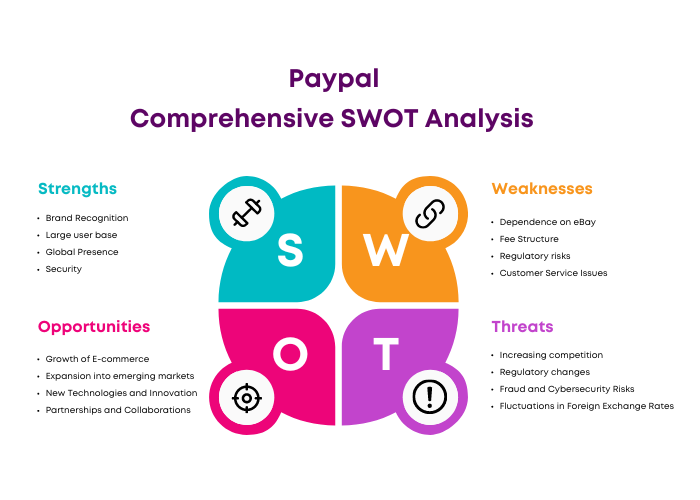

Let’s explore the detailed SWOT analysis of Paypal by understanding its strengths, weaknesses, opportunities, and threats.

PayPal, a pioneer in digital payments, has made sending and receiving money as simple as entering an email address. Its global reach, with operations in more than 200 markets, allowing customers to get paid in more than 100 currencies, withdraw funds to their bank accounts in 56 currencies, and hold balances in their PayPal accounts in 25 currencies, demonstrates its vast impact on e-commerce. The platform’s ongoing innovation ranges from peer-to-peer payments to extensive enterprise solutions, cementing its presence in millions of daily financial transactions.

PayPal’s commitment to security and a seamless user experience has earned it widespread confidence, making it the preferred method for online transactions. PayPal maintained its competitiveness despite the emergence of fintech startups and established banks’ digital operations by making targeted acquisitions such as Venmo, which targets the younger population. PayPal’s superior infrastructure and global reach keep it at the forefront of the financial technology industry, promoting the advancement of digital payments.

Overview of Paypal

- Company type: Public

- Industry: Financial technology

- Predecessors: Confinity, X.com

- Founded: December 1998; 25 years ago (as Confinity), October 1999; 24 years ago (as X.com), March 2000; 24 years ago (as PayPal)

- Founders: Ken Howery, Max Levchin, Luke Nosek, Yu Pan, Peter Thiel, Elon Musk, Harris, Fricker, Christopher Payne, Ed Ho

- Headquarters: San Jose, California, U.S.

- Area served: Almost worldwide.

- Key people: John Donahoe (Chairman), Alex Chriss (President and CEO)[1]

- Products: Credit cards, payment systems

- Revenue: US$29.77 billion (2023)

- Website: paypal.com

Table of Contents

SWOT Analysis of Paypal

Paypal’s Strengths

1. Brand Recognition

PayPal’s brand is a heavyweight in the online payment industry, with widespread recognition, particularly in the United States and Europe. This award is based on years of dependable service, making PayPal a go-to for consumers doing online transactions. Its brand value in 2023 is 17.7 billion US dollars.

2. Large user base

PayPal benefits from a network effect, meaning its value grows as more individuals join and use the platform. A large user base attracts more users, resulting in a growth cycle. Paypal has 426 million active consumers and merchant accounts. It serves a large clientele and operates in approximately 25 different currencies.

3. Global Presence

PayPal, which serves over 200 regions and supports several currencies, provides exceptional convenience for international transactions and caters to a global user base.

4. Security

With buyer protection rules and cutting-edge fraud detection technology, PayPal has gained user trust. This security is the foundation of their confidence in PayPal.

5. Range of Services

PayPal’s comprehensive service portfolio, which includes peer-to-peer transactions and merchant accounts, offers it an adaptable option for various payment demands, emphasizing its role as a one-stop financial service provider.

6. Innovation

With a firm eye on technology, PayPal has launched several essential industry innovations, like one-touch payments and mobile wallet integration. Its venture into cryptocurrencies demonstrates its dedication to driving innovation.

