Let’s explore the SWOT analysis of Visa by understanding its strengths, weaknesses, opportunities, and threats.

Visa Inc. is a global leader in digital payments, linking millions of customers, businesses, and financial institutions across 200 countries. It provides several payment options, including credit, debit, and prepaid cards, and its superior technology-driven infrastructure improves the efficiency of worldwide business.

Faced with the challenges of fintech developments, digital payment adoption,, and shifting regulations, Visa actively embraces change through strategic alliances and acquisition of new technology. This forward-thinking approach ensures sustained leadership in the payment processing sector, establishing it as a key player in the digital financial world.

Overview of Visa

- Company type: Public

- Industry: Payment card services

- Founded: September 18, 1958; 65 years ago (as BankAmericard in Fresno, California, U.S.)

- Founder: Dee Hock

- Headquarters: One Market Plaza, San Francisco, California, U.S.

- Area served: worldwide.

- Key people: Ryan McInerney (CEO), Alfred F. Kelly Jr. (Executive Chairman), Oliver Jenkyn (Group President & Global Markets), Kelly Mahon Tullier (Vice Chair & CPO), Chris Suh (CFO)

- Products: Credit cards, Debit cards, Payment systems

- Revenue: US$32.7 billion (2023)

- Website: visa.com

Table of Contents

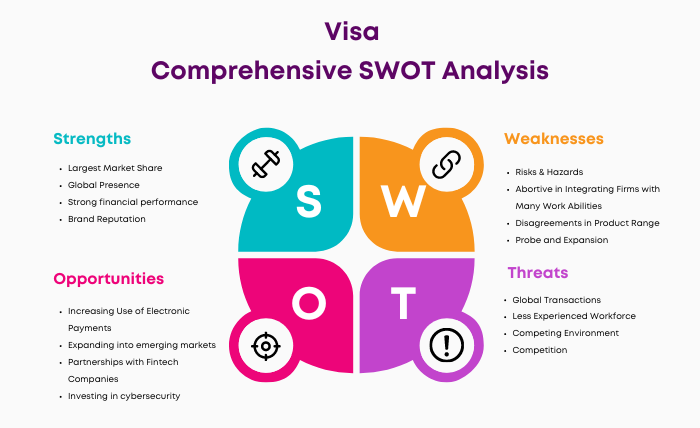

SWOT Analysis of Visa

Visa Strengths

1. Largest Market Share

Visa has the most significant market share in the United States, reflecting its strong position in the worldwide payments business. Its dominance extends to digital transactions, demonstrating a solid position as the segment leader. Visa is still considered the dominant bank card company in the rest of the world, where it commands a 50% market share of total card payments.

2. Global Presence

Visa, which operates in over 200 countries, has a significant worldwide advantage. This geographical distribution creates a worldwide mark and lays the groundwork for future expansion.

3. Strong financial performance

Visa’s track record of strong financial results, including sustained revenue and earnings growth, demonstrates its fiscal health and economic vibrancy. For the quarter ending March 31, 2024, Visa’s revenue was $8.775 billion, while for 2023, its revenue was $32.653 billion.

4. Brand Reputation

With a globally known brand, Visa has built trust among customers, merchants, and financial institutions, fundamentally improving its market position. Visa took the sixth spot, with a brand value of 169.1 billion U.S. dollars in 2023.

5. Innovative products

The company hopes to stay on top of consumer trends by releasing new products regularly. These solutions align with its consumers’ changing requirements and behaviors, assuring Visa’s continued popularity among users.

6. Secured Dossier Centers

Visa’s security architecture is robust, with dossier centers protected from crime and natural or man-made disasters. These centers are intended for durability, processing around 65,000 transactions per second and implementing over 500 security checks to prevent fraud, demonstrating the company’s dedication to transactional security.

7. Endorsements

Sponsorships of high-profile events such as the Olympics, Paralympics, and FIFA strengthen the brand. Such endorsements boost Visa’s global image by associating the company with excellence and international fellowship themes.

