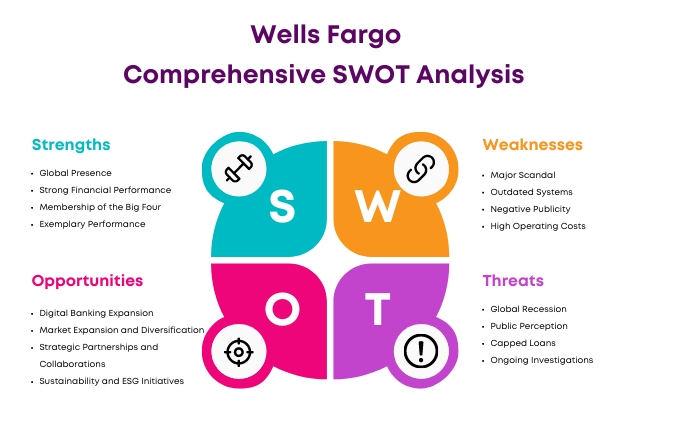

Let’s explore the SWOT Analysis of Wells Fargo by understanding its strengths, weaknesses, opportunities, and threats.

Wells Fargo & Company, founded in 1852, is a financial services leader offering a wide range of banking, investment, and mortgage products. Known for its extensive branch and ATM network in the US, the company serves millions of customers with various financial products. San Francisco-based banking giant has a history of trust, resilience, and innovation during economic ups and downs.

Recently, Wells Fargo has focused on technical innovations, customer experiences, and sustainable practices to satisfy the changing needs of its clients and stakeholders. Despite regulatory and competitive pressures, the bank has exploited its strong brand recognition and operational efficiency to focus on its strategic goals. Wells Fargo’s heritage and adaptability make it a worldwide banking powerhouse.

Overview of Wells Fargo

- Industry: Financial services

- Predecessors: Norwest Corporation, Wells Fargo (1852–1998)

- Founded: January 24, 1929 (95 years ago) in Minneapolis, Minnesota, U.S. (as Northwest Bancorporation) April 1983 (as Norwest Corporation) November 2, 1998 (as Wells Fargo & Company)

- Founders: Henry Wells, William Fargo (Wells Fargo Bank)

- Headquarters: Sioux Falls, South Dakota, U.S. (legal); 30 Hudson Yards, New York, NY 10001 U.S. (executive)

- Number of locations: 5,200 branches (2021), 13,000 ATMs (2021)

- Area served: Worldwide

- Key people: Steven Black (chairman), Charles Scharf (president and CEO)

- Revenue:US$20.8 billion (Q1, 2024)

- Net income:US$4.6 billion (Q1, 2024)

- Website: wellsfargo.com

Table of Contents

SWOT analysis of Wells Fargo

Strengths of Wells Fargo

1. Global Presence

Wells Fargo operates on five continents in the financial industry. This international scale gives businesses access to a wide range of consumers and marketplaces, which boosts growth. The company operates in 35 countries and serves over 70 million customers worldwide.

Wells Fargo is well-known and respected in developed economies and is strategically growing into emerging markets like India. This regional diversity lets the company capitalize on varied consumer tastes and economic landscapes.

2. Strong Financial Performance

Despite recent problems, Wells Fargo has consistently demonstrated strong financial performance. Its solid profitability, healthy balance sheet, and diverse revenue streams are basic strengths, exhibiting financial resilience and stability.

Wells Fargo’s revenue for the quarter ending March 31, 2024, was $20.8 Billion, and its net income was $4.6 billion.

3. Membership of the Big Four

Wells Fargo, one of the four major firms in the US banking sector, has considerable power in policymaking and greatly impacts the sector of corporate and investment banking dynamics. Wells Fargo’s strong position as a member of the “Big Four” provides it with significant operational leverage and strategic prospects.

4. Exemplary Performance

Wells Fargo has consistently delivered outstanding results, obtaining an “excellent” rating in the US banking industry. This exceptional performance is evidenced not only by various accolades and honors but also by the delight of its consumers. As per the MarketWatch rating in May 2024, Wells Fargo is the third largest bank in the U.S., with consolidated assets of over $1.7 billion, as reported by the Federal Reserve, and branches in 36 states and Washington, D.C.