7. Partnerships and integrations

Strategic agreements with major online platforms such as eBay, Airbnb, and Uber make it easier to pay for these services. PayPal’s market position is strengthened further by its seamless interaction with various e-commerce platforms.

8. Subsidiaries

Owning various financial systems, such as Venmo and Xoom, broadens PayPal’s products and market reach, giving them a competitive advantage.

9. Strong Tech Background

Following eBay’s takeover in 2002, significant improvements were made to PayPal’s security systems. Today, the name is synonymous with cutting-edge technology and strong security for online transactions.

10. User Friendly

PayPal’s user-friendly interface appeals to merchants and regular customers. It streamlines account creation and payment transfers while protecting its technology from easy replication and balancing usability with security.

11. Active Users

PayPal had 426 million users as of March 2024, up from 329 million active users in 2023 and about 6.8 billion during the fourth quarter of 2023.

12. Acquisition by eBay

eBay’s acquisition of PayPal for $1.5 billion in 2002, followed by PayPal’s extension as an independent entity in 2014, has been essential to its tech and security advancements.

13. Acquisition of Various Companies

PayPal’s acquisition strategy, which includes firms such as Braintree and Venmo, diversifies its offerings and improves its position in the payments ecosystem.

14. Mobile Integration

With the shift to mobile transactions, PayPal’s mobile-friendly software improves the user experience and assures a smooth payment procedure.

15. Ease of Use

The ease with which a PayPal account can be set up and used contributes significantly to its widespread popularity.

16. Merchant Partnerships

Collaboration with online shops increases PayPal’s usability, making it a standard payment method across e-commerce platforms. Over 36 million merchants use PayPal in over 200 countries worldwide.

17. Risk Management

PayPal’s sophisticated risk management structure detects fraudulent transactions quickly and effectively, protecting consumers.

18. Scalability

PayPal’s solid infrastructure allows scalability, allowing it to handle a higher volume of transactions without affecting performance.

19. Loyalty Programs

Paypal fosters user loyalty by offering rewards and credit options, adding value beyond transactions.

20. Corporate Social Responsibility

Phillips’s socially responsible brand image is enhanced by initiatives focusing on financial inclusion and support for marginalized areas.

21. Flexibility

PayPal’s ability to process a variety of payment methods, including credit cards and direct bank transfers, demonstrates its versatility for a wide range of payment preferences.

Paypal’s Weaknesses

1. Dependence on eBay

PayPal was founded as eBay’s payment arm, yet despite its declining reliance, eBay continues to contribute significantly to PayPal’s transaction volumes. This historical linkage and eBay’s transition to an internal payment system can impact PayPal’s revenue.

2. Fee Structure

PayPal’s fee structure tends to be more expensive than other payment processors, especially for small and cross-border transactions. This has a more significant financial impact on small enterprises, prompting them to seek more cost-effective solutions.

3. Regulatory risks

Navigating a complex network of international legislation remains one of PayPal’s continuing challenges. Changes in regulatory frameworks can create uncertainty and impede market penetration, affecting worldwide operations.

4. Customer Service Issues

While PayPal works for service integrity, account disputes, and freezes have been noteworthy. If mishandled, these incidents might harm the company’s customer service reputation.

5. Competitive Market

PayPal competes in a crowded market with significant competitors such as Google, Apple, and fintech startups. Maintaining a competitive advantage in this fast-paced market necessitates ongoing innovation and agility.

6. Fraud and Cybersecurity

PayPal, despite its extensive security procedures, remains vulnerable to cyber assaults. Any significant security compromise might harm the company’s reputation and consumer trust. PayPal’s 2023 research indicates that the platform’s small businesses lose about $3.7 million a year due to fraudulent online transactions.

7. Cryptocurrency adoption

PayPal’s cryptocurrency integration innovates but exposes it to digital currency volatility and legal difficulties.

8. Controversies

PayPal has been involved in numerous scandals, including account terminations, fund withholdings, and freezes. If such activities are viewed as unjust, they may harm the brand’s reputation among consumers.

