Johnson can use its strong R&D capabilities to create, manufacture, and sell biosimilar goods to meet this expanding demand.

11. Wearable Health Devices.

Wearable health devices are growing increasingly popular, opening up new options for Johnson & Johnson. By collaborating or introducing new solutions, Johnson & Johnson may increase patient care and market share.

12. Enhanced R&D Investments

Increased R&D spending can help Johnson & Johnson demonstrate its commitment to innovation and new product development. Such investments can improve their market position and significantly meet unmet medical needs.

13. Value-Based Healthcare

Johnson & Johnson should integrate its business model with the global shift towards value-based healthcare, in which payment is based on patient outcomes. Their capacity to create value-based solutions can provide a competitive advantage in today’s patient-centered healthcare business.

14. Home Healthcare

As home healthcare becomes more popular due to changing patient preferences and technology, Johnson & Johnson may capitalize by increasing their products in this area, providing client convenience and care.

15. Expanding in Therapeutic Areas

Exploring new pathways in pharmaceuticals, where J&J now has a limited presence, or going into developing sectors such as gene therapy could bring additional growth.

16. Education & Training

Johnson & Johnson, utilizing its domain expertise, may offer healthcare professionals training programs and educational tools. This strategic move can assist them in increasing their brand reputation and strengthening stakeholder relationships.

17. Elderly Population

The growing worldwide aged population offers Johnson & Johnson the possibility of creating products tailored specifically to the health needs of seniors. Capitalizing on this demographic transition can lead to growth in supplying medical devices and equipment, pharmaceuticals, and consumer healthcare items aimed at older folks.

Johnson & Johnson Threats

1. Lawsuits

Johnson & Johnson’s legal difficulties pose a significant risk, particularly the $100 million settlement in over 1,000 talc-based products cases. Applicants claimed that talcum powder aided in the development of ovarian cancer. These legal battles may damage consumer trust and harm a brand’s reputation.

2. Gender Discrimination Allegations

Even though Johnson & Johnson says it supports equal pay for men and women, a former top executive has accused the company of discrimination and harassment based on gender on the company’s diversity and inclusion policies.

3. Competition

Johnson & Johnson faces stiff competition from Pfizer in the pharmaceutical industry, with significant demand for Pfizer’s Covid-19 vaccination overshadowing J&J’s single-dose option. Maintaining market share in such a competitive environment is an ongoing issue.

4. Surgery Deferrals

The postponement of surgeries during the COVID-19 pandemic has resulted in a drop in sales for Johnson & Johnson’s medical equipment sector. Elective treatments were postponed, reducing demand for surgical instruments and related supplies.

5. Corporate Espionage

Johnson & Johnson’s significant expenditure in R&D makes it an appealing target for corporate espionage. Hackers have attempted to obtain Covid-19 vaccine development data, endangering the security of company intellectual property and competitive edge.

6. Pricing Pressure

Governments and insurance companies are reducing healthcare costs, placing pressure on the pharmaceutical and medical device industries. This environment compromises Johnson & Johnson’s profit margins, necessitating inventive pricing strategies to remain profitable.

7. Intellectual Property Risks

Intellectual property is the backbone of companies that value innovation, such as Johnson & Johnson. Intellectual property risks, such as those resulting from patent expirations and infringement cases, pose a significant legal and financial threat.

8. Supply Chain Disruptions

Johnson & Johnson’s operations rely heavily on a solid supply network. Natural catastrophes, pandemics, and geopolitical tensions can negatively influence a company’s ability to create and deliver its products, lowering its market presence.

9. Technological Advancements

Rapid technological advancements in healthcare have the potential to challenge traditional business paradigms. To keep ahead, Johnson & Johnson must continue to invest in innovation or risk being overtaken by more technologically advanced competition.

10. Economic Fluctuations

Economic volatility can reduce consumer purchasing power, hurting Johnson & Johnson’s revenues, particularly in its consumer health area, where discretionary spending may be more elastic.

11. Product Recalls

Product recalls caused by safety or quality issues can be costly, not just financially but also in terms of consumer trust and brand harm, posing a significant danger to the company’s image and long-term customer loyalty.

12. Shifts in Healthcare Policies

Healthcare policy changes, particularly in key markets such as the United States, have the potential to substantially alter reimbursement rates and product pricing, posing a risk that Johnson & Johnson must carefully manage.

13. Emerging Market Challenges

Although emerging countries offer growth potential, they also pose dangers such as regulatory instability, currency volatility, and political upheaval, which can complicate business and reduce profitability.

14. Cybersecurity Risks

As digital dependency grows, cyberattacks threaten data security, infringe on patient privacy, and impair operational systems, necessitating comprehensive cybersecurity measures.

15. Potential for M&A Integration Issues

The challenges of combining and acquiring new companies involve cultural clashes, operational disruptions, and failure to fulfill synergy expectations, which might threaten Johnson & Johnson’s strategic expansion ambitions.

Conclusion

Johnson & Johnson is a healthcare industry giant with a strong history of innovation and a diverse portfolio that includes pharmaceuticals, medical equipment, and consumer health products. Despite facing challenges such as legal troubles, competitive pressures, and the complexity of global operations, the company’s strategic investments in R&D, commitment to sustainability, and focus on expanding its international reach highlight its resilience and flexibility.

Johnson & Johnson is well-positioned to deal with the changing healthcare landscape, with opportunities in digital health, emerging markets, and personalized medicine. To maintain its growth and prized position in the healthcare sector, it must address regulatory risks, supply chain inefficiencies, and the need for continual innovation.

Liked this post? Check out the complete series on SWOT