As a result, Wells Fargo sets a standard for providing high-quality services with high client satisfaction levels, which is a testament to its operational expertise.

5. Wide Spectrum of Services

Another of Wells Fargo’s strengths is its diverse portfolio of services. Wells Fargo serves many customers through its traditional banking, loans, insurance, merchant and online banking services, and investing activities. Its high-profile standing as a member of the “Big 4”, combined with a large range of services, attracts and serves a diverse customer base.

6. Formidable Market Presence

Wells Fargo’s formidable market position in the United States extends beyond numbers. Its broad network of branches and ATMs places it firmly in the daily lives of its customers. This significant market presence, combined with widespread accessibility, differentiates Wells Fargo as a convenient and dependable banking partner.

It has 8,050 branches 13,000 automated teller machines and 2,000 stand-alone mortgage branches. It is the second-largest retail mortgage originator in the United States.

7. Diverse Financial Services

Wells Fargo has worked out a niche by offering various financial services. These include banking, mortgages, investments, credit cards, and personal, commercial, and small company loans. This distinct set of services enables it to meet the financial needs of a wide and diverse customer base.

8. Brand Recognition

Wells Fargo’s long history of providing financial services from the nineteenth century has contributed to its strong brand image. Its current brand value is $32.9 billion.

Wells Fargo’s status as one of the most well-known financial brands in the United States significantly enhances its operations and customer connections.

9. Expansive Customer Base

Wells Fargo serves 70 million individuals and organizations, making its customer base outstanding and diverse. This vast customer base provides a consistent revenue stream and several cross-selling opportunities, strengthening Wells Fargo’s position in the financial sector.

10. Innovative Technology and Digital Banking

Wells Fargo has successfully used technical advancements to improve its digital banking platforms, mobile apps, and online services. These digital initiatives are not only crucial to improving the customer experience, but they also help to streamline processes and drive efficiency.

11. Domination in Wealth Management and Brokerage Services

Wells Fargo dominates wealth management and brokerage services, catering to the financial demands of high-net-worth individuals and institutional clients. This participation not only diversifies its revenue streams but also increases overall profitability.

12. Community Banking Model

Wells Fargo’s unique emphasis on community banking helps to build strong relationships with local communities and clients. This individualized approach increases customer loyalty and trust in corporate banking, strengthening Wells Fargo’s brand and customer base.

13. Risk Management

Wells Fargo’s vast experience managing financial sector risks is critical to sustaining financial stability and meeting regulatory obligations. This risk management skill is a considerable buffer against financial risks, ensuring firm viability.

Weaknesses of Wells Fargo

1. Major Scandal

A massive 2016 scandal damaged Wells Fargo’s business operations. To meet sales objectives, bank employees opened millions of fake customer accounts, generating a trust crisis. The $3 billion penalties hurt Wells Fargo’s income and capital flow, which it has yet to recover from fully.

2. Outdated Systems

Wells Fargo has long struggled with its outdated banking systems, which have yet to receive major upgrades. Today’s technology advancements make the bank particularly vulnerable to different security breaches, increasing the risks that its customers confront. This, in turn, worsens the bank’s difficulties in maintaining its customer base.

3. Negative Publicity

Wells Fargo lost public trust after the scandal. Due to a loan intake limit, the bank lost many customers and attracted Federal Reserve inspection. Wells Fargo’s competitors used the situation to propagate damaging rumors and enhance allegations against the bank, damaging its reputation.

4. High Operating Costs

Wasted billions of dollars from outdated systems and scandal-related settlements have harmed Wells Fargo’s profitability and long-term survival. If this trend continues, the bank may struggle to exist and must prioritize cutting back on industries that demand too much of its financial resources.

5. Reputational Damage

Wells Fargo’s reputation has suffered greatly due to numerous frauds and controversies, including the principal fake accounts incident. This considerable reputational loss has resulted in customer distrust and increased regulatory scrutiny.

6. Regulatory Penalties and Legal Issues

Following the crisis, Wells Fargo was required to pay sizable fines and penalties imposed by regulatory organizations. Furthermore, ongoing legal concerns and lawsuits have hampered the bank’s involvement in various fields of business.