9. Dependence on Internet connectivity

PayPal’s services are entirely accessible online, So It relies largely on internet access. This need limits its availability in areas where reliable internet access remains a luxury, limiting market growth.

10. Restriction in Some Countries

Despite being in over 200 countries, PayPal’s absence in emerging areas such as Sri Lanka and Pakistan represents a missed potential for revenue growth and a significant user base increase.

11. Account Freezing

Account freezes for suspected fraudulent actions have disrupted legitimate operations for some users, attracting criticism and potentially discouraging prospective new customers from using PayPal’s services further.

12. Foreign Exchange Fees

PayPal’s foreign currency fees have been criticized as being relatively excessive. This affects overseas users, who may seek better rates for online money transfers elsewhere, weakening PayPal’s competitive position.

PayPal Opportunities

1. Growth of E-commerce

The global spread of e-commerce, motivated by the COVID-19 epidemic, highlights the growing demand for secure and fast online payment platforms. PayPal benefits from this trend as businesses and consumers look for dependable and innovative payment solutions and options in an increasingly digital environment.

2. Expansion into emerging markets

PayPal can expand its influence in emerging nations, where it is still relatively new. Reaching into these regions could reveal untapped consumer bases eager to accept digital payments, increasing PayPal’s global reach.

3. New Technologies and Innovation

The fintech landscape is changing rapidly as blockchain technology, digital currencies, and innovative financial services emerge. PayPal’s entry into cryptocurrency demonstrates the company’s dedication to innovation, providing an opportunity for it to lead the finance revolution with new product offers.

4. Partnerships and Collaborations

Strategic collaborations with other tech giants or financial institutions might significantly expand PayPal’s ecosystem. Such strategic partnerships and agreements would broaden its service offerings and improve its client value proposition.

5. Providing more financial services

PayPal might expand its offerings beyond payment processing and merchant services to include banking, lending, insurance, and investment products. This expansion would leverage its large user base, transforming it into a comprehensive financial services platform.

6. Exploitation of Mobile Payments Market

With mobile payments becoming increasingly popular, PayPal can use its established applications, including its main mobile app and Venmo, to dominate this rapidly expanding market.

7. Cross-border transactions

The increased e-commerce activity opens the door for PayPal to expand its cross-border and payment gateway capabilities. PayPal can considerably improve its market share and importance by allowing frictionless international transactions.

8. Growing Gig Economy

The booming gig economy provides PayPal a unique opportunity to offer freelancers and independent contractors services, such as simpler invoicing and payment receipt processes.

9. Move to Lower Cash Economies

As some developing economies, such as India, transition to cashless or low-cash transactions, PayPal can seize the opportunity to establish and expand its digital payment solutions and gain a significant market share.

10. Digital cryptocurrency

As freelancers and online sites become more comfortable with digital currencies like Bitcoin, PayPal can develop new ideas.

11. Linked with Business

While using the commerce ecosystem, PayPal may strengthen its market position by carefully partnering with various B2C enterprises, increasing transactions, total payment volume, and client base.

12. International Expansion

Despite its presence in over 200 nations, large undiscovered areas remain to be investigated. PayPal’s worldwide expansion allows it to enter new markets, considerably contributing to its development and diversification efforts.

13. Technology

PayPal operates in a rapidly changing technical industry and is well-positioned to capitalize on emerging developments. With a solid technological basis, the company has the potential to become a pioneer in technology innovation, particularly in the emerging sector of e-banking.

14. Cryptocurrency

The growing relevance of Bitcoin in digital transactions provides PayPal with an exciting chance to be a pioneer in this space. PayPal’s ability to trade or accept digital currencies has the potential to reshape digital payments in an increasingly digitalized global economy.

By carefully capitalizing on these prospects, PayPal can strengthen its present market position and lay the way for remarkable development and innovation in the digital payments sector.

PayPal Threats

1. Increasing competition

The digital payment space is saturated, with companies like Google, Amazon, and Apple offering payment solutions. This, combined with the rise of fintech firms that bring creative approaches to digital transactions and established financial entities’ speeding efforts to digitalize, creates a highly competitive environment for PayPal.

