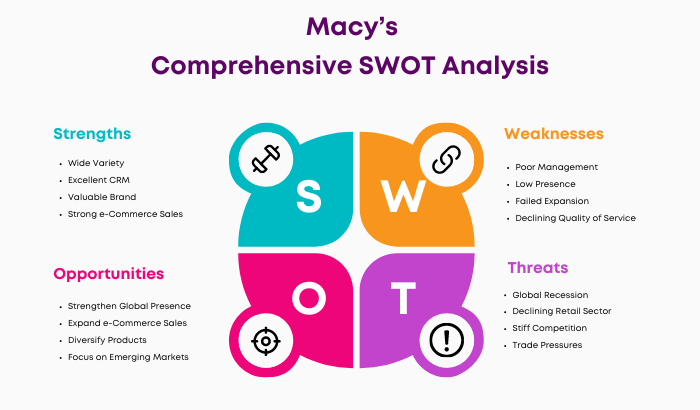

Let’s explore the SWOT Analysis of Macy’s by understanding its strengths, weaknesses, opportunities, and threats.

Macy’s is a symbol of American retail stores, having grown from a single location in 1858 to a big department store company with a solid online presence. Macy’s is well-known for its many merchandise and cultural contributions, such as the Thanksgiving Day Parade, and has successfully maintained its relevance and appeal throughout generations.

With the challenges of a changing retail landscape, Macy’s has concentrated on digital expansion, technological advances, and improving the in-store experience. Despite these efforts, it faces the pressures of online competition and shifting consumer tastes, emphasizing the importance of ongoing change in its strategy.

Overview of Macy’s

- Company type: Subsidiary

- Industry: Retail

- Founded: October 28, 1858, 165 years ago in New York City, U.S.

- Founder: Rowland Hussey Macy

- Headquarters: New York City, U.S.

- Number of locations: 508

- Areas served: United States, Puerto Rico, Guam, U.S. Virgin Islands (coming soon)

- Key people: Tony Spring (Chairman/CEO)

- Website: macys.com

Table of Contents

SWOT Analysis of Macy’s

Macy’s Strengths

1. Wide Variety

Macy’s offers a wide selection of products, including garments, accessories, cosmetics, fragrances, home furnishings, and more, making it a one-stop shop for a diversified customer base.

This broad collection includes several brands under a single brand, such as Macy’s, Bloomingdale’s, and Bluemercury, catering to the requirements of men, women, and children equally and keeping customers interested with its diverse products.

2. Excellent CRM

Macy’s operates and excels at customer relationship management, addressing customer dissatisfaction promptly and transforming potentially unpleasant experiences into positive ones. This commitment to customer satisfaction keeps customers and fosters loyalty, distinguishing Macy’s in a competitive industry.

3. Valuable Brand

Since its founding, Macy’s has established a strong, identifiable brand by following a customer-centric approach, ranked 120th among Fortune 500 companies. This worth reflects the company’s long history and continued capacity to remain competitive, relevant and valued by its customers. Macy’s net worth as of May 17, 2024 is $5.4B.

4. Strong e-Commerce Sales

Macy’s robust e-commerce infrastructure has dramatically increased corporate income in an era when internet shopping is more than a convenience but a necessity for many individuals. As of Q1, 2024 Digital sales remain strong, with Bluemercury achieving its 13th consecutive quarter of comp growth.

This digital foresight and implementation enabled Macy’s to enter a bigger market, reflecting the changing purchasing habits of the modern consumer.

5. Effective Marketing

Macy’s distinct marketing strategy, highlighted by the iconic Macy’s Thanksgiving Day Parade, illustrates marketing genius by serving as a massive cultural event and a powerful promotional tool that rivals major sporting events, providing unparalleled visibility and engagement with consumers.

6. Huge Investment in Automation

Macy’s significant automation investments have streamlined processes, increasing cost-effectiveness, efficiency, flexibility, and productivity. This technology development puts Macy’s ahead of its competitors by streamlining several operational factors.

7. Household Name

As a brand that has become synonymous with retail shopping, Macy’s has the immense advantage of being a household name. This recognition fosters trust and dependability, which are essential for retaining and attracting a broad customer base.