7. Operational Risks and Compliance Failures

The errors that caused the bank’s reputational damage have exposed operational vulnerabilities and significant compliance failures at Wells Fargo. Such difficulties necessitate redesigning the corporate culture, internal control mechanisms, and compliance frameworks.

8. Restrictions on Growth

As a result of its governance problems, Wells Fargo faced regulatory growth constraints, including a cap on asset size. This barrier limits the bank’s capacity to expand operations and develop its balance sheet in competition.

9. Dependence on Domestic Markets

Although it has foreign operations, Wells Fargo primarily relies on the United States market. This overdependence increases the bank’s vulnerability to domestic economic swings and prospective regulatory changes.

10. Challenges in Innovation and Technology Adoption

Although Wells Fargo’s attempts to invest in digital banking and technology have failed to keep up with the rapid speed of technical breakthroughs that are changing the banking business.

11. Workforce Management

The big scandals and subsequent organizational reforms have significantly impacted Wells Fargo’s staff morale and retention. Recruiting and keeping top-tier talent becomes even more difficult when a company faces reputational challenges.

12. Competitive Disadvantages

The combination of reputational harm, regulatory restrictions, and operational challenges has caused Wells Fargo to fall behind its competitors, who may not be exposed to intense public scrutiny or constraints.

Opportunities of Wells Fargo

1. Digital Banking Expansion

The fintech revolution is changing banking, with customers favoring digital banking. Wells Fargo offers many digital opportunities. Implementing cutting-edge technology and taking advantage of AI and machine learning trends can help Wells Fargo improve customer experience, optimize procedures, and generate new revenue.

Imagine a smooth, all-encompassing digital banking platform that exceeds all consumer banking expectations.

2. Market Expansion and Diversification

Wells Fargo has endless chances to expand geographically and diversify its services. The bank can mitigate risks from overreliance on its traditional banking base by expanding into unknown regions and diversifying its portfolio.

Wells Fargo might capitalize on demographic benefits in Asia and Africa by diversifying beyond wholesale banking into wealth management or digital banking.

3. Strategic Partnerships and Collaborations

Collaboration is often the key to driving innovation and growth. Wells Fargo might accelerate its expansion into new financial services markets by forming agreements with fintech companies and non-traditional banking institutions.

These collaborations could result in a symbiotic relationship in which Wells Fargo combines traditional banking trust and scale with technology agility and innovation.

4. Sustainability and ESG Initiatives

Concerns about the environment, social responsibility, and governance (ESG) are on the minds of both consumers and investors. Wells Fargo sees pushing sustainability practices and green financing as more than an opportunity; it is a need.

By pioneering ESG initiatives, Wells Fargo may improve its brand reputation, attract socially conscious investors, and make a good contribution to the world.

5. Wealth Management and Private Banking Expansion

The growing global wealth gives Wells Fargo an excellent potential to increase its presence in wealth management and private banking. Wells Fargo, building on its strong reputation, has the potential to become the preferred bank for high-net-worth individuals and families, providing specialized, sophisticated financial solutions.

6. Enhancing Cybersecurity Measures

In a period where cyber dangers are prevalent, investing in top-tier cybersecurity measures is critical. Wells Fargo believes that strengthening its defenses against cyber attacks will protect the bank’s assets and, more crucially, its customer trust. Consider it constructing an impregnable fortress in the digital realm, ensuring the bank’s and its customers’ peace of mind.

7. Regulatory Compliance as a Competitive Advantage

Wells Fargo’s past contacts with regulatory impediments can be leveraged for competitive gain. By achieving and exceeding regulatory expectations, Wells Fargo can set a new standard for compliance, changing public opinion and potentially easing regulatory restrictions.

8. Customer Experience Improvement

Customer happiness is vital to the banking industry. Wells Fargo can tap into this core by redefining the customer experience, which includes tailored banking products, responsive assistance, and intuitive digital platforms. The goal is to create a banking environment where customers feel genuinely understood and respected.

9. Innovation in Payment Solutions

Mobile payments, digital wallets, and the introduction of blockchain technology are transforming the payments industry quicker than ever before. Wells Fargo has the chance to lead this movement by providing payment solutions that are secure convenient, and ahead of the curve, establishing new industry standards.