8. Currency of Progress

Visa is at the top of digital currency education, claiming that such innovations may strengthen economies and improve business productivity. Its support for stablecoins such as USDC shows this forward-thinking strategy.

9. Large and Diversified Customer Base

Visa’s diverse clientele, which includes several financial institutions, corporations, and individual consumers, demonstrates a revenue stream that avoids overreliance on a single industry.

10. Advanced Technology Infrastructure

Visa’s technology expenditures demonstrate the company’s dedication to dependable and fast payment processing, critical for preserving consumer trust and happiness in a competitive digital economy.

11. Strong Relationships with Financial Institutions

Visa’s network includes partnerships with numerous global banks and other financial institutions, allowing for widespread card distribution and acceptance. Visa has 222 partners, 92 of which are technology partners and 130 channel partners. Oracle is its most significant partner.

12. Innovative payment solutions

Visa is always on top of the latest tech trends and customer expectations by offering new payment methods, such as contactless transactions and mobile wallets.

13. Effective Marketing Strategies

Visa achieves long-term brand visibility and recognition through targeted marketing strategies and event sponsorships that appeal to its target audience.

14. Adaptability to Regulatory Change

The organization has shown flexibility in negotiating regulatory landscapes across multiple countries, demonstrating its adaptation and resilience in the face of global compliance problems.

15. Commitment to Sustainability and Corporate Responsibility

Visa’s expanding commitment to sustainable and responsible business practices strengthens its attractiveness to a rising number of socially concerned stakeholders, improving its corporate image.

Visa Weaknesses

1. Risks & Hazards

Visa’s vulnerability to risk and fraud is a significant problem. There have been instances where the transaction system has been compromised, resulting in fraudulent payments. Such incidents cause financial losses and diminish customer confidence in Visa’s security procedures, potentially leading to a preference for competitors’ more secure networks.

2. Abortive in Integrating Firms with Many Work Abilities

Visa has demonstrated difficulties in efficiently integrating acquisitions with various operating capabilities. This inability to assimilate and handle several work streams concurrently has hampered its adaptability and responsiveness to changing market needs, destroying its competitive advantage.

3. Disagreements in Product Range

Customers are dissatisfied with Visa’s product offers due to a lack of diversity. Consumers’ choices are limited, allowing competitors to acquire market share with more innovative or complete solutions, harming Visa’s market position and consumer base.

4. Probe and Expansion

Despite investing significant resources in R&D, Visa needs to catch up in innovation. The gap is becoming clearer as other financial sector competitors offer game-changing technology, challenging Visa’s supremacy and market share.

5. High Dependency Rate on Large Contracts

Visa’s financial stability is at risk due to its overreliance on a few large contracts for most of its revenue. Changes in these relationships, or the loss of important clients, could disproportionately impact the company’s financial results.

6. Increasing competition

The payment industry’s ongoing growth brings new rivals, such as fintech startups and cryptocurrencies. This increasing number of competitors affects Visa’s market share and financial performance.

7. Inability to Expand in Certain Markets

Visa’s global expansion attempts are periodically delayed by legislative, political, and cultural constraints, which limit its growth potential in profitable regions.

8. Dependency on technology

Visa confronts risks from technological breakdowns, cyberattacks, and data breaches in a business that relies on advanced technology. These incidents can cause significant financial losses and harm the company’s reputation.

9. High operating costs

Maintaining its large network incurs enormous marketing, regulatory compliance, and innovation costs for Visa, which may decrease its profit margins. Visa operating expenses for the March 31, 2024 quarter were $3.421B, while operating expenses for 2023 were $11.653B.

10. Dependence on the Banking Sector

Visa’s performance is intimately related to the health of the global banking and financial sector. Any slowdown in this industry can significantly affect Visa’s business and income.