8. Brand Recognition

Macy’s is one of the most well-known names in the American department store industry, owing to its historical tradition and continuous significance in the retail sector and its successful brand-building efforts.

9. Diverse Product Mix

Macy’s strength is its extensive product mix, which provides customers with a wide range of options from fashion to home products, increasing the shopping experience and responding to a broad spectrum of consumer demands and tastes.

10. Geographic Reach

With a large geographic footprint across the United States, Macy’s has access to a diverse consumer base, ensuring that its presence is felt broadly and can effectively adapt to regional preferences and trends.

11. Omnichannel Presence

Macy’s has expertly balanced a robust online presence with its physical locations, providing customers with a flexible and convenient shopping experience. This omnichannel strategy fits modern consumers’ expectations for convenient, multi-platform buying.

12. Loyal Customer Base

The company has effectively built a loyal client base through efforts such as the Macy’s Star Rewards program, which incentivizes repeat business and fosters a strong community of Macy’s shoppers.

13. Strategic Store Locations

Macy’s stores are strategically placed to attract customers and maximize foot traffic and visibility. This strategic positioning, which includes flagship stores in key urban areas and shopping malls, improves customer accessibility and brand visibility. At the end of the financial year 2023, Macy’s Inc. had a total of 718 stores, 65 stores fewer than a year earlier.

14. Private Labels and Exclusive Products

Offering exclusive brands and products that can only be found in Macy’s stores creates a distinct value proposition, attracting shoppers looking for distinctive products and driving sales.

15. Experienced Management

Macy’s seasoned management team offers vast expertise and understanding to navigate the complicated environment of retail operations, assuring informed and effective strategic decisions.

16. Vendor Relationships

Macy’s benefits from long-standing connections with various vendors, giving it access to a diverse range of items and attractive purchase conditions, expanding its product offers and competitive advantage.

17. Seasonal Events and Sales

Macy’s is well-known for its seasonal sales and promotional events, which it uses to increase customer traffic and sales significantly, building customer anticipation and excitement.

18. Credit Card Operations

The company’s credit card operations boost client loyalty and spending, positively impacting its financial health.

19. Real Estate Assets

Macy’s has a massive quantity of valuable real estate, which provides financial leverage and stability to its operations and strategic ambitions.

20. Supply Chain and Logistics

Macy’s has built complex supply chain and logistics operations to effectively manage inventory and ensure product availability coincides with consumer demand.

21. Customer Service

The emphasis on customer service, including personal shopping assistants and a simple return policy, increases customer satisfaction and strengthens Macy’s reputation for outstanding service.

22. Corporate Social Responsibility

Commitment to sustainability and corporate social responsibility aligns with contemporary consumer ideals, establishing Macy’s as a responsible brand in the minds of its customers.

23. Innovative Initiatives

Macy’s adoption of technology and innovation, such as virtual reality experiences for furniture shopping and mobile checkout services, establishes it as a forward-thinking store in an increasingly digital shopping market.

24. Financial Resources

As a well-established firm, Macy’s access to money and financial resources allows it to continue investing in operational, technological, and strategic initiatives that will help it maintain and improve its competitive market position.

Macy’s Weaknesses

1. Poor Management

Macy’s needs to correct its management mistakes, which have harmed its operational efficiency and growth. For example, the delay in implementing the Polaris Plan, which aims to streamline processes, represents missed opportunities to improve performance.

2. Low Presence

Although a global brand, Macy’s has a relatively modest presence in many places, with some countries having only one or two stores. This low footprint has been compounded by the closure of around 125 outlets in the United States due to economic issues caused by the pandemic.

3. Failed Expansion

Macy’s has made headlines for abruptly canceling planned expansions, including its forthcoming debut in Abu Dhabi. This cancellation damaged trust and disappointed potential customers and business partners.

4. Declining Quality of Service

Macy’s focused expansion across the United States stretched business resources fragile, resulting in overcrowded, disorganized stores and declining customer service quality. This reduction is attributed to inadequate staffing and a failure to maintain a clean, appealing shop environment.

