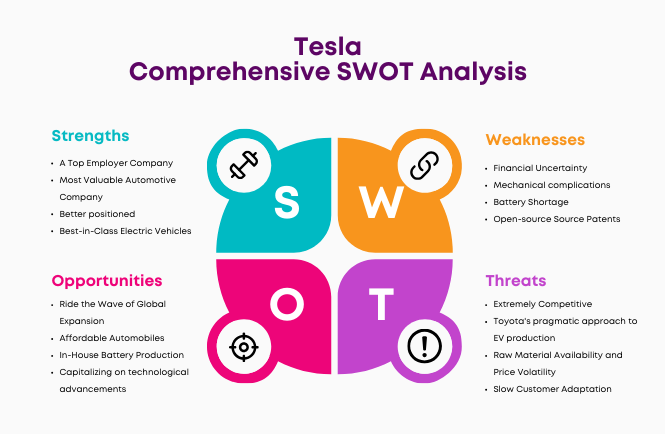

Let’s explore the Swot analysis of Tesla, a leading automotive company, by understanding its strengths, weaknesses, opportunities, and threats.

Tesla, led by Elon Musk, has revolutionized the auto business with electric cars and sustainable renewable energy solutions. Its electric vehicle lineup and investments in battery technology and renewable energy make it a key green player.

Tesla’s innovation, global reach, and brand loyalty led to the sustainable transportation shift despite production bottlenecks and severe competition. This context helps assess Tesla’s strengths, weaknesses, opportunities, and dangers in a fast-changing industry.

Overview of Tesla

- Company type: Public

- Industry: Automotive, Renewable energy

- Founded: July 1, 2003; 20 years ago in San Carlos, California, U.S.

- Headquarters: Gigafactory Texas, Austin, Texas, U.S.

- Number of locations: 1,208 sales, service and delivery centers

- Area served: East Asia, Europe, Middle East, North America, Oceania, Southeast Asia

- Key people: Elon Musk (CEO), Robyn Denholm (chair)

- Products: Model S, Model X, Model 3, Model Y, Semi, Cybertruck, Powerwall, Megapack, Solar Panels, Solar Roof

- Production output: 1,845,985 vehicles (2023)

- Revenue: US$96.8 billion (2023)

- Operating income: US$8.9 billion (2023)

- Net income: US$15.0 billion (2023)

- Total assets: US$106.6 billion (2023)

- Total equity: US$62.6 billion (2023)

- Owner: Elon Musk

- Number of employees: 140,473 (2023)

- Website: tesla.com

Table of Contents

SWOT Analysis of Tesla

Tesla’s Strengths

1. A Top Employer Company

Diversity and innovation have earned Tesla, Inc. a great workplace reputation. According to The Wall Street Journal, this attraction has made Tesla a coveted job. Tesla’s competitiveness in attracting and retaining top talent is ideal for young, creative professionals eager to join a forward-thinking firm. Tesla’s participation on Forbes’ America’s Best Employers 2024 list reinforces its technological leadership and aspirational environment.

2. Most Valuable Automotive Company

Tesla’s financial achievements reflect its significant position in the automobile industry. In fiscal year 2023, Tesla’s net income was $14.99 billion, with a record delivery of 1,808,581 units. This financial competence led the company’s market cap to $477.49 billion as of April 2024. surpassing the combined valuation of established automotive industry giants Toyota, Volkswagen, Daimler, Ford, and General Motors. This financial statistic demonstrates Tesla’s strategic understanding and highlights the company’s unquestionable industry dominance.

3. Better positioned

Economic uncertainty is a big business problem, but Tesla has demonstrated remarkable endurance and adaptability. Tesla’s revenues were $96.773 billion in 2023. This growth trajectory shows Tesla’s business growth, strong market presence, and ability to prosper in market uncertainty, giving investors and stakeholders further confidence in the next electric vehicle industry giant.

4. Best-in-Class Electric Vehicles

Tesla’s EVs are industry-leading. Tesla has the best range for electric cars. Tesla’s battery innovation and engineering skills allow the Model S to outperform competitors with a 600-kilometer range. Tesla dominates this high-end electric vehicle market, ensuring consumer approval.

5. Tesla’s Noble USP

Tesla’s selling point is sustainability and environmental care, not technology. By constantly opposing fossil fuel automobiles, Tesla has improved worldwide environmental protection. Tesla’s appeal comes from its desire to encourage sustainable mobility, making it stand out among environmentally conscious buyers.

6. Effective Marketing Strategies

Tesla switched from traditional to unconventional advertising. Thanks to its CEO’s social media presence, the company correctly emphasizes new releases and word-of-mouth preaching. Tesla’s mythical $0 marketing budget shows its low-cost but effective brand promotion. Tesla markets via online buzz and the CEO’s personality. CEO Elon Musk’s social media engagement has increased brand awareness and free exposure.

7. Innovative Company

Tesla’s innovation has made it a tech leader. Tesla’s first electric semi-truck and new sports car show its ability to innovate and set industry norms. Tesla’s market faith in its invention leads to financial gains and a competitive edge.