11. Regulatory Compliance Costs

Visa faces high compliance expenses in the complicated financial services market, limiting its operational flexibility and margins.

12. Vulnerability to cyber threats

As a global leader in digital payments, Visa is constantly vulnerable to cyber threats. Breaches could harm consumer data, resulting in decreased consumer confidence and financial consequences.

13. Limited Control over Issuing Banks

Visa’s business model, which relies on partnerships with issuing banks for card distribution, limits its direct control over customer service and product features.

14. Competition with New Payment Technologies

The emergence of new digital payment networks, technologies, and platforms, including cryptocurrencies, challenges Visa’s traditional payment processing services.

15. Legal and Litigation Risks

Ongoing legal concerns, particularly competition and interchange fees, pose financial and reputational threats for Visa.

16. Market Saturation in Developed Countries

With the debit and credit card markets in developed countries approaching saturation, Visa’s development options are limited in these regions.

17. Currency fluctuation risks

Visa’s global operations subject it to currency fluctuations, which impact its financial performance.

18. Interchange Fee Regulation

Visa’s revenue model, primarily based on interchange fees, is still being determined due to regulatory changes, which could influence its profitability.

Visa Opportunities

1. Increasing Use of Electronic Payments

Electronic payments are becoming increasingly fast, secure, and convenient. This presents a perfect opportunity for Visa, renowned for its leading digital payment systems. As consumers increasingly quit cash, Visa may expand its services to places that still rely on traditional ways of payment, increasing its user base and income possibilities.

2. Expanding into emerging markets

Developing countries with expanding middle-class populations present considerable growth opportunities for Visa. By collaborating with local financial institutions, Visa can broaden its market presence and disrupt the current cash-based transaction culture.

3. Partnerships with Fintech Companies

By partnering with financial technology firms, Visa can provide more diverse, innovative, and convenient payment solutions, improving consumer ease and experience. This could improve client loyalty and encourage revenue development.

4. Investing in cybersecurity

With growing cybercrime risks, a significant investment in cybersecurity can help Visa maintain its reputation as a trusted payment service. These proactive steps can set Visa apart from competitors and attract security-conscious customers.

5. Technological Innovations

Visa can discover new revenue streams and improve the user experience by implementing emerging technologies like blockchain, RFID for contactless payments, and mobile wallet apps.

6. Growth in e-commerce

The ongoing increase in online consumption allows Visa to manage more significant transactions. It also makes a strong case for increasing their secure digital payment network and options.

7. Increasing Demand for Cashless Transactions

Global consumer preferences also are shifting toward cashless economies, which might boost demand for Visa’s digitized payment systems.

8. Diversification of services

A broader service portfolio would include expansion into linked to financial services sector areas such as insurance, lending, and wealth management, addressing a wide range of customer demands.

9. Enhanced Security Features

By investing in cutting-edge security solutions, Visa can differentiate its offers and build confidence with customers and merchants.

10. Strategic Acquisitions

Acquisitions of payment technology companies can broaden Visa’s service offerings and increase its global reach.

11. Mobile Payment Integration

Collaborating with mobile payment apps and platforms will help Visa gain popularity among the tech-savvy, younger generation.

12. Leveraging Big Data

Harnessing the power of big data from numerous transactions can provide significant customer insights, enable targeted marketing campaigns, and improve fraud detection processes.

13. Regulatory changes

A quick and effective response to various market regulatory changes and internal and external factors can give Visa an advantage over competitors with less nimble operations.

14. Sustainable and Ethical Practices

Visa’s brand image could be improved by committing to sustainable operations and ethical behavior.

15. Customized Financial Solutions

Tailoring financial solutions for various demographic categories, including the underbanked, allows Visa to reach out to unusual customer bases.

Visa Threats

1. Global Transactions

Visa’s activities cover many nations, leaving it vulnerable to currency changes. These variations occur because different countries have distinct currencies whose values vary considerably, particularly in a dynamic political atmosphere. Such fluctuations can unpredictably influence Visa’s earnings and operational costs.