5. Emotional Disconnect

The shift to digitalization and automation has caused an emotional separation from clients. Macy’s dependence on technology over personal human connections has weakened the traditional shopping experience, which is defined by personal touches and exceptional customer service.

6. Overdependence on the US Market

Macy’s emphasis on the US market renders it susceptible to domestic socioeconomic swings. The events following George Floyd’s death, which resulted in the looting of Macy’s flagship store in New York, demonstrate this vulnerability.

7. Heavy Dependence on Brick-and-Mortar

In an age of growing e-commerce, Macy’s traditional emphasis on its physical store locations and storefronts has proven to be a weakness. This reliance presents strategic issues for reacting to the rapidly changing digital retail sector.

8. High Operating Costs

Running many physical businesses incurs significant expenditures, such as rent, utilities, and salaries. These charges significantly impact Macy’s profitability in the face of severe competition and changing consumer demands.

9. Competition

Macy’s competes with internet giants like Amazon and traditional rivals like discount and specialty retailers. This intense competition may harm Macy’s market share and profitability.

10. Market Share Erosion

The department store industry, including Macy’s, is losing ground to quick fashion labels, e-commerce platforms, and discount shops, indicating a broader shift in customer purchasing behavior.

11. Supply Chain Disruptions

Global supply chain challenges have affected Macy’s ability to store and distribute products properly, affecting sales and customer satisfaction despite rising demands for quick and cost-effective delivery.

12. Changes in Consumer Behavior

Macy’s must adapt to changing consumer trends, such as increased internet shopping and a growing need for sustainable products. Adapting to these advances is crucial for being relevant in the retail industry.

13. Outdated Store Experience

Some Macy’s locations appear outdated, failing to appeal to a younger clientele seeking modern, engaging shopping experiences. This discrepancy with consumer expectations might result in lower foot traffic and revenue.

14. Inventory Management

Macy’s faces a big issue maintaining the correct inventory balance to prevent overstocking and shortages. Misaligned inventory levels might result in discounted sales, which reduces profit margins.

15. Private Label Performance

While Macy’s private labels are often intense, success is not guaranteed. Failure to connect with customers or meet quality standards threatens the company’s brand reputation and financial performance.

16. Cybersecurity Threats

As Macy’s grows its both online and offline channels presence, cybersecurity becomes a key concern. Data breaches can harm customer trust and negatively affect brand loyalty and sales.

17. Debt Levels

High debt can affect Macy’s capacity to invest in new technologies, shop renovations, or market expansions, limiting its ability to respond to changing market dynamics. According to Macy’s ‘s latest financial reports the company’s total debt is $5.98 B.

18. Cultural and Management Inertia

Institutional opposition to change within Macy’s culture and management can interfere with implementing innovative methods and practices critical to the company’s renewal and success.

Macy’s Opportunities

1. Strengthen Global Presence

Macy’s can reach a more extensive customer base by growing its global footprint. Rather than focusing primarily on improving physical department stores, Macy’s could use digital platforms to capitalize on the tremendous prospects in the worldwide market. This adjustment could dramatically boost their consumer base and revenue.

2. Expand e-Commerce Sales

Although Macy’s success in e-commerce is impressive, there is significant room for growth in online sales. Macy’s may benefit from the increasing move toward online purchasing by fine-tuning its e-commerce strategies and platforms, with the goal of matching or exceeding its traditional sales performance.

3. Diversify Products

Macy’s already has a varied product line. However, there is still a possibility of expanding into other categories, such as second-hand apparel, or entirely distinct industries, such as the food industry. Such diversification may attract a new customer population in store sales and generate new revenue streams.

4. Focus on Emerging Markets

Luxury goods and high-end designer brands are in high demand in emerging economies such as Africa, Asia, and Latin America. By focusing on these markets, Macy’s may take advantage of enormous expansion potential while connecting to a growing consumer base demanding quality and luxury.

5. Expand through Mergers and Acquisition

Using mergers and acquisitions, such as its recent acquisition of Story, to renew creativity, Macy’s may enter new markets or industries quickly, stimulating innovation and expansion without the long runway of organic growth.