8. Market Dominator

Tesla dominates electric vehicle sales in the US. Combined with Ford and GM, Tesla comprises the “Big Three” in the U.S. electric car market, dominating and setting trends. Tesla’s market dominance shows its effective strategy and impact on the automotive market, innovation, and consumption.

Tesla Weaknesses

1. Financial Uncertainty

Tesla’s finances are a concern. Although its large financial resources are helpful, the firm has $2.857 billion in debt as of 2023. This financial mismatch could cause Tesla to need extra cash to service its loans. This may delay growth, reduce investments, and sell assets, harming long-term viability.

2. Mechanical complications

Tesla, an automotive innovator, is struggling with manufacturing and mechanical issues. Innovation’s constant iterations delayed the introduction of the Model X. The Model X production ramp-up caused delays for customers who ordered the SUV. This example illustrates how cutting-edge innovations slow product releases, cause manufacturing bottlenecks, and lower customer satisfaction.

3. Battery Shortage

Battery shortages is a major obstacle for Tesla, which sells battery electric vehicles (BEVs) and plug-in electric automobiles. This scarcity reduces Tesla’s ability to meet rising demand for electric automobiles and energy storage solutions, slowing growth. Due to battery dependence and supply, Tesla’s operational plan could be better.

4. Open-source Source Patents

Tesla’s patent management, notably Elon Musk’s open-source strategy, has raised concerns about its long-term ramifications. While stimulating innovation and growing the electric vehicle market, this method may expose Tesla to competition, necessitating help safeguarding its technological findings.

5. Leadership Wrangles

Tesla’s management-board conflicts are a significant problem. Musk’s suspected drug use and outspoken statements have put directors in challenging positions. Internal strife may hurt morale, production, and Tesla’s long-term strategy.

6. Premium Pricing Range

Tesla’s luxury brand status and high prices limit market penetration. Tesla’s new Model 3 price drop shows its efforts to expand its customer base. Tesla must balance innovation and price to stay relevant and expand market share.

7. Employee Turnover Rate

Tesla’s high turnover and low morale are HR issues. The company’s working culture was questioned after being penalized for unsafe labor practices. Employee satisfaction is key to innovation and production; this issue should be addressed immediately.

8. Dependency on Elon Musk’s image

Tesla’s success depends on Musk’s brand. Musk’s creativity boosts brand loyalty, but if he loses interest or other corporate priorities take precedence, Tesla is at risk. This case illustrates the conflict between charm-driven brand loyalty and the company’s core value.

9. Manufacturing Issues

Tesla vehicles have been criticized for automated driving accidents. Continuous innovation often causes manufacturing and mechanical dependability issues. Setbacks can affect brand reputation and consumer confidence.

10. Restricted Production

High-quality EVs are expensive to make, limiting manufacturing. High production, managerial, and space costs exacerbate this restriction. Tesla’s modest worldwide footprint reduces its scalability and flexibility by limiting global resource availability.

11. Inability to meet demand.

Tesla cannot meet market demand due to the previous issues. Innovation, production delays, supply chain bottlenecks, and financial concerns cause a supply-demand imbalance. This difference prevents customers and affects Tesla’s competitiveness.

Tesla Opportunities

1. Ride the Wave of Global Expansion

The US and China, the world’s largest car markets, have sold most Teslas until recently. According to 2023 turnover statistics, the US accounts for 46.7% car sales and China 22.5%. Tesla has limited global activities.

With its booming economy, Asia might be Tesla’s next big market. Focusing on untapped markets like India and China may significantly boost EV sales, solidifying Tesla’s global leadership in the electric car sector.

2. Affordable Automobiles

Tesla has launched on the critical mission of expanding affordable electric vehicles and technology. In its efforts to make revolutionary electric cars available to a broader consumer base beyond the premium segment, Tesla debuted Model 3, an inexpensive version of the upmarket Model S. A sail in this direction can boost Tesla’s sales and considerably contribute to the worldwide EV revolution.

3. In-House Battery Production

Panasonic may no longer provide Tesla’s batteries. Launching its battery cells offers a promising way to address supply constraints and costs. Tesla might gain production control and cost efficiency by using lithium battery cells and becoming self-reliant on this crucial component.

4. Capitalizing on technological advancements

Tesla’s DNA is one of innovation, and using technology can provide several benefits across various industries. Essential activities can be automated to save money, whereas customer data-driven insights can improve marketing results and refine corporate strategies. Inculcating these technical breakthroughs can help Tesla preserve its competitive advantage.

5. Autonomous Technology

Tesla’s safety and comfort-renowned autopilot technology offers many benefits. This autonomous driving technology also might solidify Tesla’s innovation leadership as it gains customer and market trust. Increasing autonomous driving algorithms and features might boost enthusiasm and opportunity.