2. Less Experienced Workforce

The organization needs more experienced employees in a variety of worldwide marketplaces. This scenario risks the quality and innovation of existing product offerings while posing a future danger to Visa’s competitiveness and capacity to scale operations effectively.

3. Competing Environment

Visa competes in a competitive financial sector against formidable competitors such as Mastercard and digital payment platforms like PayPal. This established competition forces Visa to constantly innovate and differentiate its unique selling propositions (USPs) to maintain and expand its market share.

4. Competition

The presence of significant players such as Mastercard and American Express increases the competitiveness of the payment processing business. Emerging businesses and technology improvements further complicate the sector’s competitive landscape, potentially undermining Visa’s market position.

5. Regulatory changes

Visa’s global operations are subject to numerous restrictions, such as interchange fees, data protection, and anti-money laundering. Any legislative changes may impede Visa’s business operations and financial success, forcing ongoing adaptation to complicated legal contexts.

6. Cybersecurity Threats

Cybersecurity dangers like data breaches and hacking loom large in an era of pervasive digital transactions. As the core of payment processing, Visa is naturally vulnerable to such threats, which might result in significant financial losses and degradation of consumer trust.

7. Political instability

Because Visa operates in various geopolitical environments, political instability has the potential to damage its business dramatically. Such instability could manifest as limited access to payment systems, affecting the company’s service delivery and revenue.

8. Economic slowdowns

Visa’s success is closely linked to the global economy. Economic slowdowns can reduce consumer spending, impacting Visa’s income and overall financial health.

9. Technological disruptions

Introducing novel alternative payment methods and technologies like blockchain and cryptocurrencies can disrupt existing payment methods. These advances may reduce Visa’s relevance and market share if not addressed strategically.

10. Changes in Consumer Behavior

Consumer preference shifts, such as a preference for other payment methods or a reluctance to use credit services, pose a significant risk to Visa’s core operations and profitability.

11. Market Saturation in Developed Countries.

In many industrialized economies, the credit and debit card markets are approaching saturation, restricting Visa’s development potential. This saturation forces Visa to seek growth in less developed markets or through novel products and services.

12. Legal and Compliance Risks

Visa faces legal, compliance, and regulatory challenges across several jurisdictions. Lawsuits, fines, and the need to navigate complex regulatory environments can all result in significant expenses for Visa, harming its brand and operating efficiency.

13. Currency fluctuation risks

As a worldwide company, fluctuations in currency exchange rates can have an unpredictable impact on Visa’s financial results, demanding sophisticated financial management measures to offset these risks.

14. Interchange Fee Regulation

Regulatory monitoring of interchange fees can directly influence Visa’s revenues. Changes or limitations on these fees endanger Visa’s business model financially.

15. Fraud and Identity Theft Risk

In today’s digital world, fraud, and identity theft are constant concerns. Such risks cause financial costs for Visa and harm consumer trust in its payment systems.

Conclusion

Visa Inc., a pioneering force in digital payments, sits at the intersection of innovation and challenges in the payments industry. Visa continues to dominate the payments business with its extensive worldwide reach, cutting-edge technology, and diverse product offerings, capitalizing on possibilities such as the growing trend of electronic payments, expansion into emerging markets, and intelligent fintech collaborations. However, the environment is filled with difficulties, ranging from cybersecurity concerns to regulatory restrictions and intense competitiveness.

Despite these challenges, Visa’s dedication to innovation, security, and strategic growth puts it in a strong position to negotiate the complexity of a fast-expanding digital financial ecosystem. As it balances its strengths against weaknesses and challenges, Visa’s continued investments in technology and worldwide markets demonstrate its ability to adapt and prosper, ensuring that its critical role in determining the future of digital payments is unshaken.

Liked this post? Check out the complete series on SWOT