6. Technology Integration

Integrating innovative retail technologies such as AI for personalized shopping experiences, augmented reality for virtual try-ons, and sophisticated CRM systems has the potential to significantly improve the online shopping experience, making it more engaging and customer-friendly.

7. Sustainability Initiatives

By embracing sustainability, Macy’s may broaden its appeal to environmentally sensitive customers by selling more eco-friendly and sustainable items. This approach coincides with worldwide environmental trends and can help Macy’s stand out in a competitive marketplace.

8. Strategic Partnerships and Collaborations

Strategic alliances with designers, celebrities, or other companies may restore Macy’s brand image, drawing new customers and updating its product offers through exclusive, collaborative lines.

9. Private Label Growth

Macy’s has a big chance to increase its private-label brands, which typically have higher profits than third-party trademarks. Investing in the growth and marketing of these brands can increase profitability and client loyalty.

10. Supply Chain Optimization

Improving supply chain efficiency may result in cost savings and better stock management, allowing Macy’s to respond swiftly to market trends and consumer requests without the burden of overstocking or supply shortages.

11. Store Experience

Bringing back the physical store experience through creative layouts, concepts, and technology can attract younger customers and make buying more participatory and pleasant, combating online purchasing trends.

12. Marketplace Model

Adopting a marketplace model on e-commerce platforms will broaden Macy’s product choices without inventory management risks, attracting a broader client base seeking diverse products and brands.

13. Consumer Analytics

Data analytics may help Macy’s better understand customer preferences and deliver tailored products. Understanding current trends and customer behavior can help you make better business decisions and provide a more personalized purchasing experience.

14. Mobile Commerce

With the development of mobile shopping, Macy’s has an excellent chance to enhance its mobile commerce initiatives, making it easier for customers to shop while on the go and improving the entire user experience on mobile devices.

15. Rental and Subscription Services

Based on the sharing economy trend, Macy’s may consider joining the clothes rental or subscription service sector. This concept could appeal to clients interested in fashion sustainability or those who want to enjoy premium things without making a complete purchase commitment.

16. Pop-up Stores

These temporary shops allow Macy’s to test new markets and goods, generate excitement, and engage with customers in new areas without the long-term commitment of traditional retail space.

17. Diversification

Venturing into non-traditional department store products, such as various services, could open up new revenue and customer engagement opportunities for Macy’s, diversifying its income streams beyond retail.

18. Real Estate Utilization

Macy’s might turn some of its real estate holdings into mixed-use complexes with retail, office, and residential spaces, producing synergies and revenue.

19. Local and Hyper-Local Strategies

By tailoring product offerings to local market tastes and demography, Macy’s may increase its relevance and sales in specific countries, responding more effectively to market peculiarities.

20. In-store Events and Classes

Hosting in-store events, workshops, or classes can boost foot traffic and turn Macy’s locations into community hubs, promoting customer loyalty and engagement and increasing sales.

21. Health and Wellness

The rising health and wellness market segment allows Macy’s to broaden its products in this category, attracting customers who value healthy living and well-being.

22. Loyalty Programs and Customer Engagement

Improving Macy’s loyalty program to provide more value to customers can lead to higher retention and lifetime value, resulting in a loyal customer base that chooses Macy’s first for their purchasing requirements.

23. Cost-Reduction Initiatives

Implementing cost-cutting methods can boost Macy’s margins and competitive advantage in a market where efficiency and agility are becoming increasingly crucial.

Macy’s Threats

1. Global Recession

The extended global recession, worsened by the pandemic’s severe impact on businesses worldwide, poses a considerable danger to Macy’s. With over a billion dollars in predicted losses, the firm intends to reduce its operational scale to navigate these financially challenging times.

2. Declining Retail Sector

The ‘ retail disaster’ refers to the industry’s decreasing income and earnings, which has adversely affected various businesses, including Macy’s, during the last five years. Macy’s profitability and long-term survival could suffer significantly if this trend continues.

3. Stiff Competition

Macy’s faces stiff competition from Nordstrom, JC Penney, TJ Maxx, and Kohl. This fierce and highly competitive retail industry landscape regularly challenges Macy’s market share and profitability.