6. Entering the Pickup Truck Market

According to the National Automobile Dealer Association, pickup trucks made up 17.6% of light vehicle sales in the US this year, second only to crossovers. Additionally, 71.6% of light vehicle sales were light trucks, indicating rising demand for electric vehicles. Tesla may expand its leadership in this enormous business by introducing the much-anticipated Cyber Truck.

7. Hertz Orders 100,000 Cars.

To meet the growing demand for electric vehicles, automobile rental company Hertz plans to purchase 100,000 Tesla vehicles, with Tesla Model 3 sedans being a key part of the order. This order represents a significant transaction and demonstrates the demand for electricity for high demand and acceptance. It also allows Tesla to demonstrate the scalability of its manufacturing skills, demonstrating its capacity to handle substantial fleet orders.

8. Venturing into the Air-Taxi Market

Demand for innovative urban air taxi services will massively increase by 2025. With its cutting-edge technology and expertise, Tesla has a unique chance to enter this global market, with electric vertical takeoff and landing (eVTOL) vehicles. Given that Tesla’s second-largest shareholder has already spent millions on air taxi company Lilium, Tesla’s foray into the future of urban mobility is promising.

9. Environmentally Friendly Cars.

As the globe moves toward sustainability, the demand for EVs is increasing significantly. By capitalizing on this trend, Tesla can strengthen its position as a leading pioneer in the green transportation revolution while benefiting from the growing global acceptance of electric vehicles.

10. The Twin Titans

Commitment to innovation has always required significant investment, causing Tesla’s vehicles to be more expensive. On the other hand, Tesla can benefit from expanded production and lower costs by using economies of scale and scope. Tesla can dramatically extend its consumer base and drive massive growth by boosting manufacturing capacity and balancing production complexity and pricing.

Tesla Threats

1. Extremely Competitive

Tesla has an evident competitive advantage because it pioneered electric and autonomous vehicle technologies. However, it must remain vigilant given the increasing competition in luxury and economic areas. Mercedes, BMW, Audi, Lexus, Toyota, Ford, General Motors, and Volvo are among the competitors, each with its own alternative fuel and autonomous driving technologies.

Given that these brands offer green and autonomous automobiles at a lower cost, Tesla’s profitable but expensive offers may need to be improved. This is a high-stakes game for Tesla, with the potential to test its market positioning and product strategy.

2. Toyota’s pragmatic approach to EV production.

Not all market participants’ strengths determine perceived hazards. Some dangers, like Toyota, are more evident. The Japanese automaker plans to grow EV output to 40% of sales by 2030. Toyota’s strong EV market share growth makes its rise even more incredible.

3. Raw Material Availability and Price Volatility

Tesla relies extensively on high-end metals and alloys, including aluminum, iron, and nickel. However, the availability and price of these materials can present considerable obstacles. Raw material price fluctuations concern Tesla, as they directly impact profitability and output.

4. Slow Customer Adaptation.

Despite Tesla’s hype and positive reviews, commercial acceptance can take much work. Electric and self-driving cars are new, so buyers need time to adjust. Tesla’s product liability litigation has hurt its brand and product uptake.

5. Product Liability Claims

Tesla, a high-tech automaker, faces considerable product liability claims. Due to technological issues with the product, its items have caused lawsuits and financial losses despite high production standards. Tesla may suffer major financial losses and image damage if these liability issues are not resolved.

6. Question Marks about Long-term Confidence

Production instability and manufacturing difficulties have generated public doubts about Tesla’s long-term viability. If Tesla and other expensive products appear unstable, they may lose investors and customers.

7. Not everyone is comfortable with self-driving cars.

Self-driving automobiles have yet to receive widespread acceptance. According to a YouGov survey, many US citizens, particularly those over 55, feel unsafe around self-driving cars. This sentiment contributes to the slow consumer uptake of Tesla’s self-driving automobiles.

8. High Risk of Using Lithium-Ion

Tesla’s use of lithium-ion cells in its battery packs presents another significant danger. Lithium, while efficient, is highly reactive and explosive. Tesla has had some reports of its cars producing smoke or catching fire, damaging the company’s reputation and harming sales.

9. Controversial Behavior of Elon Musk

Elon Musk’s image is linked to Tesla. Musk’s recent actions, such as taking marijuana and drinking whiskey on a podcast, have soiled Tesla’s reputation and questioned his visionary genius. This episode dropped Tesla’s stock market value by almost 9%, showing Musk’s influence on Tesla’s value.

Conclusion

Tesla, led by Elon Musk, has revolutionized the auto and renewable energy industries. Tesla’s high-performance electric cars and pioneering battery and renewable energy programs demonstrate innovation and environmental responsibility. Despite manufacturing delays, battery shortages, and tough competition, the company’s strengths—unmatched brand loyalty, cutting-edge electric vehicles, battery production technology, and top employer status—put it in a good position to tackle a fast-changing sector. Tesla’s narrative illustrates the challenges and prospects of this historic change toward sustainable transportation.

Liked this post? Check out the complete series on SWOT

Interesting article!