2. Regulatory changes

Operating abroad requires navigating a complex web of regulations that can change unexpectedly. This is especially true for data security and privacy legislation, which can severely disrupt business operations and strategy.

3. Fraud and Cybersecurity Risks

PayPal’s online existence puts it directly in the path of cyber threats. A significant security breach might weaken user trust destroy the brand, and impact PayPal’s business reputation, resulting in potential financial and reputational losses.

4. Fluctuations in Foreign Exchange Rates

PayPal’s global activities expose it to fluctuations in foreign exchange rates. Given the variety of currencies engaged in its transactions, this issue can have an unpredictable impact on its financial results.

5. Dependence on Certain Marketplaces

Many of PayPal’s transactions are linked to major online marketplaces like eBay. Changes in these alliances or the marketplaces’ fortunes could influence PayPal’s financial health.

6. Rapid Technological Change

The tech world is changing rapidly, and PayPal must keep up. Blockchain innovations bring both opportunities and hazards, with the potential to disrupt the online payment environment.

7. Risks associated with cryptocurrencies

Because of the volatility of the assets and the unpredictable regulatory landscape surrounding them, investing in cryptocurrencies presents new opportunities and risks.

8. Negative Economic Conditions

Economic downturns can reduce consumer and company expenditure, affecting transaction volumes on PayPal’s platform, as demonstrated during financial instability.

9. Dependence on third-party platforms

Relying on e-commerce and other transaction platforms can be a disadvantage if these companies decide to push their payment solutions or modify their operational dynamics.

10. Evolving Consumer Preferences

The digital-native demographic is rising, potentially shifting preferences away from established payment services like PayPal and toward newer, trendier platforms.

11. Technological disruptions

Keeping up with or ahead of technology changes in FinTech is a never-ending challenge, with the risk of being surpassed by faster and more innovative market entrants.

12. Geopolitical Risks

PayPal’s operations in numerous nations subject it to unpredictability in geopolitics, which might impact its business.

13. Market saturation

Finding fresh growth opportunities in developed nations with high PayPal penetration may be more complex than in emerging markets with lower brand recognition.

14. Data Privacy Concerns

In an era where data privacy is more critical, error-handling user information can result in substantial backlash and damage customer trust.

15. Alternative Payment Methods

The growth of payment methods, such as bank transfers and localized payment systems, poses a competitive challenge, particularly if these alternatives become popular.

16. Fee Structure

If competitors provide more attractive price structures or more clear pricing, customers and merchants may prefer such alternatives, reducing PayPal’s market share.

17. Integration Issues

If appropriately managed, the continual need for seamless connectivity with numerous platforms and updates may offer operational issues and create vulnerabilities.

18. Economic downturns

Broader economic recessions or downturns can directly influence consumer purchasing power, reducing PayPal transaction volumes.

19. Cultural Preferences

In some markets, local payment systems may be more trusted or traditionally preferred, posing a challenge to PayPal’s expansion or domination.

20. Decentralized financing (DeFi)

The rise of DeFi indicates a shift toward decentralized alternatives to established banking systems, which might reshape the competitive landscape for corporations such as PayPal.

Conclusion

PayPal is a digital payment industry leader, employing its massive brand recognition, global presence, and ongoing innovation to stay ahead of the curve in financial technology. Despite facing obstacles such as competitive pressures, regulatory risks, and cybersecurity threats, the company’s strengths in security, user experience, and the broad range of services cement its position as a trusted platform for millions of people globally.

Opportunities in e-commerce expansion, emerging markets, and technical advancements provide growth opportunities, while its proactive approach to threats and weaknesses demonstrates a dedication to maintaining its competitive advantage. In negotiating the complicated environment of digital payments, PayPal’s strategic agility, robust infrastructure, and emphasis on user-centric solutions demonstrate the company’s long-term relevance and potential for success in connecting and empowering a worldwide financial community.

Liked this post? Check out the complete series on SWOT

I love this

What are PayPal’s primary competitive threats and how should it respond to them?