10. Tackling Financial Inclusion

Finally, Wells Fargo faces an immense challenge and opportunity to improve financial inclusion. Wells Fargo can play a critical role in bridging the financial divide by offering products and services specialized to the underserved and unbanked, both domestically and internationally.

Threats of Wells Fargo

1. Global Recession

COVID-19 has caused a global recession, hurting banks like Wells Fargo. This severe economic downturn caused considerable losses, personnel attrition, and other issues for the company. Despite COVID’s gradual progress, Wells Fargo’s financial situation remains hazardous, emphasizing the need for the company to enhance its operations and finances.

2. Public Perception

Rebuilding public trust after a scandal is hard for any institution. Unfortunately, Wells Fargo is struggling with this issue after multiple scandals that have damaged its brand and cost clients. Thus, Wells Fargo must enhance its public image and regain client trust through transparent transactions and ethical business procedures. Trust is essential for customer acquisition and retention, so they must prioritize it.

3. Capped Loans

As a result of Wells Fargo’s dispute over bogus accounts, the Federal Reserve decided to limit the company’s lending capabilities. This necessitates a strategic effort by Wells Fargo to diversify its sources of financing while closely adhering to ethical and legal business procedures to avoid repeat scandals.

4. Ongoing Investigations

Current investigations into many charges against Wells Fargo hurt the company’s trustworthiness. The bank must address these concerns directly and forcefully while scrupulously sticking to legal business standards to prevent future damage.

5. Intense Competition

Traditional banks, credit unions, and fintech firms all compete for a large piece of the market. As a result, Wells Fargo faces increased competitive challenges, demanding continual innovation to remain relevant in the marketplace.

6. Regulatory Changes

Wells Fargo operates in an industry renowned for strict regulatory supervision. As a result, regulatory changes, increased compliance costs, and prospective new banking reforms can significantly impact the company’s operations, profitability, and growth strategy.

7. Economic Fluctuations

Economic downturns, interest rate increases, and market volatility can all substantially impact Wells Fargo’s financial performance, particularly in the loan and investment divisions.

8. Cybersecurity Risks

As the use of digital banking grows, so do the cybersecurity threats. Cybersecurity breaches can cause significant financial losses, client distrust, and harm Wells Fargo’s public image.

9. Reputational Risk

After prior scandals, any additional controversies or failures in dealing with past concerns could significantly reduce customer confidence and loyalty to Wells Fargo.

10. Technological Disruption

Because technological innovations in the banking business move rapidly, Wells Fargo must constantly innovate to keep up with digital trends and client expectations.

11. Credit Risk

Economic instability can increase the risk of loan defaults, negatively impacting Wells Fargo’s credit portfolio and resulting in financial losses.

12. Operational Risks

With its sophisticated, global operations, Wells Fargo has inherent risks such as fraud, system breakdowns, and compliance breaches, which can disrupt its operations and result in financial losses.

13. Market Saturation

The banking industry’s high level of market saturation hinders Wells Fargo’s efforts to gain new clients and increase market share.

14. Shifts in Consumer Behavior

Demand for Wells Fargo’s traditional banking products and services may suffer as consumers increasingly prefer non-traditional banking services and digital-only platforms.

15. Geopolitical Tensions and Global Uncertainties

Wells Fargo’s foreign activities subject the company to risks related to geopolitical uncertainty, trade conflicts, and other global uncertainties. Such concerns might substantially influence the company’s foreign banking operations and financial results.

16. Interest Rate Risks

Interest rate variations directly influence Wells Fargo’s expected income from lending and investing activities, providing a constant danger to its financial stability.

Conclusion

Wells Fargo, a renowned global financial institution, tells a riveting story about persistence and adaptability in modern banking difficulties and opportunities. The SWOT analysis highlights its strong international presence, various service offerings, and technical breakthroughs as key assets while identifying significant weaknesses, such as regulatory challenges and technological updates. Digital banking expansion, market diversification, and sustainability measures represent growth and innovation opportunities.

However, Wells Fargo faces dangers from economic downturns, competitive pressures, and the ongoing effort to recover public confidence. The bank’s journey is one of possible reinvention, reconciling its rich history with the demands of a fast-changing sector.

Liked this post? Check out the complete series on SWOT