4. Trade Pressures

The complex combination of political, economic, and trading challenges has harmed the trading climate. Macy’s witnessed a vivid example in 2019 when their shares fell 50% due to global trade tensions.

5. Uncertain Times

The projected second wave of the coronavirus poses a significant threat to Macy’s, which has already sustained a stunning $1.1 billion loss due to the first lockdowns. Additional lockdowns and sales drops may be too much for the vulnerable retailer.

6. Economic Downturns

Recessions reduce consumer spending in non-essential categories. In economic downturns, discretionary consumer spending affects Macy’s as a department store operator.

7. Changing Consumer Preferences

Moving toward online purchases and away from brick-and-mortar stores poses a significant risk to Macy’s as it may result in decreased foot traffic and direct sales.

8. Supply Chain Disruptions

Like many others, Macy’s is vulnerable to global supply chain disruptions caused by pandemics, natural disasters, or political upheaval, which influence stock levels and sales.

9. E-commerce Dominance

The ongoing expansion of e-commerce platforms directly confronts Macy’s, potentially taking away market share because of the convenience and competitive online cost.

10. Cybersecurity Risks

With a more robust digital presence, Macy’s is confronted with more cybersecurity concerns. A serious data breach or hack may result in the loss of customer trust and severe financial implications.

11. Real Estate Depreciation

A decline in commercial real estate values could harm Macy’s balance sheet and leasing costs, compromising financial stability and operational costs.

12. Rising Operating Costs

Macy’s profit margins are being stretched by growing labor, utilities, and other operating costs, weakening its financial position.

13. Shift to Experiential Spending

The growing customer preference for experiences over items, especially among younger generations, could divert from product-based sales.

14. Consumer Advocacy and Backlash

If Macy’s does not properly manage sustainability, ethical sourcing, and labor standards, it may face consumer advocacy and backlash, harming its reputation and customer base.

15. Regulatory Changes

Changes in regulations regulating online sales tax, consumer privacy, and import tariffs could raise Macy’s operational costs and disrupt its business model.

16. Technological Advancements

Keeping up with technology requires significant investments. Falling behind could be a concern to Macy’s if it does not upgrade by industry advances.

17. Counterfeit Products

The fight against counterfeit goods in the fashion sector can ruin Macy’s brand reputation and reduce income if buyers link their products with inferior quality or insincerity.

18. Decreasing Brand Loyalty

With so many options available to customers, Macy’s risks losing brand loyalty, which is critical for maintaining repeat business.

19. Retail Space Oversaturation

Malls with a high concentration of Macy’s stores experience retail space oversaturation, which can reduce mall foot traffic and, as a result, revenues.

20. Digital Marketing Competency

In the digital age, Macy’s must effectively employ digital marketing strategies. Failure to do so risks losing relevance and visibility among consumers who value online shopping.

21. Price Sensitivity

Economic downturns increase consumer price sensitivity. Retailers like Macy’s, known for their luxury brand positioning, may see sales drop as customers seek more cost-effective alternatives.

22. Logistics and Shipping Costs

Fuel prices and delivery costs can fluctuate, reducing Macy’s online and in-store profit margins, mainly if the company absorbs these costs to offer free shipping.

23. Generational Shifts

As Macy’s experiences generational shifts, the issue will remain appealing to younger consumers with different buying habits and expectations, which may differ from the techniques that have previously driven Macy’s success.

Conclusion

Macy’s has been an essential part of American retail for 165 years, and it continues to navigate the changing retail market by combining tradition and new ideas. Macy’s began as a single store in 1858. It has since expanded into a famous department store chain noted for its vast product choices, strong e-commerce presence, and cultural contributions, such as the Thanksgiving Day Parade.

Despite challenges such as online competition, shifting consumer preferences, and the pressures of the “retail apocalypse,” Macy’s maintains its appeal across generations by leveraging its strengths, which range from a diverse product offering and strong brand recognition to strategic technological investments.

Liked this post? Check out the complete series on SWOT

Hi,

Quick question

How would you combine Strengths-Treats and

Opportunities-Weaknesses for Macy’s.

Thank you,